In the intricate web of financial transactions, ACH transfers stand out as a beacon of efficiency and simplicity. Often overshadowed by their flashier counterparts, like wire transfers or blockchain technology, ACH transfers are the unsung heroes of the banking world. This isn’t just another bland, regurgitated guide. Here, we’re diving deep into the realm of instant ACH transfers online no verification, dissecting its nuances, and exploring its role in modern finance with a blend of personal anecdotes and expert insights.

Learn about Instant ACH Transfers

- What is an ACH transfer?

- Electronic bank-to-bank money transfer.

- How do ACH transfers work?

- Funds moved between accounts electronically.

- How long does it take for an ACH transfer to go through?

- Typically 1-2 business days.

Instant ACH Transfers: What They Are and How They Work

Let’s cut right to the chase. ACH transfers, or Automated Clearing House transfers, are essentially the backbone of the American financial transaction system. They’re what allow you to get your paycheck via direct deposit, pay your bills online, and transfer money between banks without using cash or checks. But the true game-changer in recent years has been the rise of instant ACH transfers online no verification. This innovation has significantly reduced the time it takes for these transactions to clear, offering near-instantaneous financial gratification.

What is an ACH transfer?

An ACH transfer is a form of electronic fund transfer that moves money between banks through the Automated Clearing House network. Traditionally, these transfers could be sluggish, sometimes taking three to five business days to complete. However, with advancements in digital banking, we’re now seeing options for instant transfers that bypass the usual verification processes, making the flow of money faster than ever.

How do ACH transfers work?

To understand how ACH transfers work, envision a vast, interconnected network where banks communicate, initiating and receiving payments on behalf of their customers. This network is overseen by the National Automated Clearing House Association (NACHA), which ensures that your money goes where it needs to without any hitches. The process involves two main types of transactions: direct deposits and direct payments, both of which can now be expedited thanks to instant processing capabilities.

How long does it take for an ACH transfer to go through?

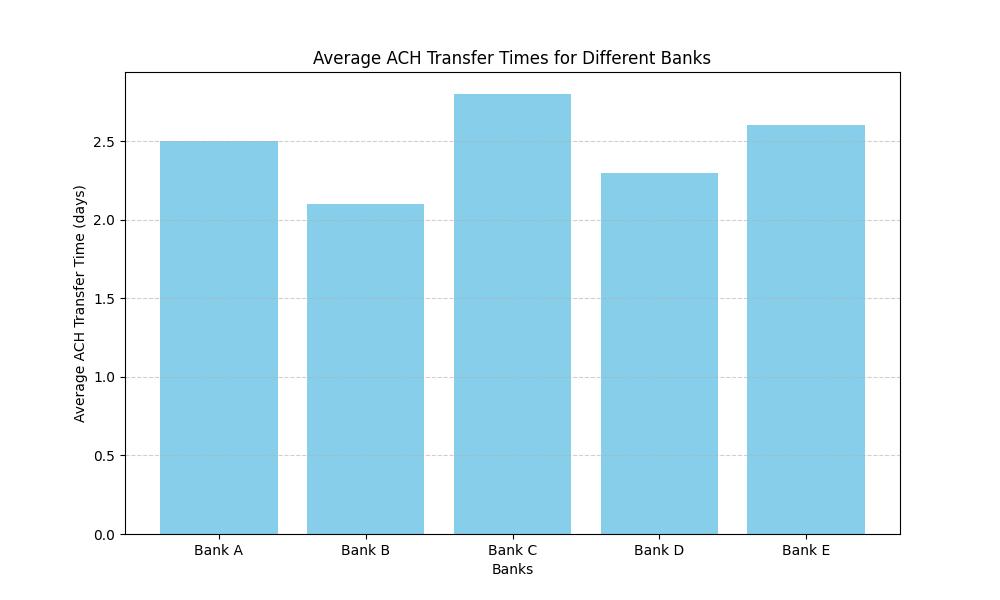

Gone are the days when you had to wait nearly a week for an ACH transfer to reflect in your account. The introduction of same-day and instant ACH transfers has drastically changed the landscape. While traditional ACH transfers could take 2-3 business days, instant transfers slash this time to mere seconds. However, it’s important to note that not all transactions qualify for instant processing, and some banks may still impose a window for processing times.

