Frugal living can be described as a way to live your life financially.

Living frugally is one way how you can change your life, improve your personal finances, and reduce stress. Frugal living is an important strategy if you are trying to get ahead in your life, especially with your finances.

If you are looking to make positive change in your life, then check out these frugal living tips and strategies for success.

What is Frugal Living?

Frugal living can be a means for a person to achieve a desired outcome in their life. This outcome could be a personal one or a financial one. Often times finances are involved even if the desired outcome is a personal one.

For example a person may want to get out of debt in their life. By living frugally, that person would hopefully be able to achieve that personal outcome.

Frugal living, also known as frugality living, is a strategy and it should be thought of as a strategy to achieve a desired outcome in a person’s life.

Or, if you have income limits and wondering how much is $40,000 per year per hour, frugality can help adjust to your budget.

Benefits of Frugal Living

Practicing a frugal living strategy can have many benefits associated with it.

However, when it comes down to it, the main benefit of frugal living for a person can be summed up in one word…Freedom.

Frugality living is a means for a person to achieve freedom in their life. People that practice a frugal living strategy have freedom to do the following:

- They are able to reduce their credit card balances and get out of debt

- Some of them have been able to pay off their mortgage early

- Saving money for a family vacation

- People have been able to save money for retirement

- If they had bad debt, they have been able to increase their credit score

- Many have been able to leave their 9-to-5 jobs

- Others have been able to open up businesses with the money that they have saved

People have literally changed their day-to-day lives by living frugal.

It is the first step in how to build wealth from nothing. You cannot build wealth if you don’t have any additional income available that is not dedicated to current expenses. Following budgeting tips can only get you so far towards building wealth.

Frugal living has a lot more to do than just living cheap. In all actuality, frugal living is a way to change your mindset. It is a way to think about how you live differently.

By living frugally, you are making conscious choices and changing the way you think about your expenses. Frugality is the way to empower your mindset. It is a motivating strategy for the freedom and change that you desire in your life.

I recently spent some time with some extended family on a lake in Northern Michigan. The subject that came up around the campfire had to do with the Chevrolet Volt car that they own.

Now this person (who we will call Randy) took me through the ins and outs of how his electric vehicle works. Randy drives to work without using one drop of gasoline.

I had asked well what happens in the winter as you know when you are running more electrical components in subzero temperatures the electric battery will drain much faster?

Randy‘s response was that he doesn’t run the heat in his car in the winter. Instead he wears two pairs of gloves!

Think about that for a moment and how that relates to his lifestyle.

First of all, yes Randy has made a conscious choice for frugality when it comes to his transportation needs.

Obviously there is a financial savings here since Randy doesn’t have to purchase gasoline at all to get him to and from work.

But Randy has also changed his mindset. He was so empowered that he wore two pairs of gloves in the winter! It is this type of extreme sacrifice that will empower a person to live frugally.

Sure you can do things like clip coupons and cut back on coffee and we will get all of those tips later, but this type of outside of the box thinking for your mindset can propel a person to a new level of frugality.

The main point of living frugal is not always about buying the cheapest box of cereal. A person can also change their mindset and be empowered to live frugally through lifestyle choices that they make. Randy is an example of that and since he has changed his mindset, he is empowered now to make other drastic changes in his life.

You may find yourself living frugally as a way how to live in retirement with no money saved.

How To Live Frugally

I believe that there are two ways to live frugally. The first step involves cheap ways to live and the second has to do with the frugal living mindset.

Cheap Ways To Live

Living frugally starts by cutting your everyday expenses. Think of your frugal living lifestyle as a newborn baby. That newborn baby has to learn to crawl before it can walk.

Reducing your everyday living expenses is a perfect analogy to that newborn baby crawling.

You have to find ways to save money before you can go on to make bigger and more drastic frugality changes within your life.

There are so many hacks that you can use to accomplish this such as using the best cash back apps for shopping and groceries available.

