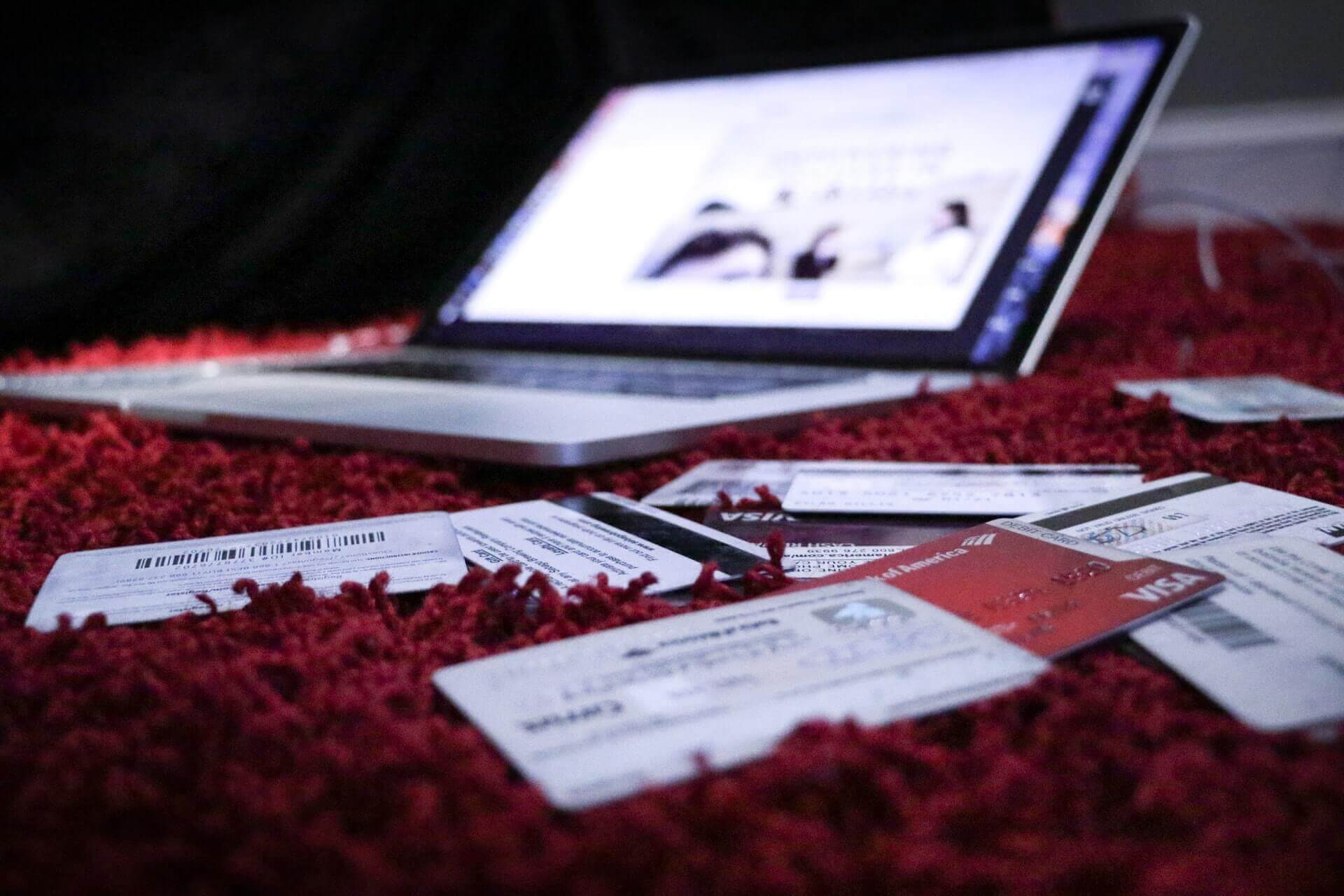

Having bad credit can make your financial life very difficult because it means you’ll struggle to secure loans or get credit cards. Even if you manage to access either of them, you may still end up paying through the nose because they’ll likely come with high-interest rates. If you have bad credit, you might be wondering how you can repair it by yourself.

How to repair your credit yourself starts with gathering your credit reports, determining what needs fixing, disputing inaccurate/incomplete credit report information, settling your debt, building new credit, and learning responsible credit habits.

Read on for details on how you can fix your credit by yourself using the above steps.

