When I tell people that I live in a housing cooperative they have no idea what I’m talking about. I usually get the standard response of “you live where” from the other parents when socializing at kids birthday parties over delicious Pokémon cake.

And let’s face it as a single dad, it’s tough enough trying to fit into these social settings with traditional families.

So lately I have been doing more of a “shock and awe” delivery approach to people and revealing to them that I live in a senior citizens community and have saved about $80,000 so far!

(Mic drop).

That always peaks their interest.

The feedback I receive from them is mainly in the form of gazes and stares. I can tell that they’re trying to comprehend what I’m saying, but it just doesn’t make any sense.

It’s almost like trying to force a puzzle piece into where it’s not supposed to go.

At that point I walk them through a snippet of my life and share with them how I’m able to save almost $20,000 a year from my previous housing costs.

The best part about accomplishing this feat is that it could almost be seen as a guaranteed return.

It doesn’t involve the stock market, income growth, and it’s not subject to downturns in the economy. Housing cooperatives are a great way how to invest 50k in real estate to yield great profits.

I’m going to pull the curtain back and provide you with a glimpse of how these largely unknown housing cooperatives operate and how they work. Below, I’m going to share with you how I’ve been able to achieve close to $80,000 in reduced housing costs all within the last four years of my life.

What is a Housing Cooperative

If you live in rural America you probably have never heard of housing cooperatives. Even if you live in a bustling urban area, it’s possible that you still might not know what housing cooperatives are.

I sold real estate for a while and it took me quite some time before I stumbled onto the financial benefits and profits of living in a housing cooperative.

This is because in the United States there are only 1.2 million families that live in housing cooperative units in the United States.

According to US census data, in 2018 there were 138.5 million housing units in the United States.

Housing co-ops, and the 1.2 million families that live in them, represent .86% of housing units in the country.

That’s it.

Those families living in cooperatives represent less than 1% of people living in housing units in the United States.

That is how rare co-op housing is.

As such, not a lot of people know about them, what they are, or what their purpose of existence is. The simplest way to think about what a housing cooperative is would be similar to nonprofit housing and community living.

These communities can be made up of single family homes, town houses, student housing, mobile home parks, special-needs housing, apartment complexes, and high-rise apartments.

Co-op Definition

A housing cooperative (also known as a co-op, coop, co-ops, coops) is a housing community in which all of the residents that live there control and have a stake in ownership of the co-op based on equal shares of membership and rights.

The best way to describe what a co-op means is to think of it as joint ownership of housing.

When Did Housing Cooperatives Start?

There are not a lot of housing cooperatives in the country. Most of the housing cooperatives were built just after World War II. After the war a lot of people, including soldiers, were returning back home and could not afford a single-family home.

Those soldiers and others faced a lot of barriers to homeownership. Therefore cooperatives became more prevalent as a path to home ownership in multi-unit buildings.

Even today, co-ops are currently one of the most cost-effective paths to home ownership available.

Additionally, cooperatives are extremely popular with senior citizens as a way how to live in retirement with no money and seen as an affordable housing option for many.

How Does a Housing Cooperative Work?

Think of a housing cooperative as a non-profit corporation and the members that live there, are also the ones that own and manage it.

In order to own part of the corporation you buy what is known as a “share of membership” into the community and the housing corporation. Your “membership” comes in the form of a unit to live in.

- The main difference between a housing cooperative and a condominium is that a in condominium you physically own the real estate. You have a deed and mortgage on your condominium. Additionally, you pay the maintenance fee to cover some maintenance items of the condominium association.

- A housing cooperative functions completely different. You are buying a share of membership, not a property. The main differences are you don’t receive a deed and you can’t buy your share of membership with a traditional mortgage because you’re not buying a property to secure it with.

Therefore you either have to pay with cash or take out a private loan to finance the purchase of your share of membership.

There is also a maintenance fee that you pay with housing cooperatives as well but what it covers is usually far more extensive than a maintenance fee you would pay be in a condominium association.

- Just like condo associations, housing co-ops also have a board of directors as well.

Although there are different types of housing cooperatives which we will cover below, majority of them when it comes to ownership are the same.