A good way to ease into frugality is by following cheap meal recipes to make meals. You can also use services like Amazon’s Prime Pantry.

Be sure to check out our guide “how does Prime Pantry work” if you have questions about it.

Frugal Living Mindset

The second step in frugal living involves a lot more than just skipping Starbucks and brewing coffee from your kitchen.

This step involves your mindset and making drastic changes just like Randy did with his electric car.

I can relate to Randy.

Although I probably won’t be sacrificing the heat in my car during Michigan winters anytime soon, I have made drastic lifestyle changes such as Randy.

I lived a keeping up with the Jones lifestyle for 15 years of my life. During that time, I did everything that finance experts said to do such as:

- Look for low mortgage rates

- Shop around for the best home insurance

- Cary high deductibles

- Reduce expenses

A person can only cut and reduce so many day-to-day living expenses. Some of my other expenses included things such as:

- $5,000 every year in property tax

- $3,000 a year in home maintenance

- $13,000 a year in mortgage payments

- $2,000 over the course of five years in subdivision fees

Yes you read that correctly. I spent in excess of $2,000 to live in a subdivision over the course of five years. I ended up changing my mindset on the lifestyle I was living and sold my house.

I now save close to $30,000 a year.

That is as much money as some people make in a year. I now use my savings to build wealth and attain freedom in my life.

Taking control of your life starts with these frugal living tips below:

Frugal Living Tips For Your Household

1. Get rid of your land line.

2. Only run your dishwasher when it is full.

3. Wash your clothes in cold water.

4. Put up a clothesline in your basement (or some other location) and air dry your clothes.

5. Only plug-in small appliances when you are using them.

6. Use leftover bars of soap and wrap them in a cheesecloth. You can use them in the shower as a soap exfoliator and scrubber.

7. Change your furnace filters regularly.

8. Keep your hot water tank slightly above vacation setting.

9. When you plan to be gone from your house for several days, use the vacation setting on your hot water tank.

10. Use a programmable WiFi thermostat.

11. Check with your utility company to see if they have a monthly budget payment program.

12. Be sure to use energy efficient drapes.

13. BONUS TIP: For extra savings, use a double curtain rod with two layers of energy efficient drapes.

14. Get rid of your cable and use alternatives to cable TV.

15. Declutter and organize your household.

16. Buy your household cleaning supplies at dollar store.

17. Be sure to purchase laundry detergent in bulk from Family Dollar in order to utilize digital coupons and bonus savings.

18. Purchase an Internet cable modem instead of renting them from your internet company.

19. Move into a smaller house.

20. Sell household items you no longer need or plan to use.

21. Cut the tops off of toothpaste containers when you are getting low to make sure to use all of it.

22. Purchase reusable hand towels at the dollar store and forego buying paper towels.

23. Consider using power strips if you have several items that need to be plugged in. Then just turn off the power strip when not in use or unplug it.

24. Replace electrical landscape lights with solar lights.

25. If you have a deck or patio, consider using solar light caps or other type of outdoor solar spotlights.

26. If you need a spot light in your backyard, use an LED spotlight. It will more than pay for itself.

27. Cut your bulk food containers (such as ketchup and mustard bottles) and scrape the remaining product into small Tupperware containers to extend the product life.

28. Purchase a warranty plan for the mechanicals of your home and save money on appliance repairs.

29. Use spray foam insulation around the foundation sill plate of your home. This will block out your drafts and air leeks, not to mention save you money on your heating and cooling costs.

30. Use automatic on off switches for all of your rooms in your house. This investment will more than pay for itself with reduced electrical costs when you are not in the room.

