Recurring payments for bills and other items help those who don’t want to deal with remembering to pay on time. However, when it comes to canceling these payments, you can sometimes run into trouble. Can you cancel a recurring payment when you cancel a credit card?

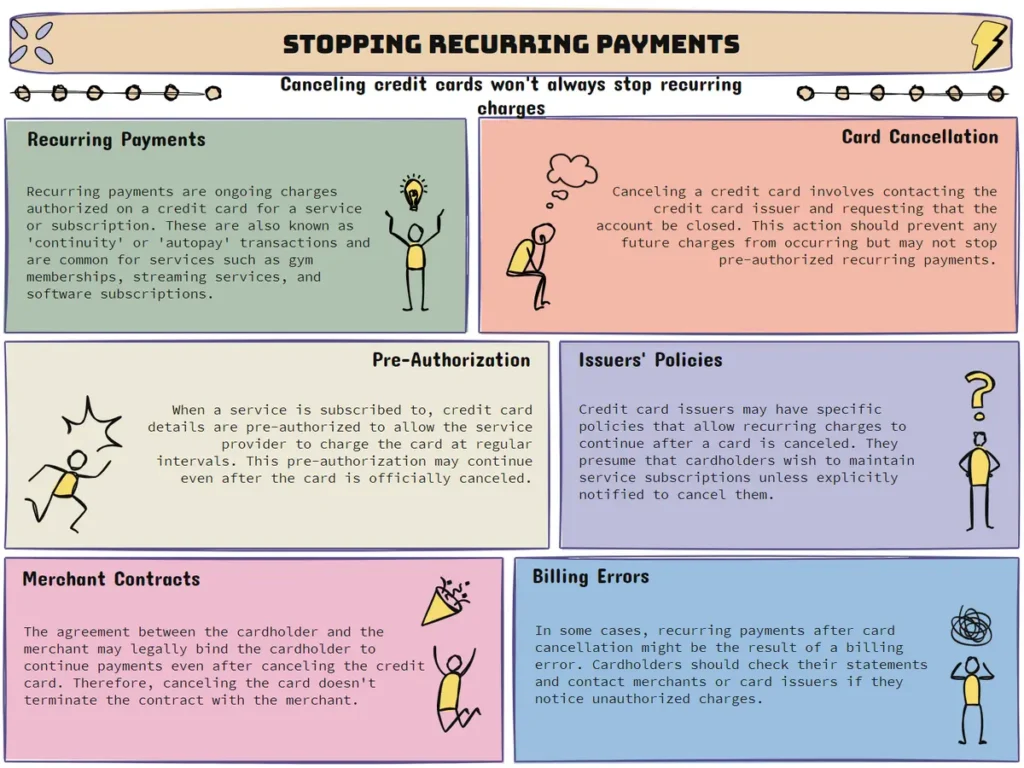

Canceling a credit card won’t stop recurring payments. Canceling the credit card without canceling the payment can harm your credit score, and if you owe money, that debt won’t disappear. To stop recurring payments, you need to cancel the payments through the company.

This article will discuss how recurring payments work, why canceling a credit card to stop recurring payments hurts your credit, how to cancel payments successfully without doing any harm, and how to handle disputes with companies. There are also a lot of alternatives to recurring payments that you can try.

What is a Recurring Payment?

A recurring payment is a payment that is automatically withdrawn by one party from another’s account.

The company will typically withdraw the funds at set intervals and then send an invoice to the person receiving the charge for those services or goods.

Some examples of recurring payments paid with a credit card are:

- Internet or cable bills

- Gym membership payments

- Streaming Services

Certain credit cards will offer an option to enable recurring charges for the cardholder’s convenience. These are typically paid monthly, quarterly, semi-annually, or yearly. A user can also set up a one-time charge that becomes recurrent with every purchase made on the account in question.

How Many People Sign Up For Recurring Billing in the US?

In 2017, it was estimated that more than a billion people subscribed to recurring billing in the US. That number has grown and will continue to grow as more people realize the convenience of a recurring bill.