Gather Your Credit Reports

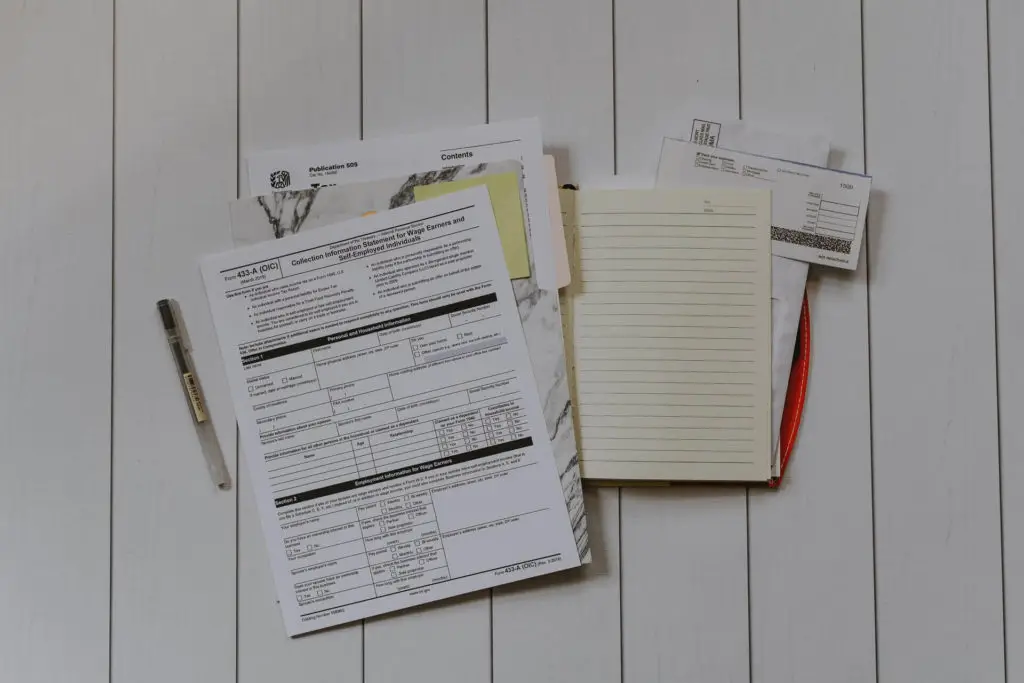

Before you even think about fixing it, you need to assess your credit situation to find out why it’s not-so-great in the first place. Gathering credit reports will give you a chance to identify negative items or incorrect information that might be affecting your credit score.

The first step for how to repair your credit yourself involves conduction an assessment on your credit. To perform this assessment, you’ll need to get your hands on your credit report.

Luckily, this won’t be hard to do, thanks to credit bureaus such as Equifax, Experian, and TransUnion. These organizations are legally required to furnish you with your credit report once every year (all you have to do is ask). You can also access free credit reports via AnnualCreditReport, a federally-recognized website jointly run by Equifax, Experian, and TransUnion.

The way you access your credit report may vary across the three bureaus (visit their individual sites to learn more). Nevertheless, you’ll want to order your credit report from all three because some of your lenders may report your financial information to just one of the bureaus. Since the bureaus usually don’t exchange this kind of data, you may end up with varying information on your credit reports from each organization.

Ordering your credit report from all three organizations lets you get around this issue by providing your complete credit history. This way, you can fix your credit at not just one but all three bureaus. It also helps to make a copy of all three reports so that when you need to dispute some info, you can keep a copy and send the other to the credit bureau in question.

Determine What Needs Fixing

With all your credit reports at hand, take your time to go through each and compare them. In case of any discrepancies among the reports, note them down.

Generally, three types of data often need fixing when taking the DIY route to repair your credit. These include:

- Incomplete or inaccurate account information: For instance, payments that may have been mistakenly reported late

- Duplicated items: For instance, debt may be reported more than once

- Wrong personal information: For instance, your social security number, name, date of birth, or address

- Mixed credit files: This simply means that another person’s information is being mistakenly recorded on your credit file. It often happens when two individuals share a name. For instance, a son and his father (i.e., Sr. and Jr.)

- Unfamiliar items that may indicate identity theft or credit fraud: For instance, credit accounts (collection accounts included) that seem strange

When deciding what items on your credit report need fixing, it helps to mark each type of information with a separate color highlighter. This makes it easier to develop a credit repair plan because each type of fixable information will require a different approach. You don’t want to be revisiting your credit report every time you need to file a dispute, call a creditor, or make a payment.

Dispute Incomplete/Inaccurate Credit Report Information

If you come across any incorrect or incomplete information when reviewing your report, you have a legal right to file a dispute online with the bureau that provided an erroneous credit report. Filing disputes are a good way how to improve your credit score fast. Usually, credit reports come with instructions for filing a dispute online.

Filing a Dispute Online

Let’s take a quick overview of the steps involved with each credit bureau.

Experian

While you can still do it via mail or phone, the easiest and fastest way to dispute an erroneous Experian Credit report is to submit your desired corrections via their online Dispute Center.