31. Additionally, use light dinners to save more energy.

32. Make sure you have a low flow shower heads and toilets.

33. Use a thermal blanket around your hot water tank.

34. Use insulation strips around your entry doors.

35. In the winter use draft blockers for your doors to keep warm air in your home and reduce your energy bill.

36. Buy hand soap at the dollar store.

37. When your hand soap container is empty, simply purchase the liquid soap refill.

38. Watch movies in the comfort of your house with free movie streaming sites available.

38. Instead of throwing t-shirts out, cut them up and use them as rags around the house.

39. Check out how to save money on streaming services instead of paying full price.

Frugal Tips For Restaurants

1. Check for coupons in circulars before you go shopping.

2. A lot of coupons for restaurants are available in weekly coupon booklets that many people receive in the mail.

3. BONUS TIP: If you have kids, be sure to go to a restaurant where kids eat free! Check out our post of over 110+ restaurants where kids eat free or cheap! Not only will you save some money, but you also will get a great meal!

4. Use Groupon and also Facebook pages for restaurants. Often times restaurants run deals or have coupons posted there.

5. Skip the expensive drinks. A fountain pop is close to $2.00 if not more at today’s prices. For a family of four this would be $8.00 minimum for something to drink. Skip the fountain drinks and just have water. It could save as much is 25% off of your food bill at a restaurant.

6. Purchase gift certificates at restaurants.com. Supercharge your purchase by using shopping apps such as Rakuten to get the most bang for your buck!

7. Sign up for promotional emails from certain restaurants. I receive a lot of coupons by email for certain restaurants. This is also a great way to cut your restaurant bill and save money.

8. Split portions in half. My parents know all the restaurants where they can order a dinner and eat off of it for three nights. Splitting portions is a great way to save money.

9. Use car side to go instead of dining in. Normally if I’m at a car side to go restaurant, I will give a couple bucks for a tip but not 20%. This is a great way to save yourself some cash.

10. Check for restaurant apps and reward programs.

Frugal Living Tips For Shopping

1. Shop clearance whenever you can.

2. When you do have to buy something, only use cash. It helps resist the “splurge urge” with credit cards.

3. When you are in a department store, price check the item with Amazon. Often times many stores (such as Target at time of this posting) price match and on top of that, you can use your target card for additional 5% off.

4. If the department store doesn’t price match, buy your item on Amazon.

5. Buy specialty items on Amazon.

6. Use shopping apps such as Rakuten, Paribus, and Ibotta when you make purchases in stores and online.

7. Shop at secondhand stores for specialty kids items and specialty clothes.

8. Be sure to check out Walmart for kids clothing. Since kids outgrow clothing so fast, buy the cheapest t-shirts you can find normally around $3.00 or $4.00. At those prices, it is cheaper to buy new clothes at Walmart versus secondhand store. I do this for a lot of my basic kids clothing.

9. I also shop back to school sales for kids clothing as well in August because you can score some major discounts off of clothing sometimes as much as 50% off.

10. If you are purchasing specialty items, be sure to check Craigslist and Facebook Marketplace as well for cheaper alternatives.

11. Shop for clothes at the end of the season when they are often cheaper and have been drastically marked down.

12. If you are unable to donate your clothes for a tax write off, then consider selling them on sites. Check out best things to sell on eBay for profit.

13. Avoid impulse purchases and only buy what you need for the moment.

14. Consider joining a Mom to Mom exchange instead of shopping for baby clothes and baby paraphernalia such as cribs, furniture, and toys.

15. Shop directly from clothing brands such as Hanes.com. I’ve picked up tons of active sports wear such as t-shirts for under $6.00 each. Skip the retailers and buy directly from the manufacturer.

Frugal Tips For Food & Groceries

There are tons of ways to save money on food and groceries. Be sure to check out our shopping tips on how to save money on groceries so you can save $100’s per month!

1. Be sure to create a meal menu before you head to the grocery store.

2. Create a grocery shopping list which will ensure that you only buy items for the meals that you have listed on your meal plan.

3. Check your pantry and inventory to see what you need from the grocery store.

4. Make meals in bulk so you can freeze the leftovers and make additional meals out of them.

5. BONUS TIP: Be sure to check out our 270+ cheap meal recipes for large families on a budget.

6. Don’t go grocery shopping when you are hungry as this might lead to additional purchases for items not on your list.

7. Don’t shop at membership stores such as Costco because you will end up buying more than what you need and often times the food will go bad before you can use it all.