What are the benefits of ACH transfers?

The allure of ACH transfers isn’t just in their efficiency. They also offer a level of cost-effectiveness and safety that is hard to beat. For businesses, the ability to handle payroll and vendor payments electronically saves significant amounts of time and money. For individuals, the ease of moving money between accounts or paying bills online adds a layer of convenience to personal finance management.

What are the downsides of ACH transfers?

However, it’s not all sunshine and rainbows. One of the main gripes with ACH transfers, especially the instant variety, is the potential for security risks. The speed of these transactions can sometimes outpace security measures, leaving a window for fraud. Additionally, the reliance on digital infrastructure means that technical glitches can occasionally disrupt the flow of transactions.

How do I set up an ACH transfer?

Setting up an ACH transfer is a relatively straightforward process. Most banks and credit unions offer the option to initiate these transfers through their online banking portal. You’ll typically need the routing number and account number of the receiving account, along with some basic information about the recipient. For businesses looking to set up payroll or regular vendor payments, contacting your bank to discuss bulk transfer options might be the way to go.

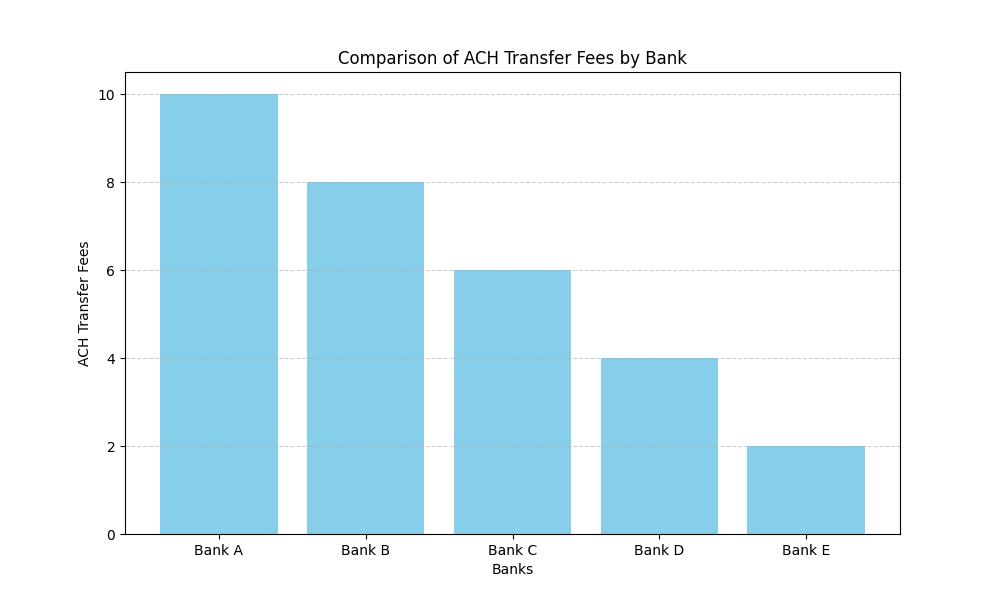

How much does it cost to send an ACH transfer?

The cost of sending an ACH transfer can vary widely depending on your bank and the nature of the transaction. Many banks offer free ACH transfers for personal use, while business transactions might incur a fee. Instant ACH transfers, due to their expedited nature, may also come with a premium. It’s essential to check with your bank for the most up-to-date fee structure.

Are there any limits on ACH transfers?

Yes, ACH transfers often come with limits, which can vary by bank and account type. These limits can range from daily to monthly caps on how much money you can send or receive. For those looking to move large sums of money, it might be necessary to plan your transfers accordingly or explore alternative methods.

Can I reverse an ACH transfer?