Usually, any credit report provided by the organization will have the following sections:

- Accounts

- Personal information

- Inquiries

- Public records (not always included)

If there are items that may be hurting your credit, they’ll be indicated under an extra section labeled “Potentially Negative.” Frequently, this is where inaccuracies exist, and you can dispute them using the following steps:

- Visit the Dispute Center (link above) and read the instructions for correcting credit report inaccuracies or incompleteness. When you’re done, click on “start a new dispute” to access your report and choose the entry you’re looking to dispute.

- From the dropdown menu, select your reason for filing the dispute. With some entries, you may be required to type your explanation. In other instances, you may be instructed to provide supporting documentation to substantiate the correction. Act accordingly.

- Double-check the dispute and hit the submit button. If it goes through, a confirmation page will appear, as well as an “upload a document” link that you can use to add scanned documents to support your claim.

- Allow 30 days for the dispute process to take its course. Throughout the dispute review process, Experian will keep you updated via email. You’ll also get notified when the results of your dispute are available. In addition to email updates, you can also track your dispute’s progress in the Alerts section of the organization’s Dispute Center.

- View the results of your dispute. After the dispute process plays out, visit the Dispute Center’s Completed section to access your results.

TransUnion

Like with Experian, the easiest and fastest way to dispute credit report information with TransUnion is via their free online credit dispute service.

Here’s how to go about it:

- On the credit dispute service page linked above, click on the “Start a Dispute” tab and create an account if you don’t have one. With an account, it’ll be easy to track your dispute’s status and check the results of your investigation. If you previously filed a freeze, fraud alert, or a different online dispute with TransUnion, you don’t need to create an account. Simply log in with your user name and password.

- Once logged in, click on “New Investigation” and select the item you’d like to dispute. If you’re disputing multiple items, make sure you select all of them before you proceed to the next step.

- After selecting all your dispute items, you’ll get an option to upload supporting documents. These can be relevant lender-or-court paperwork that can act as evidence for your claim(s). Note that TransUnion doesn’t allow document uploads for claims related to updates to personal information. If you’re disputing such information, you’ll have to use their phone or mail dispute services.

- Having added all the documents you need to support your dispute, hit the submit button and wait (could 30 days or less) for the process to take its course. Once they’re done investigating your dispute, you’ll be notified via email, after which you can log in and check your results as well as your updated credit report.

Equifax

The process of filing a dispute online with Equifax is more or less the same as that of TransUnion and Experian, so we won’t go step by step to avoid redundancy. Simply create an account if you don’t have one, attach all supporting documents and submit. In case you get stuck, check their disputes FAQs.

If you prefer a do it yourself credit repair letter and want to use to use mail, click here to learn which supporting documents you’ll need to include. Once you compiled everything you need to support your claim, send it to the following address:

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374-0256

What to Expect After a Filing a Dispute

After you file the dispute, the bureau in question will investigate the problematic item. Depending on their findings and the nature of the disputed item, one of the following things will happen:

- Erroneous information will be rectified.

- Unverifiable information will be deleted or updated.

- Information that’s deemed accurate will remain unchanged.

If you aren’t satisfied with the outcome of the bureau’s investigation, you can follow up on your credit dispute by contacting the creditor who submitted your information to the credit bureau.

Alternatively, you can supplement your credit report with a statement of dispute, explaining why you still believe that information in question is incomplete or erroneous. This statement will reflect on your credit report whenever a prospective lender or creditor requests it. This way, they can request you to provide further details on the disputed item(s) during their review process.

Lastly, you can also submit another dispute with more relevant supporting documents. If the extra evidence substantiates your claim, chances are you’ll get a different outcome.

How Disputing May Help Repair Your Credit

The simple act of filing a dispute with any credit bureau won’t affect your credit. However, what could affect it are the changes that may be made to your credit report after the dispute is processed. Depending on the outcome of the dispute, your credit score may go up, down, or remain unchanged.

For instance, your credit score may improve following the deletion of wrongly reported negative information like unpaid collection accounts or overdue payments. However, while updates to your personal details are critical to accurate credit tracking, such changes won’t affect your credit score.

Settle Your Debts

Whether outstanding balance vs principal balance, paying up your debts can be another way to improve your credit score. That’s because your payment history is one of the five key factors affecting your credit score, accounting for up to 35% of your FICO score (the most widely used credit score by lenders).

There are several ways to reduce your debt, and each may be ideal for varying financial situations.

Let’s review them below.

Pay in Full

This simply means paying the full amount that you owe as opposed to a portion of it. It’s always the best option when you want to improve your credit as soon as possible because when an account is reported as “paid in full” on your report, it shows prospective lenders that you settled the full debt that was due; thus, you are creditworthy. You can use a personal finance flowchart to help prioritize what to pay.

Since accounts closed in good faith reflect on your credit report for up to a decade, paying in full can be a great way to bump up your credit score in the long run.