8. Instead of membership stores, shop at discount grocery stores such as Aldi’s.

9. Look in your weekly sales ads to see what food items are on sale.

10. Utilize coupons and shopping apps such as Rakuten, Paribus, and Ibotta.

11. Buy produce at farmers markets since it is usually cheaper and in better condition than what you buy at the grocery stores.

12. When possible, buy generic brands for food items.

13. Buy food based on unit prices.

14. Buy frozen juices as these containers take up less room than buying three bottles of apple juice. Additionally, frozen juice is half the cost of bottled juice.

15. Get rain checks whenever possible for items not in stock that are on sale.

16. Don’t buy items in the checkout aisles.

17. Use reward credit cards when possible for buying groceries.

18. Pay with gift cards so you can receive additional incentives.

19. Buy meat when it is on sale only since you can freeze it.

20. Be sure to take your leftovers for lunch.

21. Make a garden and grow your own food.

22. Skip buying seeds. Rather save your scraps and stick them out in your garden and watch your food grow organically.

23. Buy a deep freezer so you can purchase large quantities of meat when it goes on sale and then freeze it.

24. Be sure to can your fruits and vegetables.

25. You can make holiday cookies and give them out as gifts in addition to making cookies for your family regularly.

26. You can also make your own bread (if you have a bread machine).

27. Use a crock pot whenever possible.

Frugal Living Tips For Your Insurance

1. Check for membership discounts. Often times you can get lower car insurance if you belong to certain types of banking institutions or if you work in a certain profession so be sure to check with your insurance agent.

2. If you don’t drive a lot of miles to work, you might be able to receive a discount for that. For example if you drive your car 5 miles to a bus stop and then take a bus to work, your insurance rates could be a lot lower since you are not driving that much to get to work.

3. Be sure to insurance shop. This is especially true for your home insurance. For several years, my home insurance premiums didn’t increase. Then one year I got my renewal invoice and it had increased over $450 to an overall annual premium of $1,450!

By shopping around for new homeowners insurance I was able to cut my insurance in half. That’s right down to just over $700 a year which is a huge savings. So it pays to shop around.

4. If you have two automobiles in your household but there is only one driver, be sure to let your insurance agent know that your second vehicle is a recreational vehicle. You may be able to lower your premiums since you are not driving that vehicle every day.

5. Use insurance bundles. By bundling your auto and home owners insurance together, you can lower your overall premium that you pay.

6. Increase your deductibles. You can save substantial money on your automobile insurance premiums by carrying higher deductibles. The downside to this is if you are in an accident or have a major home repair home repair, you are going to be responsible for the deductible at that point. So be sure to start budgeting and create an emergency fun so you can have the money on hand if needed.

7. Skip the car rental insurance. More than likely, your normal automobile insurance covers car rentals as well. If you are going on a family vacation, be sure to check in with your insurance agent to see if you really need to splurge for that extra car rental insurance.

8. If your car is older than seven years, consider dropping full coverage for your car insurance.

Frugal Living Tips For Your Utilities

There are multiple ways to save on utilities including how to save money using solar power for some of your home expenses.

1. Use ceiling fans also in the summer to reduce your air conditioning load, but also in the winter to help circulate heat.

2. Turn your thermostat down in the winter and dress warmer to save and reduce your heating bill.

3. Use LED lights and light bulbs whenever possible.

4. Consider replacing fluorescent lights in your home often found in the kitchen with an LED light fixture.

5. Only buy energy-efficient appliances and avoid purchasing the cheaper appliances as they take more resources to run those appliances.

Thinking about upgrading your appliances and not sure what to do with your old ones? Check out our post on who buys used appliances near you and get cash for your old appliances.

6. Compare utility rates with other utility providers and see about switching if possible.

7. Hose off your air conditioning coils outside to remove debris. This will help your air conditioner run more efficiently.