Related Article: Best 1031 Exchange Companies Near Me [Guidelines]

Types of Co-operative Housing

We have discussed the co-op meaning up above as far as how they operate. When discussing the functionality and what type of co-op to buy into there are three basic types. The popular and common types of co-operative housing include leasing cooperatives, limited equity, and market rate cooperatives. You can find the different types of co-operative housing below:

Leasing Cooperatives (zero-equity/group-equity)

Leasing cooperatives (group-equity) are probably the most restrictive of the three housing cooperative structures.

In this set up, the housing cooperative does not own the property, rather the coop leases it from an institutional or commercial investor.

Since the cooperative is leasing the property, and when I refer to property I are talking about all of the units collectively as one property, they’re not in a position to build up equity with the property.

The disadvantage in this structure for a potential shareholder would be:

- Did the initial investment for a share of membership increase or decrease?

This co-op has a greater likelihood to gain very little equity (if any at all) than the other co-op structures.

Additionally sometimes leasing cooperatives are able to buy the property from a commercial investor and convert it either to a limited equity housing cooperative or a market rate cooperative which we will cover below.

Limited Equity Housing Cooperative

In the limited equity housing cooperative structure, the cooperative does own the property. The main difference here is that when the owner goes to sell their share of membership, there is a formula or limitation as to the maximum amount of money the owner can acquire from selling their share.

- The reason for this is that if sellers start selling their shares at high prices, it no longer will be affordable housing for other potential members.

Additionally a lot of these types of co-ops benefit from below market mortgage rates, tax abatements, and other financial incentive tools that may have restrictions on when the owners sell their shares of membership as far as equity is concerned. There may be penalties that have to be paid if the equity was free-market driven.

Market Rate Housing Cooperatives

This is the type of housing cooperative that I live in. As stated above, I tell people that I live in a senior citizens community. However technically, my market rate housing cooperative is not classified as that. Living in a co-op is a great way to ensure I can make payments on my income share agreement that I have.

My housing cooperative consists of 403 units occupied by senior citizens more or less, and then a single dad with two kids and two Jack Russell Terrier‘s (that’s me)!

Housing cooperatives are extremely popular with senior citizens but we will discuss the reasons for that later on.

- In a market rate housing cooperative, there is a lot more freedom as far as what you can buy and sell your share of membership for.

Keep in mind that you cannot use a mortgage to finance your share of ownership in a housing cooperative so that is a huge limitation for a lot of potential buyers and affects what you can sell your share of membership for.

Additionally in a market rate housing cooperative, you don’t have the following fees when purchasing your membership share:

- No title insurance

- You don’t pay a Mortgage

- No mortgage loan origination fees

- Appraisal not necessary to buy

- No private inspection

Buying a share of membership is a very simple and clean process that’s extremely fast. You can close immediately pending the arrangements of the seller because sometimes they may need occupancy.

If that is the case, it doesn’t matter since your paying cash.

Market rate condos are the closest thing to standard residential real estate with the exception of the finance piece and lack of title work necessary.

Cooperative Housing Pros and Cons

You’ve probably gathered so far that there are a lot of advantages and also some disadvantages to living in a housing cooperative. Living in a cooperative is a completely different lifestyle than a traditional single family home.

We will discuss some of these issues below.

Cooperative Housing Pros

There are so many financial advantages to living in a cooperative.

Some of those would include the standard ways to save money on traditional housing costs but there are also other ways as well not that commonly known.

Cheap living

Living in a housing cooperative is one of the best ways to practice frugal living and living stingy when it comes to housing costs.

No mortgage

You don’t need a mortgage to buy any share of membership for each of the three types of housing cooperatives. Also, there is no need to fret about how to pay off your mortgage early because you don’t have one in a cooperative!

You don’t pay property taxes

Since you don’t own the property you also don’t have property taxes. The co-op will receive one property tax bill for the whole establishment.

And wait it gets even better…

Since you are a part owner, you are also entitled to deduct a share of the overall property taxes on your personal tax return. If there is a mortgage on the co-op property you are also entitled to your share of the interest on that as well.