If you have several debts and are looking to pay in full, here are two repayment methods you can use:

- Debt avalanche: This simply means settling debts starting with the debt that bears the highest interest rate. The advantage of using this method is that you’ll reduce the total amount of interest that you’ll pay over time.

- Debt snowball: With this approach, you start paying debts with minimal balances first. The main advantage of using this approach is that once you’ve completed paying your small debts, it will motivate you to settle other debts with higher balances.

Debt Consolidation

Dealing with several high-interest debts can be quite costly. This is why sometimes it can be ideal to consolidate them. Debt consolidation simply means securing one massive loan to help you settle all of your debts at once.

Since you’ll only be left with a single debt, you won’t incur as much interest expense as you would when dealing with multiple high-interest debts.

Work-Out a Payment Plan With Lenders

The bottom line for lenders is that they just want their money plus interest back, and sometimes they will care less how long it takes for that to happen if the alternative is a borrower defaulting a debt. Working out a payment plan with lenders will allow you to get out of debt fast.

So if, for some reason, you can no longer keep up with the initially agreed sum for monthly payments, your lender might be willing to renegotiate for a more favorable arrangement rather than having you fail to pay altogether. Whether they agree to such a request will depend on their consent and the terms of your agreement.

Build New Credit

It is noteworthy to point out that how to fix your credit involved building new credit. There are several methods that you can use to build new credit, and each works differently. Let’s take a look at how you can leverage them to boost your creditworthiness.

- Become an authorized user. You can become an authorized user by requesting a family member/close friend with a dependable history of on-time payments to include you in his/her credit card account as an authorized user. Once included, their stellar payment history will also be reflected on your credit report, effectively boosting your credit score.

- Credit builder loans are uniquely designed to help you repair your credit by allowing you to make monthly payments over the life of the loan as a means of demonstrating to credit bureaus that you can make timely payments. Unlike your typical loans, the lender will not give you money upfront. Rather, they’ll deposit the money into a savings account that you will only have access to once you’ve paid the loan in full.

- Open a new credit account. Regardless of your bad credit status, you may be surprised to learn that you may still qualify for a secured credit card. All you need to do is pay a small refundable deposit to qualify. While your new credit card won’t come with some of the benefits that normal credit card users enjoy, it’ll allow you to build a brand new history of reliable on-time payments, which will boost your credit score.

If you need a bank accoutn but have unfavorable financial history, there are banks that don’t use Chexsystems to check your bank history.

All you need to do is decide checking vs. savings account for yourself.

Learn Responsible Credit Habits

Learning how to repair your credit yourself also includes long-term management. Educating yourself on good credit habits will help you avoid future cases of bad credit. You should also create your own monthly budget and stick to it. The top three responsible credit habits you’ll want to nurture include:

Paying All of Your Debts on Time

The benefit of paying your loans or credit card debts on time is twofold: it will help improve your credit score and help you avoid incurring extra interest charges associated with late debts payment.

One way to ensure that you always pay your debts on time is by activating automatic payments. Automatic payment is an understanding between you and your lender whereby the lender is allowed to make periodic withdrawals from your credit card or savings account as a means of settling your debt. Exercising this option can help avoid forgetting to make payments on time and subsequently reduce your interest charges. Budgeting tips and tricks such as automatic payments will help avoid late fees.

It’s worth noting that payments less than 30 days late will not damage your credit score because only payments that are more than a month late are reported to credit bureaus.

You should also take note of bank direct deposit times so you know when your paychecks are transferred into your accounts. You can avoid overdraft fees by knowing this schedule.

Keeping Your Credit Card Balance Low

Your credit utilization is one of the major factors affecting your credit score besides your payment history. By definition, credit utilization is the proportion of your gross credit card debt to your credit limit. Essentially, a higher credit utilization ratio will damage your credit score.

What this means is that as long as you settle your credit card debts before the statement closing date, you’ll still have a low credit utilization ratio, and consequently, your credit score will remain intact. Use budgetary guidelines to keep your balances low.

Only Borrowing What You Can Afford

You should always avoid borrowing loans that you can’t settle promptly because they will end up hurting your credit score. Similarly, you should steer off swiping your credit card for amounts that you can’t settle in full within a month. If you are having a hard time making your bills consider moving back in with parents so you can dedicate more of your income to bills.

Summing Up

Determining how to repair your credit yourself doesn’t have to be a daunting task. Before we round things up, understand that even after jumping through all these hoops to repair your credit, you’ll still need good old patience to start noticing a difference in your credit reports.

Typically, negative items such as loan defaults and late payments will remain in your reports for about 7 to 10 years. However, the good news is that the impact of these negative items on your report will gradually wear off with time. There are ways how to get pre-approved for a car loan when you have bad credit so the credit repair won’t impact your life that much. Eventually, your credit will recover (unless, of course, you plunge back into irresponsible credit behavior), so hang in there. All the best!