8. If your air-conditioner is older than 15 years, consider upgrading it to a replacement one that is more efficient. Your utility company may provide rebates for this as well.

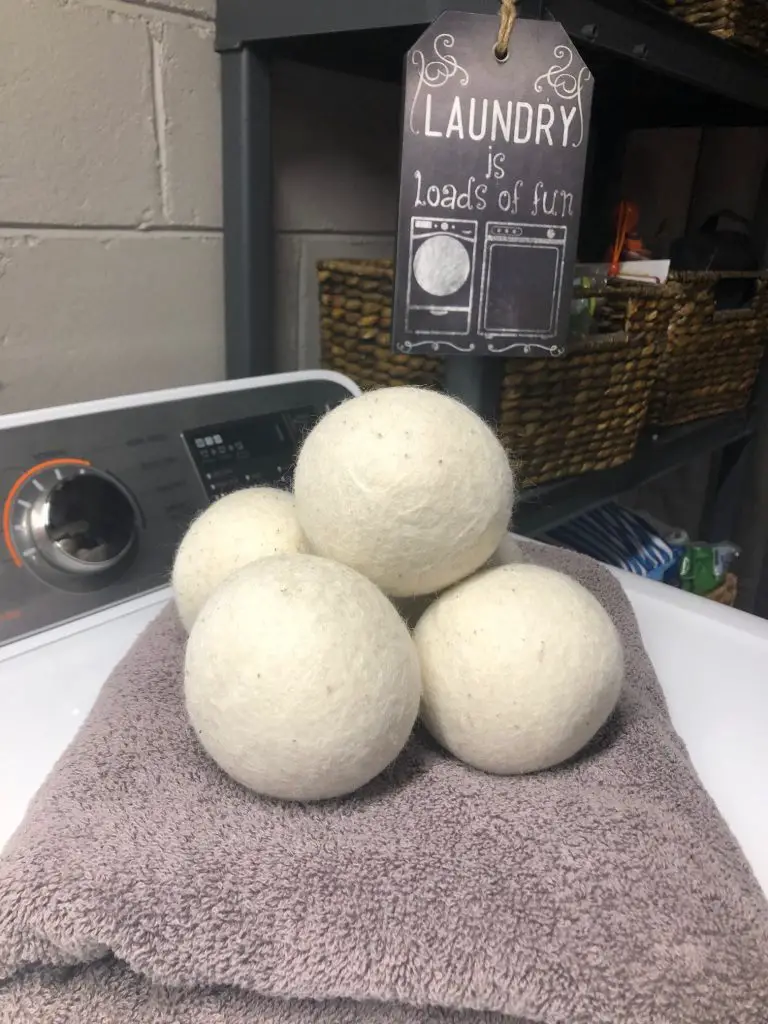

9. Use dryer balls made of wool as they can reduce the time and energy needed for drying your clothes.

Frugal Living Tips For Entertainment

1. Don’t rent movies on demand. Instead go to your local library and check them out for free.

2. Consider using a streaming service such as Netflix, Hulu, or Amazon. This will give you tens of thousands of viewing choices.

3. If you belong to a membership organization such as AAA, check for travel discounts and substantial savings and other entertainment activities.

4. Focus more on activities such as walking, bike riding, going to the local zoo, or take up a hobby such as running. Not only will you be saving money, but you also will improve your health.

5. Check out meetup.com for local activities that might interest you.

6. Look into community events. My community has many free concerts in the summer time which is a great way for free entertainment for my family.

7. Don’t go to the bars, instead focus on cheap date ideas and have drinks and cocktails at home.

8. Consider hosting a monthly dinner or potluck with your friends.

9. If you have a hobby that you are partial to, turn it into a side hustle. There are many creative ways to make money nowadays and a lot of them started by people who had hobbies.