This would be more common in the market rate and limited equity co-ops so it makes a lot of sense to check into how your co-op will function and is set up before you buy.

No water bill

Your water is covered with your monthly maintenance fee.

No gas bill

If you are fortunate to have gas as your heat, this is also paid by the cooperative.

A part of your monthly maintenance fee goes to cover this. My dryer is currently a gas dryer and believe me that is a huge savings to have the cooperative pay for the gas use for my dryer for my family.

You don’t need homeowners insurance

Since you don’t own property, you are not responsible for the outside structure or inside.

The cooperative is responsible for all of the exterior structure issues and some interior as well. You should have content insurance however for your personal property.

No ongoing maintenance costs

Think of all the things you probably spend money on being a homeowner. There are so many items such as appliances, landscaping, replacing toilets, and flooring that a homeowner spends money on just to name a few.

Then there are the bigger updates such as kitchens and bathrooms that sometimes must be done in order to sell your single family home for the highest price available.

In a co-op a lot of these items are covered, including appliances. My particular co-op provides a stove, refrigerator, and a dishwasher in my particular unit.

I looked up who buys used appliances near me before I moved and sold all of my appliances.

Housing cooperatives also cover things such as the furnace and hot water tank as well which I have had both replaced in my unit.

When these items break or need a repair, I call the office and someone from the maintenance staff comes over. I have had a hot water tank replaced and installed within 8 hours once.

If I was living in a single family home, and had to replace these items such as a hot water tank and a furnace, I would easily spend $5,000 in replacement costs.

Cooperative Housing Cons

There are disadvantages however to living in a nonprofit housing cooperative. There are other communities out there that do practice community urban living such as Serenbe in Georgia, but cooperative communities are vastly different.

Lack of freedom

One of the biggest disadvantages when it comes to living in a co-op is that you are subject to follow all the rules of the housing cooperative community.

Most cooperatives will not allow you to make any physical changes to the structure that you live in without permission from the Board of Directors.

The only thing I am allowed to do without permission is paint walls different colors and install carpeting.

That is the extent of my HGTV makeover dreams I am allowed to pursue without paperwork.

Anything other than that, I’m required to fill out an alteration permit request form which also has to go in front of the board of directors for approval.

There are a lot of rules in housing cooperatives

Housing cooperatives are allowed to implement any type of rules that they see fit. For example in my particular co-op, if I have my vehicle bumper parked too close to the sidewalk, I can receive a $25 fine. In a way it’s considered a step above moving in with your parents since you do have some privacy.

I have been notified about this before.

If my pets are barking too much, I can also be fine for that as well.

Living in a housing cooperative means you have to abide by these rules in the co-op. The co-op has the authority to enforce these rules with monetary fines or other actions as they see fit.

Limited Privacy

A lot of these housing cooperatives were built in the 1960’s. Mine was built in 1968 and back then the building codes weren’t as stringent as what they are today. As a result of that, my walls are paper-thin between my unit and my neighbors.

For example when my neighbors phone rings inside of their unit, I can hear it.

I can also hear when my neighbors are going up and down the stairs.

However it goes both ways I am sure that they can hear me as well including my two sons and dogs.

So you kind of always have to be on guard about noise such as if the TV is too loud or if I’m yelling at my kids to get off Roblox from the bottom of the stairs. Chances are my neighbors have heard me as well!

Income Requirements

A lot of cooperatives have minimum income requirements that must be met in order to become a member. If you don’t make enough of the minimum income, the board will not approve you for membership, and you won’t be able to buy a share of membership.

Are Cooperatives Good Investments?

Depending what your current financial health is and what your financial goals are in your life, co-ops can be excellent investments.

They are one of the fastest ways to increase your net worth and build wealth in your household.

Since they function as nonprofit corporations, the focus to the membership is really about saving money.

Their goal is to provide a safe housing community for all while at the same time, keeping costs extremely affordable.

Co-ops can save their members substantial money on housing costs compared to that person living in a single-family home or even renting an apartment.

In a housing cooperative, all you have is the monthly maintenance fee which also covers a lot of your utilities.

It’s also not uncommon for people to join a waiting list to buy into a housing cooperative so they can purchase membership shares when they become available.

