Answering how many credit cards you should have is tricky, but sometimes having more than one can help. However, there are disadvantages of having multiple credit cards.

According to the bulk of authorities, having many credit cards can either benefit or harm your credit score depending on how responsibly you handle them.

Is it advisable to have several credit cards? No, you are already aware of this if you have ever racked up a significant amount of credit card debt.

Despite this, Americans continue to use their available credit cards. Currently, the average American has four credit cards, according to a recent Experian study.

This statistic is consistent with American consumers paying off credit card debt as the coronavirus outbreak spreads economic anxiety and is marginally lower than in previous years.

Isn’t it a Bad Idea to Have Several Credit Cards with ZERO Balances?

Your credit card balance is one factor that determines your credit score. If carrying a credit card balance from month to month, your credit score will take a hit. As a result, it’s typically preferred to pay off your credit card in full at the end of the month.

Conversely, if you have several credit cards with zero balances, that will not necessarily hurt your credit score.

In fact, having multiple lines of credit with no balance (or a low balance) can actually improve your credit score because. This behavior shows lenders that you’re capable of managing multiple lines of credit responsibly. Your credit limits benefit.

Higher credit scores allow:

- Easier qualification for loans with lower interest rates

- Access to new lines of credit more easily

- Streamlined approved for rent or a mortgage

- Consumer cell phone financing no credit check plans with better terms

In other words, having multiple credit cards can actually help you out if you’re using them responsibly.

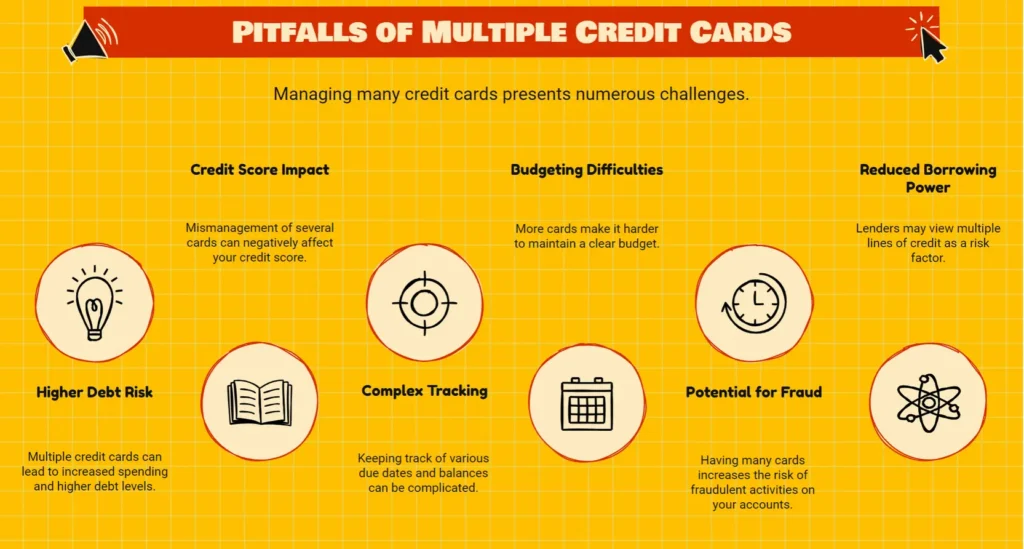

What Are the Disadvantages of Having Multiple Credit Cards?

It’s tempting to apply for every credit card you like because the finest credit cards provide a wide range of rewards. You can receive more sign-up bonuses, earn more rewards in more spending categories, and enjoy even more benefits by having several cards. However, having multiple credit cards might affect your credit usage ratio in a number of ways.

Here are some disadvantages of having multiple credit cards:

Your Credit Score May Be Impacted

There are a few ways that having many credit cards might damage your credit, even if the number of cards you have has no impact on your credit score.

Your credit score is based in part on how long your credit history has generally been open. Your average account history will be shorter if you open multiple new credit cards.

New credit inquiries, which include hard credit inquiries made whenever you apply for a credit card, are another aspect that affects your credit score.

You will have numerous hard queries on your credit file if you apply for several credit cards, which will lower your credit score.

More Annual Fees Could Be Paid

Annual fees are associated with many of the credit cards that offer the most benefits, particularly the most well-known travel cards.

If you use a credit card frequently and benefit much from it, it is simple to justify paying an annual fee for it. When you have annual fee cards, make sure that you understand the terms and conditions of each one. You must carefully consider whether you use each one sufficiently to justify the fees.