10. If you do end up going to the movies, forgo the concession stand snacks.

11. Consider going out for breakfast than dinner. With a breakfast purchase, all you have to purchase is a cup of coffee. When you go out to eat for dinner, it’s not uncommon to spend more than $6.00 for a glass of wine and $2.50 for a fountain drink.

12. If you end up traveling, for example to a waterpark, go during the week instead of on the weekend. Often times when I travel with my family out of town, we do activities during the week. Prices are a lot cheaper at waterparks for example during the week versus the weekend.

13. Consider installing a high range HD digital antenna to pick up several free digital TV subscription channels.

Frugal Living tips For Transportation

1. Consider using public transportation.

2. Don’t go to car washes in the summertime. Consider washing the car yourself.

3. Get into a car pool or a van pool if you are not able to utilize public transportation. There are many ride share websites that exist which can help link up drivers and riders.

4. Get rid of all the extra clutter in your car because it’s adding additional weight.

5. Drive 10 mph lower on the freeway. You will use up to 35% less gas by driving slower.

6. Try to work at home and telecommute a few days a week if your employer will allow it.

7. Be sure to maintain the scheduled maintenance on your household cars. If you end up deferring maintenance, it just causes a bigger repair bill down the road. (I’ve been there!)

8. Don’t travel on toll roads if possible.

9. Most people don’t know this but you can use apps such as Rakuten to save money on booking hotels when traveling.

10. Become a one car household. Owning two cars can add significant cost to not only your car insurance bill, but also the cost of maintaining two vehicles is expensive.

A set of tires alone can run around $500 minimum with installation not to mention gas as well. Additional costs are especially true if potholes exist in your state. By having a second car you are doubling the chance that you could blow out a tire from a pothole or receive stone chips in your windshield from flying concrete.

11. Consider switching back to a high mileage sedan. People love SUVs. I have always found this phenomenon fascinating because they remind me of old school station wagons from when I was a kid. The only difference is that they just look like they are beefed up on steroids today!

12. Consider biking to work if you live close enough.

13. If you live too far to bike you can purchase a gasoline scooter to get you to work instead of buying a second car. Scooter usage however is dependent on climate.

Frugal Living Tips To Improve Your Health

1. Exercise daily.

2. Go for walks around your neighborhood.

3. You can also take up running as well to burn those calories.

4. Additionally you can also pick up cheap used exercise equipment at secondhand stores or even at the curb for free sometimes. Build yourself a workout gym and save those gym membership fees.

5. Don’t buy bottled water. Consider placing filters on all of your faucets and use reusable water bottles.

6. Skip the barber and try to cut your own hair. It is easy for men to do. Men can buy a hair trimming kit for about $50 or less on Amazon.

7. Cut back on your Starbucks purchases and brew coffee at your house. You will notice a significant financial savings by home brewing your coffee.

8. Practice meditation daily and schedule time for yourself to decompress.

9. Stop using tobacco products.

10. Try to schedule your doctor check up appointments well in advance so you can financially prepare for them.

11. Buy your eyeglass frames from sites such as AliExpress. A little known secret is that eyeglass frames are extremely cheap to produce since all they are is plastic. Find a frame that you like then have your lenses made at a retail store.

My friend Eric does this all the time.

You will save at least a couple hundred dollars by doing it this way and if you have to buy 10 or 15 pairs of glasses frames, remember all you have invested is less than $100 for the frames. You can save significant amounts of money on the frame.

12. Floss daily and after every meal so you can avoid tartar buildup, gum disease, and getting cavities.

13. Take electronics breaks during the day. Don’t answer emails or respond on social media to inquiries.

14. Transfer prescriptions over to new stores. Often times when you do this you can cash in on some pretty big promotions like $20 gift cards.

15. Open up a flexible spending account for health insurance expenses if your employer provides one.

16. Attend community college for all your basic classes then transfer those credits to a four year university. You will save $1,000’s in tuition.

17. Consider taking online classes if the credits will transfer. You won’t have to worry about transportation costs.

Frugality Living Tips For College Students

1. Buy furniture off Craigslist or see if your university has a salvage surplus store. I purchased an $8.00 couch this way that lasted me years when I was in college.

