I recently went on a trip where I thought a lot about retirement savings.

For the most part, when I travel with my kids and fly, I am a wreck. Going through security is by far the worst part.

For this past trip, I had 4 bags with me and a man purse. I had to pull out all my medicines for my kids, liquids in TSA compliant bottles, electronics, iPads, laptops, and undress to go through a body scan.

I was there in what seemed like forever just grabbing plastic bin after plastic bin loading anything and everything standing with no belt and in my socks holding my pants up with one hand. It was a process to say the least.

Once I got through all that hoopla of stress, I was sitting down at the gate waiting to board the plane.

I overheard a younger man in his late 20’s on a phone use the dreaded “it’s not you it’s me” line. I pegged him as some type of engineer or sales consultant judging by his Travelpro Platinum Elite Luggage and fancy mahogany brown wing-tipped shoes.

The next words he spoke were “I am sorry but I am just looking for more out of my financial planner.” A few of us in the immediate area did a double take as in disbelief of what we had just heard and witnessed.

I realized that this guy got the memo on retirement savings. According to AARP, half of Americans fear running out of money in retirement.

Focusing and thinking on retirement savings should be something that we all do at all stages of life. He was still young.

This made me reflect back on myself when I was his age. Retirement savings was something that I too was practicing. I was maxing out my contributions just as one should for the maximum payoff benefit.

Life put me on a different path shortly after and I lost sight of this. The outcome was that I had to stop contributing to my retirement savings. I won’t go into the details of this but you can read about it if you choose at My Journey to Financial Freedom.

My Retirement Savings Epiphany

It was not until recently that I experienced a major epiphany on my retirement savings, changed my life, and saved $30,000 into my retirement accounts each year. Here is how I did it:

1. Analyzed Expenses

One of the first actions I took to try and come up with some extra money to put towards my retirement savings was to look at my everyday expenses. This included things such as:

- my cable bill

- car insurance

- reducing my grocery bill

- looking at my cell phone expenses

There was not much that could be done with my cable bill as I was already at the bare minimum service requirement necessary for internet. Had I removed my cable completely, I would actually be paying a higher amount JUST to have internet!

Next I called April, my insurance broker so I could see if it was possible to lower my car insurance. In Michigan, surprisingly, car insurance premiums are one of the highest in the country. This is mainly due to the unlimited medical coverage that exists for severely injured motorists (at the time of this posting).

What happens is either people forego insurance because it is so expensive or they pay hundreds of dollars more on their premiums to cover this.

- I was paying over $2,000 a year for a 12 year old pickup truck and a 7 year old minivan. I ended up dropping my car rental option and I also increased my deductibles. This resulted in a small savings on my premiums.

Dissecting my food budget was my biggest reduction in these four categories. I ended up saving money on groceries which equaled about $150 per month. I switched off of major supermarket chain stores and over to a lower-cost smaller grocery chain. Additionally, there was no sacrifice of food quality. I was sort of shocked that they had organics, and carried about 90% of all items carried at major chains.

Looking at my cell phone plan was a bust. This did not net me any savings at all as my monthly expense was pretty low.

All of these actions netted $162 dollars a month which works out to $1,944 a year. Clearly, not enough to supercharge my retirement savings.

2. Examined My Financial Foundation

I had no other daily expenses left to cut which forced me to look at big ticket items. These included things like my mortgage loan, property taxes, house maintenance, and association dues. When I calculated the annual totals for those numbers it worked out to the amounts below:

Mortgage $13,320

Association Dues $400

Property Tax $4,500

Property Insurance $1,200

House Maintenance $3,000

These categories collectively came to $22,420 PER YEAR!

I was sort of shocked that my housing was so expensive.

I sold real estate for a while so my understanding of the housing market was fairly decent. At the time I put these numbers together, we were (and still are) in a seller’s market. I knew I could get over six figures in equity back if I decided to sell.

The problem was that I would still need a place to live and would have to start all over with a new mortgage and paying all of those fees that are associated with buying and selling a house.

Even if I were to downsize I still would not be able to find anything decent to buy because of the market. Additionally, I would still have property tax, maintenance, and insurance. So I would not really be saving much money at all let alone contributing anything significant towards my retirement savings. Or so I thought.

3. Thinking Outside The Box

A friend of mine told me about a certain type of condominium called a condominium cooperative (co-op). These differ VASTLY from traditional condos. I practiced real estate in an area that did not have these types of condos which was why I was so unfamiliar with them.