Furthermore, even if the answer is affirmative, costs can still add up.

It’s More Difficult To Be Accepted For New Credit Cards

The thing that irks me the most about having so many credit cards is how much more difficult it is to get new ones approved. Many credit card issuers now reject applications because the applicant has either too many credit accounts and credit lines open already or has recently applied for too many cards.

Credit scores will not always be lowered by these activities, but they may influence a credit card issuer’s decision to approve or deny an application.

Having multiple cards also makes it more likely that you’ll be rejected for a new card because your credit utilization ratio will be too high.

You Must Keep In Mind Which Credit Card To Use For Each Purchase

The ability to collect extra rewards on your purchases is one perk of having several credit cards. For instance, you might combine a card that offers a respectable flat rate on all of your purchases with cards that offer greater bonus rates on particular expenditure categories, like travel, dining, groceries, and gas. It’s a terrific method to improve your earnings of cash back or travel rewards.

The drawback is that to receive those additional benefits. You’ll also need to understand which card to use for whatever bonus category.

As a result, you might find yourself attempting to recall which of your numerous cards will give you the best rewards when you’re waiting in line at the register.

Your Odds Increase for Credit Card Debt

With multiple credit cards in play, you might miss promotions such as an initial interest-free period on a balance transfer or a 0% APR on new purchases.

If you’re not disciplined with your expenses, it’s easy to spend more than you can afford and wind up with debt on several cards.

You can find your finance charge with an average daily balance if you end up missing promotions.

You Should Manage More Accounts

Your finances become more complex every time you carry more credit cards. The likelihood of a missed payment is increased because you have another bill to pay. Keep an eye out for fraud on this account.

You probably won’t experience too many problems once you have one or two credit cards. But when the number of accounts grows, managing them all becomes much more difficult. Remember canceling a credit card won’t stop recurring payments from the billing cycle.

You could lose money from any missing payments or other errors, so you should only accept this kind of responsibility if you are confident that you can handle it.

You probably won’t experience too many problems once you have one or two credit cards. But when the number of accounts grows, managing them all becomes much more difficult.

You could lose money from any missing payments or other errors, so you should only accept this kind of responsibility if you are confident that you can handle it.

Should You Always Carry a Credit Card on You?

It would be much easier if you could use cash from a liquid account, like a savings account, rather than having to use your credit card in an emergency.

Being prepared for your emergency is the best way to handle it. Consider having at least two credit cards just in case one of them gets depleted due to unforeseen circumstances like unanticipated medical bills or job loss, which could leave you unable to make ends meet until your next payday rolls around!

Situations Where You Would Need a Credit Card Instead of Cash

- Remote Toll Roads: While many toll roads accept cash or have electronic tolling systems, some remote or less-traveled roads may only accept credit card payments at unmanned toll booths.

- Unmanned Gas Stations: In remote areas or late at night, some gas stations may not have attendants present and only accept payment through automated machines, often requiring a credit card.

- International Travel: In some countries, especially those with less developed banking systems or limited acceptance of debit cards, having a credit card can be essential for making purchases, booking accommodations, or securing transportation.

- Hotel Incidental Charges: When checking into a hotel, they may require a credit card for incidentals such as room service, minibar purchases, or damages.

- Remote Purchases: If you’re in a situation where you need to make a purchase online or over the phone for an unexpected item or service, a credit card might be the only accepted payment method.

- Renting Equipment: When renting equipment such as tools, outdoor gear, or recreational vehicles, the rental company may require a credit card as a form of security deposit.

- Emergency Hotel Stay: While there are a lot of hotels that take cash, if you encounter unexpected travel delays or cancellations, having a credit card can be crucial for booking last-minute accommodations.

- Paying for Medical Supplies or Services: In situations where you need to purchase medical supplies or services outside of a traditional healthcare setting, such as at a medical conference or from a private clinic, a credit card may be the only accepted form of payment.

- Unexpected Vehicle Repairs: If your vehicle breaks down in a remote area or during off-hours, the repair shop may only accept payment via credit card for parts and services.

These cards should have no annual fees, a high credit limit, and low-interest rates. To prevent racking up too much debt, employ extreme caution if you decide to use credit cards after losing your job.

How Many Credit Cards are Too Many?

Possessing too many credit cards can lead to financial problems. More than one card can be difficult to keep track of. It can be tempting for a new rewards card and to sign up for multiple cards in order to take advantage of rewards and other perks, but this can quickly become unmanageable.