2. Take snacks with you for lunch instead of having to purchase meals in dorm or college cafeterias.

3. Use your student ID for discounts. Many places (such as Amtrak or the movies) offer student discounts for their services.

4. If you have a meal plan, take snacks and food back with you such as an apple. Snack on that instead of purchasing snacks from the grocery store.

5. If you are able to drive home every couple of weeks, wash your laundry at mom and dads instead of the laundromat. Thanks mom!

6. Swap books instead of buying them. Use sites such as www.paperbackswap.com to exchange books with others.

7. Sign up for sites like Prize Rebel where you can earn points in your spare time which are redeemable for gift cards.

8. Try to forego takeout food. Rather make meals yourself.

9. Limit your bar trips to just on the weekends if you partake in that lifestyle.

10. Try to avoid alcohol altogether.

11. Start a side hustle. College is the perfect time to make money with surveys for example in your down time. You can make upwards of $1,000 per month!

12. If you are in student housing, consider moving off of campus. You can save significant money living off campus.

13. If your lease will allow it, consider getting a roommate.

14. Start biking to class instead of public transportation.

Frugality Living Tips For Everything Else

1. Be sure to create a budget so you can plan for unnecessary expenses that come up in your life.

2. Find another couple and take turns watching each other‘s kids for babysitting. This way you and your significant other can go out on a date night and you won’t have to pay the sitter $50.

3. Buy family memberships to things such as the zoo. Often times the zoo membership can be good at several zoos throughout the country.

4. Buy greeting cards at the dollar store. I do this (sorry kids) but it is significant savings and all of that money saved is going into my kids college fund!

You can save as much as $6.00 a card multiply that by four cards a month you are talking real money $24 a month and $288 a year.

5. Renegotiate your cell phone plan.

6. Look at how much your internet is and renegotiate your internet services for a cheaper plan.

7. If you have a lot of student loan debt, consider refinancing it.

8. Round up all of your payments you make each month where you have an interest charge such as credit card debt payments, mortgage payments, or car payments. You will save yourself money by reducing interest charges.

9. Always fill up your car with gas when it goes down. You can use apps such as GasBuddy to determine where gas is cheapest in your area.

10. Make appliance repairs yourself. Appliances break down a lot these days but there are repair places such as repairclinic.com that will help diagnose the problem and walk you through how to correct it. You can also refer to videos on YouTube for additional reference support.

11. Buy school supplies when they go on sale during back to school days in late summer. Even these prices are cheaper than what you would pay at the dollar store. Consider going to Target and using your red card for additional savings.

12. Recycle and reuse gifts whenever possible.

13. Camp out in your backyard instead of driving somewhere to camp. You will save yourself tons of money and have just as much fun.

14. Start tracking your income and expenses.

15. If your bank is charging you bank fees for minimum deposits, find a new bank.

16. If you are not earning any interest on your bank account, check into high-yield savings account such as CIT Bank that is currently paying one of the highest interest rates for a savings account in the country.

17. Unsubscribe from all junk email offers (so you won’t make impulse purchases).

18. Use sites such as Swagbucks and Survey Junkie to make extra money.

19. Unless your kids spilled Capri Sun all over you, wear your jeans a few times before washing them.

20. Live below your means when possible.

21. Use shopping bags for waste basket liners.

22. Put shredded mail and bills into your flower beds to help control weeds. You an also use free newspaper for gardening as well.

Wrap Up

Whatever your personal or financial goals in your life are, these frugal living tips can help you accomplish those dreams.

By following some of these frugal living tips you’ll have many benefits of living below your means, you will have your finances back on track in no time.

Additionally, its’s also a way how to deal with lifestyle inflation in your life. If you are looking for additional information check out our resource links below and be sure to subscribe to our newsletter.

Looking for more ways to save money?

Check out our Saving Money Guide: Saving Money Strategies That Work