Chances are there has been a time in your life where you have received a gift card from somebody (maybe that aunt who always pinches your cheeks at holiday time…yes I have that aunt too!) that wasn’t useful.

If you were to walk over to your dresser right now you probably still have these gift cards tucked away in one of the drawers.

You are probably thinking if there was only a way I could sell my gift card and at least get some money for them.

After all, you can sell video games that you don’t use anymore but what can you do with that stack of unwanted gift cards?

Well…your prayers have been answered! There is a way you can sell your unused and unwanted gift cards and receive money through CardCash.

Those gift cards in your dresser no longer have to be dust collectors.

This CardCash review will walk you through the whole process from start to finish.

What is CardCash?

CardCash is a company that will buy your unwanted gift card for less then the balance left on the gift card.

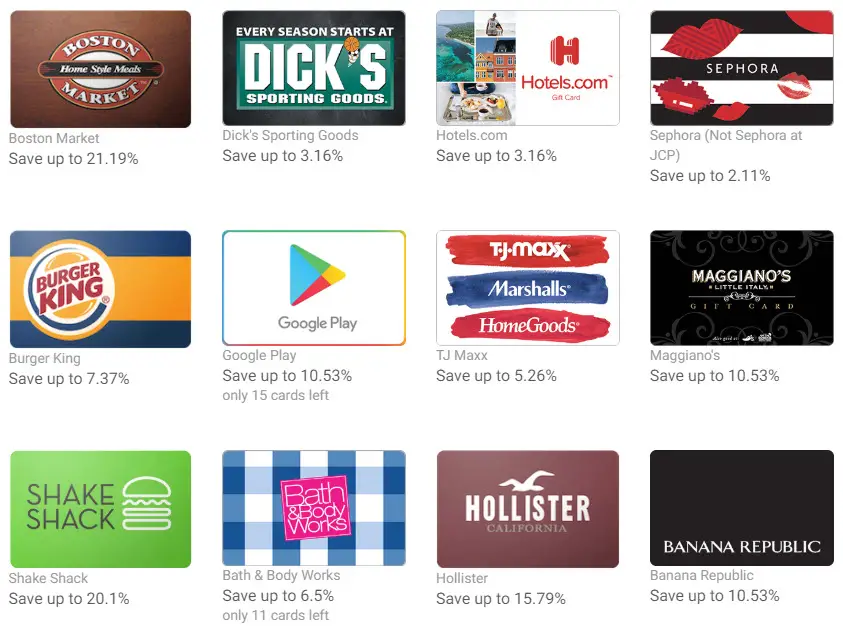

The gift cards are resold on CardCash at a discount to consumers. There are tons of stores represented by these gift cards. Consumers end up scoring huge discounts and bargains to their favorite companies and stores.

Some of the discounts offered are as much as 25% or more on the gift card purchase. With CardCash you are actually buying and receiving a used physical gift card.

Our CardCash review will walk you through all the ins and outs of how it works.

CardCash Prices

If you are looking to sell your gift card, there are a couple things you should know. Luckily, this CardCash review has you covered.

- First, you don’t get the full value of what the gift card balance is (otherwise CardCash wouldn’t make any money.)

Their website currently states that you can get up to 92% however of the value of your gift card.

- Second, how much money you receive for your gift card depends on the popularity of your gift card.

For example if you have a Target, Amazon, Home Depot, or Walmart gift card, you will be on the higher end of earning. Gift cards from those companies would be considered some of their top businesses and are in high demand by consumers.

So if you have any gift cards from those stores sitting around, be sure to sell them to CardCash.

CardCash Discount Codes

CardCash also offers CardCash Coupon Codes. These CardCash Discount Codes are wildly available all over the internet.

All you have to do to find the most active CardCash Coupon Codes is do a quick search. You will find all kinds of unique CardCash promo codes.

There are also CardCash ecodes as well that can be used to maximize your purchasing power.

What Gift Card Brands Does CardCash Offer?

CardCash carries more than 1,100 retailers which is pretty much all major chains and department stores. Some of those would include:

- CardCash Target

- CardCash Home Depot

- CardCash Starbucks

- CardCash TJ Maxx

- CardCash Petco

- CardCash Lowes

- CardCash Michael’s

- CardCash McDonald’s

- CardCash Chipotle

- CardCash Walgreen’s

- CardCash Kohl’s

- CardCash Old Navy

- CardCash AMC Theaters

- CardCash Texas Roadhouse

- CardCash Subway

- CardCash GAP

- CardCash Burlington Coat Factory

- CardCash Southwest Airlines

- CardCash Kroger

- CardCash Apple iTunes

- CardCash Red Lobster

- CardCash Express

- CardCash Victoria Secrets

- CardCash Hotels.com

These are just some of the hundreds of retailers that you can purchase gift cards for on CardCash.