For example, if you want to set up an automatic payment for your electric company every month with your credit card, this is possible through many providers and by using a service like Plastiq or other similar companies that offer these services. Some even give rewards points on top of paying bills.

What Are Some Companies That Have Recurring Billing?

Some of the most common companies with recurring billing are Netflix, Apple Music, and Spotify. However, many other businesses offer this type of billing as well, such as Square for credit card processing or Adobe Creative Cloud software.

Why Do Companies Offer Recurring Billing?

Companies promote recurring billing because it is substantially more profitable for revenue than one-time billing. It is estimated that the profit companies make on recurring billing is between $200 and $300 billion in the US. A lot of consumers also prefer a recurring payment option. This is why you see a lot of online store credit cards with guaranteed approval from companies.

What Are Some of the Benefits or Drawbacks to Recurring Billing?

Some benefits are that it is convenient for customers, there’s no need to sign up every time they want service from the company, and recurring billing can be an inexpensive option if people have regular access to funds.

Reports are customer retention may also be higher with automated methods. Additionally, some merchants and companies don’t process or mail out invoicing. An invoice is usually offered online on the site of the merchant for the customer’s account.

A drawback would be that some companies offer different prices on their services depending on whether someone subscribes separately or uses recurring billing. Therefore this could impact customer’s accounts and be a disadvantage for people who only occasionally make purchases with this type of pricing plan.

How Do Recurring Payments Work?

Recurring payments are used to save time and reassure the company that you will pay your bills on schedule. Many people think recurring payments and automatic payments are the same things, but they are slightly different. So what are recurring payments, and how do they work?

Also known as Bill-pay, recurring payments give permission to your bank to send payments to the company. Whereas with automatic payments, you allow companies to take money out of your account. While these payments can come in handy, they can also become a hassle for someone wanting to cancel.

Most people have recurring payments that they forget about or do not know how to cancel.

There are advantages to recurring payments, such as the convenience of having a company automatically withdraw money from your account. However, there are disadvantages as well, such as the possibility that you will forget about the payment or not be able to afford the product or service anymore.

If your proportion of loan balances to loan amounts is too high, canceling your credit card will not eliminate your loan balance.

Some additional downsides of recurring payments are if your bank account is closed or the company sends an incorrect amount. This will cause issues for both parties. This could cause users financial hardship such as overdraft fees as an example.

How To Stop Recurring Payments

There are many reasons why someone may want to stop recurring payments on a credit card, including being low on funds, a change in an account, the bill has been paid off, or wanting to cancel a monthly membership.

To safely stop recurring payments, you need to contact the company in which you’re paying and stop the recurring billing charges for the product or service. Canceling the credit card you use to pay the bill won’t stop them from charging you, and you will still owe money to the company. If you don’t stop the charges, it can go on your credit report.

Stopping a payment to your credit card is different from a debit card. For a credit card, you only need to request that the payments stop from the company that you’re paying. However, you need to be careful and watch your expenses and bank account.

If they continue to charge you, you need to contact your bank, and you’ll have 60 days to dispute the charge.

Stopping recurring payments from a checking account is a little different. After contacting the company, you need to tell your bank at least three business days before the money is scheduled to be transferred.

A credit card transaction is different from a debit card in that you need to contact the company paying your bill and ask them to stop billing you.

For checking account recurring payments, it’s a little more complicated:

- If recurring payments are coming out of your checking account, tell the company as soon as possible, at least three business days before the money is scheduled for take-out.

For debit cards, timing is key when requesting that future funds not come out on certain dates or times. Make sure that transaction dates do not interfere with other payment obligations like rent/mortgage or other personal product or service charges. Use payment plans instead. Research what is progressive leasing to see if you can qualify.

There are several ways to cancel recurring payments on a credit card:

- Call the company. Not all companies allow you to cancel recurring payments over the phone, but some will. After you cancel a payment, you’ll need to call the company again to make sure they have stopped all future payments.

- Go online. If you have recurring payments, you probably have an online account. Most companies, if not all, should allow you to cancel payments online. As long as you have an account, you should be able to stop the payments within your online account.