Condo co-ops can be gold mines. The more I learned about them, the more excited I got. Basically, instead of being the owner, you buy a “share of membership” in the co-op. Co-ops do function similar as a traditional condo association in that there is a board of directors and they have monthly meetings. They do not provide the member with a deed, just the share of membership certificate.

In a co-op association, the co-op is the one who is responsible for majority of the unit, or your condo. There is one mortgage, one property tax bill, one gas bill, and one water bill.

Some of them have pools and other amenities. Additionally, as a member you are entitled to deduct a share of the overall mortgage for the entire complex and also the property tax.

So, there can be a co-op with 400 units, yet there’s just one mortgage. And, since you are technically not the owner, you are not responsible most of the time for maintenance.

There is usually a maintenance staff to fix things like toilets, appliances (you don’t own those either), or whatever else might be going on.

You must pay cash for these because remember you are buying a share of membership and there can only be one mortgage for the entire complex. However, most of the time co-ops are a lot cheaper in price in comparison to traditional condos. Co-ops are great for senior citizens or anyone else who does not want to have the burdens of taking care of a house.

Additionally, you also pay a monthly fee similar to a traditional condo. This fee however covers heat, gas, and water majority of the time. Although each association probably does vary here and there on some specifics.

4. Reviewed Financial Options: Retirement Savings vs. Jones Lifestyle

For several months, I went back and forth trying to decide if I should consider selling my house now and buying a condo co-op. A mental tug-of-war played out almost daily in my head on the notion if this was a great idea or would it turn into the worst decision of my life?

What I knew was that I was spending a TON of money (over $22,000) on a big house that in reality I never was able to enjoy. It didn’t bring me happiness, was expensive to maintain, and turned me into a financial stress ball pretty much every day of my life.

I was basically sacrificing FIRE and not contributing to my retirement savings in order to live in this posh pad and keeping up with the joneses lifestyle.

Then, I tried to envision how my life would be different if I sold it. I would be mortgage free. And that is huge.

Remember that $22,420 I would be saving by not having a house anymore? Keep in mind that those numbers are actually AFTER TAX. IF, I were to use this money now to fund my retirement savings PRE-TAX I would have an additional $7,500 to put towards my retirement savings EVERY YEAR. That amount along with my hardcore $22,420 savings number comes to around $30,000 PER YEAR!