What is the CardCash Refund Guarantee?

CardCash offers a 45 day CardCash money back guarantee on the purchase of all discounted gift cards.

They make money by selling pre-owned gift cards that are discounted to customers.

This in turn works out to be a savings on the items that they buy with the gift card.

They offer a 100% guarantee that every gift card purchased from them is valid by the merchant and for the dollar amount specified on your order.

This is guaranteed for a full 45 days from the date you purchase a gift card through them.

If you have any problems within that 45 day period, you can contact CardCash and they will issue a full refund.

Can I Trust CardCash?

Having a 45 day money back guarantee definitely instills trust by CardCash. We all know that gift card sometimes can expire.

However there are other times when the gift cards themselves can become canceled.

This could happen if a gift card was purchased in an illegal way or the owner may have use the card after they sold it to CardCash.

That is why the 45 day money back guarantee is so important if you are going to buy a used gift card from CardCash.

Additionally, CardCash occasionally requires additional verification from people selling gift cards as part of their fraud prevention.

They may contact you through your email address or phone number for verification.

How To Protect Yourself Against Fraud

If you are worried about getting scammed out of money, relax. There are a couple things you can do to protect yourself.

Check out these steps below to help lessen the chance of becoming a victim of fraud and losing money.

- Be sure to use the full balance of the gift card within 45 days. There is probably the most important rule.

- If you have any problems with your gift card, you can contact [email protected] for assistance.

How Long Does It Take To Get Money From CardCash?

It varies a little bit depending on if you are a new member or not. Once CardCash has received your order they verify the balance on the gift card and then issue payment.

Once they receive payment and order approval for your gift card, the payments are typically sent out from 1 to 2 days.

If you are buying a brand new gift card from Cardcash, the delivery time will be longer. It could take up to seven days to arrive by mail.

If you decide to buy a printable e-card, those can be delivered within 24 hours to your email inbox.

CardCash recommends checking your spam folder because often times these electronic gift card emails can end up there.

How Do I Receive Payment From CardCash?

CardCash has several options for you to choose from to receive payment if you are selling a gift card to them.

You can select an old fashion paper check as payment. CardCash will mail you a check via USPS.

Additionally, you can also select an ACH deposit (or CardCash direct deposit) and have the money sent directly to your bank account.

If you are worried about providing your address or banking information, there are other options as well.

You can also receive money by PayPal which is a very secure way to receive money. CardCash PayPal is one of the best ways to receive payment from CardCash.

Some people might not want to even deal with receiving cash at all for their gift cards. For those people there is the option of trading gift cards online instantly. You can also trade your gift cards online and instantly for brand new gift cards to any store available.

CardCash states that this is the best bang for your buck if you elect to do a trade.

Giftcard Alternatives

CardCash is a safe and convenient way to sell your old gift cards that are just sitting around losing value and collecting dust. However, if you are purchasing new gift cards there are better alternatives out there.

Surveys

A lot of survey sites will give you free gift cards by completing tasks. Some of these tasks include taking surveys, being part of the focus group, watching videos, visiting websites, and reading emails.

Gift Card Transfers

You can do transfers if you would rather have the cash in hand. Many people transfer their gift cards instead of being stuck with them.

CardCash Customer Service

A lot of reviews on the Internet don’t give CardCash high marks when it comes to customer service. However, I believe that they have made strong improvements with their customer service from the information I reviewed.

Not only do they have an email address on their website for your concerns, there is also a phone number available as well should you need to reach them by phone.

In addition to that they also offer the CardCash 45 day money back guarantee. So worst case, you are going to get your money back if you do encounter anything fraudulent with your transactions.

Best Selling Gift Cards at CardCash

Some of the best selling gift cards a card cash would be the following stores:

- Walmart

- Target

- Home Depot

- Lowe’s

- T.J. Maxx

- iTunes

- CVS

- Macy’s

- Best Buy

- Starbucks

- JCPenney

- eBay

- Kohl’s

- Toys “R” Us

- McDonald’s

- Sears

- AMC Theaters

CardCash Review Summary

Hopefully this CardCash review has shed some light on what to do with your old gift cards. It is no surprise that gift cards are a multi billion dollar industry. The gift card market totals roughly $127 billion according to the CardCash website.

As such there’s a lot of gift cards out there that go unused everyday. Even in my own dresser, I found three unused gift cards that have expired.

Having a site like CardCash offers a solution to the problem of unused gift cards.

If you are looking to get a couple bucks for your unused gift cards I would (without hesitation) recommend using a site like CardCash.

Many think the site is a scam, but CardCash is definitely a legit site. They stand behind purchases with their 45 day money back guarantee, they conduct fraud prevention protocols, and also have a strong customer service department.

Those three things should put your mind at ease about buying and selling used gift cards from CardCash.

Leave a Reply