- Write a letter. Sending a letter might seem old-fashioned, but having this hard-copy proof can help you if you run into trouble while trying to cancel the payments. Sending letters with tracking will provide proof of delivery. Usually, you’ll need to write a letter when a company doesn’t want to cancel recurring payments.

How To Handle Disputes

Occasionally, a company will be difficult and not want to cancel your recurring payments. However, federal law provides protection for recurring automatic payments, and it’s your right to stop a company from taking payments.

To handle a company not wanting to cancel your payments, write and call the company and your bank asking for cancellation. Sending letters will provide physical evidence of wanting to cancel your account, which can be used to your benefit. If the company continues to charge you, you can dispute the charge and get your money back. Having the evidence of calling and writing letters will help with this dispute.

You can prevent a lot of problems from happening by paying attention to your account, as you need to make sure there are no unauthorized transfers.

Being vigilant will allow you to see the pending charge as soon as possible, so you can put a stop to it immediately.

Why Will Canceling My Credit Card Hurt My Credit?

Canceling your credit card while there are still recurring or automatic payments linked to it can affect your credit score. Canceling the credit card that they’re using to charge you might seem appealing, but this will cause you more problems in the long run. When you have a recurring charge that goes unpaid, it reflects negatively on your credit score.

You need to make sure you correctly cancel your credit card to protect your credit score.

How To Cancel a Credit Card

Many people prefer not to cancel their credit cards even if they’re not using them. Simply closing an account can affect your credit score. However, there are several reasons that someone might want to cancel a credit card.

One example, and one of the worst scenarios, is credit card fraud. If your credit card or card number is stolen and used without your permission, canceling the card is the best thing to do. Canceling a credit card has to be taken seriously.

Whatever your reasoning for canceling your card, you should do it correctly.

Here are four steps to take to cancel your credit card successfully:

- Pay off any remaining balance until the balance on your credit card is zero. Trying to cancel your card before paying off the balance will just hurt your credit score, and you’ll still have to pay it off.

- Cancel any recurring payments linked to the account. You need to cancel any recurring payments before canceling a credit card. Otherwise, the company will still charge you, and you’ll eventually have to pay the payments anyway. If you want to change the account the fees are going to, contact the company.

- Call your bank. Before informing the bank that you’re canceling your card, make sure you confirm that you completely paid the card off and there aren’t any interest fees that the company will charge to it. After confirming, let the bank know you’re canceling your card. Your bank might try to talk you out of it, but typically they will cancel it without any trouble. If the bank doesn’t cancel your card, then contact the company that issued your card and ask them to close it.

- Send a cancelation letter. If you’re having difficulties with canceling or want extra assurance, you can send a cancelation letter. Request confirmation in writing that your account was closed, then request your credit report to state the account was closed at your request, which looks better on your credit.

What Happens if I Don’t Pay My Recurring Payment Balance?

If you stop your recurring payments and don’t pay your balance, you’ll be charged a late fee and interest.

Canceling Your Recurring Payment Plan Might Not Be Worth It

There are a lot of banking issues that affect recurring payments. If canceling your account would make it harder to keep track of purchases or if the recurring charge plan offers benefits such as waived annual fees, then don’t cancel it!

Don’t Cancel If You’re Almost Done With Your Balance:

Instead, consider switching from automatic payments to manual withdrawals so that you can pay off the balance without incurring any more charges. This is useful for people who have an irregular income like freelancers but want to avoid finance’s high interest rates on credit cards.

When considering whether or not to cancel your card, ask yourself: Do I need this type of service still? If you can manage your money and don’t need the recurring payment anymore, consider canceling the account.

You can manually pay this bill each month instead of relaying it to your credit card. Additionally, this will also help you monitor your monthly budgeting. Since you will be making the payment each month, you will be able to notice any irregularities.

You can also avoid finance’s high-interest rates by paying off your credit card balance without incurring more charges. If this is not a service that you need anymore, then cancel the account and find an alternative way of making these payments.

Can a Merchant Charge a Cancelled Credit Card?