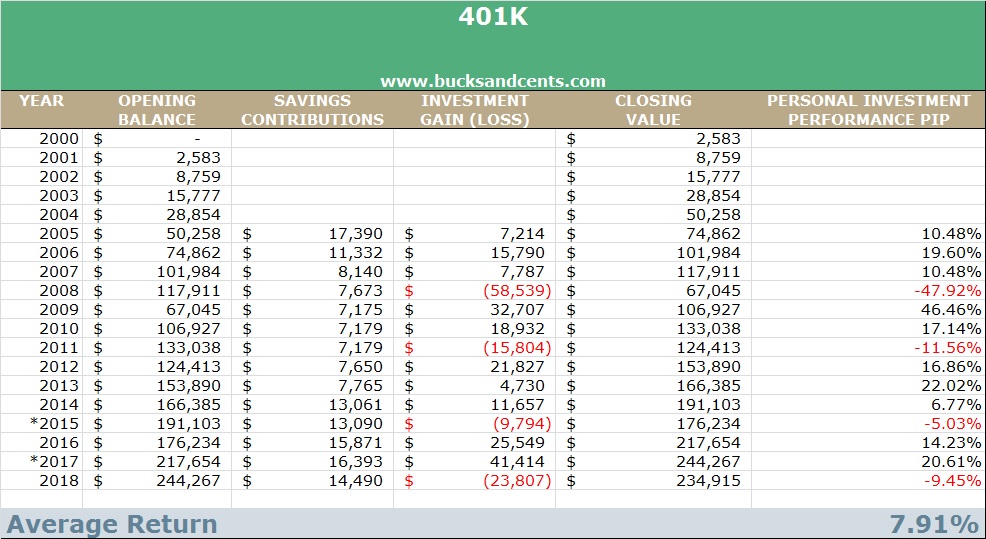

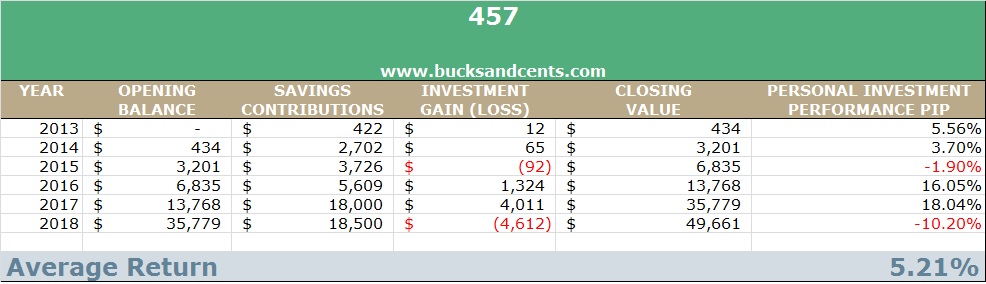

Factor in that the stock market over time has historically returned 8%, I would actually be doing BETTER than any return I could come close to achieving by owning a house. I ran my own retirement projections and guess what, my return came back at over 8% per year. My charts are below.

Historically, houses do not average an 8% return per year. I have seen people make the argument that they do, but things like repairs, taxes, and ongoing maintenance all eat away at the appreciation.

That is money that you have TO SPEND in order to own a house.

5. Making a Decision To Buy and Sell

Once I ran my numbers, I knew what my decision was. I ended up buying a 3-bedroom condominium co-op townhouse that had a cost of 11% of what my house was worth.

That’s right I paid $33,000 for a beautiful 1,000 sqft townhouse. I decided to sell my house and pay off my mortgage early. With the proceeds from selling my house, I was able to pay cash for my condominium co-op townhouse.

My house had multiple offers, and sold in 3 days. I got over asking price as one should in a sellers market.

The best part was that all the proceeds from my house are earning interest which covers majority of the monthly maintenance fee. All I have to shell out from my pocket each month is some money for an electric bill. That’s it. Talk about financial independence.

I am pretty much living for a couple hundred bucks now a month as far as household expenses go.

6. Being Open To Change

Being OPEN TO CHANGE and the possibilities of financial independence was why this worked for my family.

Not only was this a huge financial savings and a way to increase my retirement savings, but this was also a major lifestyle change.

Now, I won’t lie and pretend that it was not a lifestyle change because it was. I went from living on a third of an acre to looking out my window and watching my neighbor brush her teeth with curlers in her hair. My abode went from 3,000 square feet to 1,000.

I now needed permission to plant bushes outside my place and park in certain parking spots.

So yes, I had to sacrifice some things and comforts I was used to.

7. Freed Mindset

One of the biggest struggles was that I had to free my mind from the constraints of what I thought was “normal” in society to make this work.

Most families would not sell their suburban home, reduce their living footprint by 66%, and squat in a senior-citizen community. It’s just NOT a “normal” thing to do at the stage of life progression that I was at.

Yet, I had done just that for financial freedom.

And once I realized my mindset had changed, the world became mine.

Not only has this been a huge financial windfall on my retirement savings, but my life changed in ways I did not think it could.

I noticed myself becoming a lot more positive about things in life.

My old world of routine financial stress and worries about money was gone. It was no more, dead, muerto.

Today my lifestyle consists of the freedom and financial independence to do or go wherever I want.

I live experiences today I could not imagine doing a couple years ago. As such, my views on a lot of things have changed for the better, for the positive.

Today, I see the world is filled mostly with good, than bad.

Final Thoughts

I do credit these seven steps as the path for increasing my retirement savings by $30,000 a year. There is no question about that. These steps that I took above will allow me to save over $150,000 in under FIVE YEARS.

However, they are much more than a pathway to retirement savings and financial independence. They are seven steps that also changed my life. This worked for me because I pushed myself past the societal conformity and barriers that I had been confined to living in and I was open to change.

I significantly downsized my house, sold possessions, and re-prioritized EVERYTHING in my life. ALL of these things freed my mind in ways unimaginable and forced me to live a new and different lifestyle. Sometimes, with great change, there can come great success and happiness.

Everyday financial stress CAN ruin your health and your life. But, when you are able to beat it and win, there is no greater feeling in the world.

Whatever your challenges, whatever your struggles, find a way to bust through them and take your life back. Punching debt, getting rid of loans, whatever it is in your life holding you back from living, be empowered to change it. Don’t stop fighting, because I assure you once you make it to the other side, the rewards are great.

It’s all waiting for you; success, happiness, accomplishment, free choice, and financial independence. You just have to find a way to get there.

Leave a Reply