It’s possible that you’re having trouble making payments on time or keeping track of your spending if you find yourself in this position.

It’s important to use credit responsibly in order to avoid debt and keep your finances healthy. Knowing how many credit cards is the right number for you to have is hard. If you’re unsure, consider talking to a financial advisor.

Pros And Cons of Having Several Credit Cards

Do several credit cards indicate sound money management or approaching financial ruin? Given that carrying many cards has advantages and disadvantages, that is a challenging question to answer:

Pros

Prevention Of Fraud

You are more susceptible to fraud if you only use one card for everything. The likelihood of a card being compromised increases with the overall volume of purchases with that card.

Furthermore, if your card is hacked, you won’t have access to plastic while you wait for a replacement to be delivered. It spreads the risk of having several cards.

Back-Up

Having a backup card on hand gives you security in case one of your credit cards is denied or becomes compromised. Are you going abroad? A second credit card can help you save money while on vacation if one of your credit cards has no international transaction fees or bonus points.

Multiple Benefits

The ability to take advantage of numerous rewards programs is one clear perk of having many credit cards. There are so many easy department store credit cards with guaranteed approval offering maximum rewards for new accounts. The card that offers the best supermarket rewards can be used at the grocery store, while the travel rewards card can be used to purchase airline tickets.

Real credit card experts are skilled at manipulating the system to maximize the benefits of owning multiple cards. Maximum reward cards that offer the best rewards also come with high annual fees.

Cons

Payoff Risk

Having many cards is problematic if you have a tendency to overspend or are already in debt from credit cards and can’t pay bills effectively. Stick with a single credit card if there’s a danger that you’ll view each card as a chance to spend more money than you have. A backup payment method might be necessary. Consider paying off a credit card with a gift card as a means.

Credibility Risk

Your credit score will suffer if you open several lines of credit quickly. Having a few high-limit cards that you use sparingly but frequently and always pay off in full over time will do wonders for your credit.

However, in the near run, applying for several cards gives the credit bureaus the impression that you are desperate to accumulate additional debt.

Confusion

Your financial life grows more complicated the more credit cards you have. If you want a good credit score, you’ll need to keep up with more bills, remember to pay them on time, and maintain your credit utilization ratio below 30%. Make sure you know the difference between outstanding balance vs. principal balance when calculating your repayment capacity. Having many credit cards may not be the ideal option if you’re busy, under pressure, or just plain forgetful.

How to Improve Your Credit Utilization Ratio

Statistics show that the credit utilization ratio is roughly 30% of your credit score is based on the amount of debt that you owe, which makes it one of the most important factors in your credit score calculation.

Paying down your debt is one method of improving your credit utilization ratio. Another way to boost your credit utilization ratio is by increasing the credit limit on your cards.

If you have multiple credit cards, you can ask your card issuer for a higher credit limit. Implementing this will lower your credit utilization ratio, and you won’t have to pay extra money towards any debt.

Related Questions

What Is The Ideal Number Of Credit Card Applications?

In theory, you can apply for an unlimited number of new credit cards. The average online application process is just a few minutes long, so you can submit plenty of applications quickly.

It’s common to apply for several credit cards at once, but it doesn’t follow that you should go out and apply for a lot of them. It may help your credit score by allowing time between credit card applications.

Increased Credit Card Use: Does It Improve Credit Score?

Having several new credit cards can improve your credit score, but they can also lower it. Your ability to control your cards effectively will determine everything.

No matter how many credit cards you have, these guidelines still hold true:

- Maintain a low balance

- Make a prompt payment of all credit card bills.

Although the number of cards you have certainly won’t have an impact on your score in and of itself, you should refrain from applying for multiple new credit cards at once.

More credit cards and a bigger credit limit over time, if used responsibly, can help you raise your credit score.

Should You Use The Same Credit Card Twice?

As long as you match the requirements, many credit card companies love you for another one of their credit cards. Additionally, if you’ve always used your present credit card responsibly, it can be simpler for you to be approved for the new card.

The terms of your new credit card will depend on the current income and financial standing that was established when you applied for this particular offer in order to qualify.

Conclusion

Numerous credit cards come with various benefits, but only if you use them sensibly. Keep in mind the advantages each card can provide, as well as your credit limit on each account, and, most importantly, your payment due dates to ensure that having numerous credit card accounts benefits you rather than harms you.

Utilize each card to the fullest extent possible, keep your balances low, and, if at all possible, pay off all of your balances by the due dates every single time.