If you cancel your credit card, the merchant cannot charge it.

It is possible that a merchant can still use an old expired card to take payment from you for goods or services provided before they knew about the canceled status of your account. Checks are not processed as quickly and may be able to process transactions without realizing there was no balance on them.

Merchants do not need consent in order for transactions to process with their terminal. They will see only “Processing” when processing any transactions.

Merchants are unable to charge your credit card if you have canceled it and the account was closed at your request.

Is There a Penalty for Cancelling a Credit Card?

If you are wondering if there is a penalty for canceling a credit card, you should know that most of the time, there is not if there is not a balance. However, sometimes penalty terms can vary depending on the account, which can be found on the terms and condition page of your cardholder agreement.

It’s always a good idea to cancel credit cards you no longer need or use just in case of any fraudulent activity. It will not be financially detrimental to close an account if your balance has been repaid and the card had low balances at all times. However if you cancel a card to stop payments, it’s not a fix for how to deal with lifestyle inflation.

What Happens to Subscriptions if You Cancel Your Credit Card?

If you are wondering what happens to subscriptions if you cancel your credit card, after canceling a subscription from the account page, it will no longer charge at renewal time.

Sometimes there may be an option that asks for new payment information or set-up of automatic future payments, which can help minimize any interruption in service while managing recurring charges.

If you want to keep your subscription, make sure to find a new means to pay. Many people have subscriptions set up as recurring payments, and they don’t use the service. That’s why it could be beneficial for customers to cancel.

Should I Turn Off My Recurring Billing?

If you are worried about a recurring charge, it is worth looking into to see if you are eligible for a refund or cancellation. Financial anxiety is real, and if recurring billing is causing you to worry, it’s worth considering. If you are in a negative financial situation where the recurring expense is causing stress and anxiety or if there really isn’t any need for the subscription anymore, then turning off your recurring billing is probably the best option.

Can I Pause My Recurring Payments?

Sometimes there may be an option that asks for new payment information or set-up of automatic future payments which can help minimize any interruption in service while managing recurring charges.

What Are the Alternatives to Recurring Payments?

There are some alternatives to recurring payments, such as following a “pay-as-you-go” system. Additionally, another option is to just set up a one-time payment and then cancel your subscription.

Alternatives to recurring payments can be beneficial due to some recurring billing systems that charge a monthly fee, which can be reduced to just one-time payments.

You can also use credit card technology. Customers should consider alternatives to recurring payments because they can be beneficial. You can come up with a new payment schedule to help you navigate the due dates.

How Do I Pay Recurring Payments If Unemployed?

If you are unemployed, there are options for you as well instead of the interest hit with recurring payments. There are guaranteed loans for unemployed individuals that may be able to assist with monthly bills. Some loans may have lower interest that credit card finance charges.

How Will I Keep Track of My Payment Schedule?

If you stop your recurring payment and cancel your credit card, you will have to track payment due dates. For example, every other Friday at 12 PM EST will be the date that your payment is made.

You should plan out what day(s) of the week your recurring billing system charges on in order to get ready for those paydays and have them written down somewhere accessible like an email or text message reminder service, which would notify you before time runs up.

The best way to keep track of this information is just by using hard copies of invoices as reminders. You could also use these days with weeks left (12/14). This means that if it’s December 14th, there are two more Fridays until Christmas Day arrives!

Final Thoughts

Canceling a credit card is a relatively straightforward process. However, canceling a credit card to stop recurring payments will do nothing to stop recurring charges and will damage your credit score. The only safe way to cancel recurring payments is to contact the company and your bank.

While typically canceling payments is painless, sometimes companies may try to dispute. Nevertheless, by law, you have the right to cancel any recurring payments. While sometimes it might become a long, lengthy process, fighting with a company to cancel payments instead of canceling your credit card will protect your credit score.

You can always opt for sending in the payment instead of relying on your credit card. Using a payment schedule will reduce the chance of being late with a payment or having your product or service declined.

Deciding whether to set up a recurring payment can be tricky, but by following these steps, you will be able to make your decision more easily.