Reversing an ACH transfer is possible but comes with caveats. Typically, you have a small window, usually within 24 hours, to cancel or reverse a transfer. Beyond this period, reversing a transaction becomes more complicated and requires going through a dispute process that can be lengthy and not always successful.

Can I cancel an ACH transfer?

Canceling an ACH transfer is similar to reversing one but must be done before the transaction is processed. If you catch a mistake early enough, most banks allow you to cancel the transfer through their online banking portal or by contacting customer service.

Are ACH transfers safe?

ACH transfers are considered one of the safest methods of moving money electronically. The network is highly regulated, and banks implement multiple layers of security to protect your funds. However, as with all forms of digital transactions, vigilance is key. Ensuring the security of your banking credentials and monitoring your accounts for any unauthorized transactions is crucial.

Real-Life Example: Sarah’s Instant ACH Transfer Experience

Sarah’s Frustration with Traditional Transfers

Sarah, a small business owner, used to rely on traditional bank transfers for paying her suppliers. However, the delays and uncertainty associated with these transfers often caused issues with her inventory management.

Discovering Instant ACH Transfers

After researching alternative payment methods, Sarah learned about instant ACH transfers. Intrigued by the promise of near-instant transactions, she decided to give it a try for an urgent supplier payment.

The Seamless Process

Sarah initiated an instant ACH transfer through her online banking portal, entering the recipient’s information and the transfer amount. To her surprise, the funds were credited to the supplier’s account within minutes, allowing her to secure the much-needed inventory without any delays.

The Impact on Sarah’s Business

The efficiency and speed of instant ACH transfers not only helped Sarah streamline her payment process but also improved her relationships with suppliers by ensuring timely payments. Sarah now relies on instant ACH transfers for time-sensitive transactions, benefiting both her business operations and cash flow management.

Conclusion

In the ever-evolving landscape of digital banking, instant ACH transfers online no verification stand out as a monumental stride towards financial ubiquity and fluidity. They embody the perfect blend of speed, convenience, and efficiency that modern consumers and businesses crave. Yet, as we embrace these advancements, it’s vital to remain cognizant of the security implications and navigate the financial waters with informed caution. ACH transfers, in their essence, are a testament to how far we’ve come in financial technology, and yet, they’re just the tip of the iceberg in what’s possible in the future of banking.

Insider Tip: Always verify the details of your ACH transfer twice before hitting send. A single digit off in the routing or account number can send your money astray, turning a convenience into a conundrum.

Remember, whether you’re a seasoned financial professional or a novice navigating your first direct deposit, understanding the intricacies of ACH transfers can empower you to make more informed, efficient, and secure financial decisions.

Questions and Answers

What is an instant ACH transfer online with no verification?

It is a quick way to move funds electronically without needing to verify your identity.

How can I initiate an instant ACH transfer online?

You can do so by using a platform that offers this service and following their specific instructions.

Who can benefit from using instant ACH transfers with no verification?

Individuals looking for quick and hassle-free fund transfers can benefit from this service.

What if I am concerned about the security of instant ACH transfers?

Platforms offering this service usually have advanced security measures in place to protect your transactions.

How fast are instant ACH transfers completed?

Instant ACH transfers typically process within a few minutes to a few hours, depending on the platform.

What if I prefer a more traditional and slower transfer method?

If you prefer a more traditional transfer method, you can opt for regular ACH transfers that may take longer but offer more verification steps.

With a background in finance and over a decade of experience in the banking industry, our author is well-equipped to guide you through the intricate world of ACH transfers. Holding a Master’s degree in Financial Management, they have conducted extensive research on payment systems, including ACH transfers, and have published articles in reputable financial journals. Their expertise extends to understanding the nuances of electronic fund transfers, ensuring that the information provided is accurate and up-to-date. Additionally, our author has collaborated with industry experts and studied consumer behavior to provide insights into the benefits and drawbacks of ACH transfers. By drawing on real-life examples and industry practices, they aim to empower readers with the knowledge needed to navigate the complexities of modern banking systems.