For me personally when I moved from suburbia into a housing cooperative, it turned out to be one of the best investments I’ve made so far in my life.

Living in a housing cooperative is a great way to save money. Even if you have to move cross country, there are ways to save money moving cross country that won’t blow your budget.

The financial advantages outweigh the negatives.

Down below I’ll go through the numbers.

How I Increased My Net Worth Living in a Housing Cooperative

It is true I increased my net worth substantially by living in a senior housing cooperative. This was possible because I made the unconventional decision to leave my keeping up with the Joneses lifestyle and suburban living.

I say this is unconventional because this was a major lifestyle change for my family and I.

Most middle-age families with children and pets tend to increase the square footage when they move.

Those families, more often than not, are looking for additional space and comfort for their growing family. They don’t make a move in the opposite logistical housing direction with smaller square footage. It just doesn’t work that way in mainstream America.

Think about young families and the typical stereotype of purchasing a “starter home.”

Society has this perception that as families grow and continue on their life trajectory, they need more square footage to accommodate the stereotypical family characteristics.

They live this lifestyle until their kids leave which at that point they are coined as “empty-nesters.”

It’s at that time that they downsize their square footage.

What ends up happening is as these families grow, their housing costs also continue to increase.

These families are saddled with extreme housing costs in some cases for as long as TWO DECADES!

These costs include everything from water bills, property taxes, and ongoing maintenance. Sometimes these costs can be substantial.

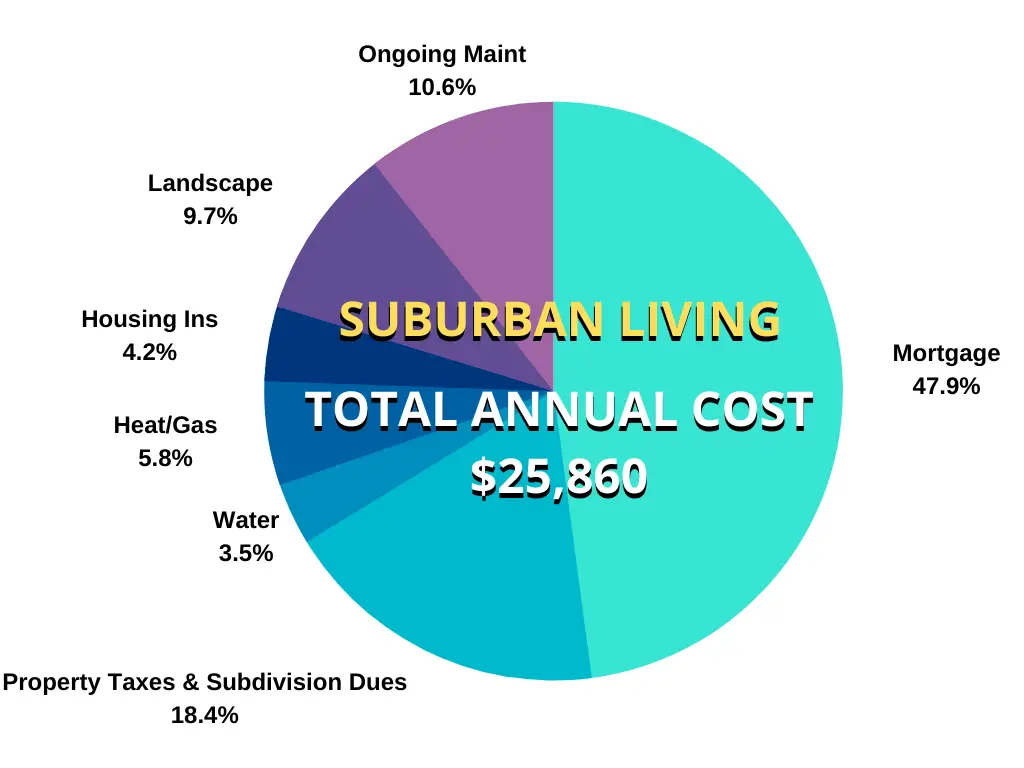

My annual housing costs of when I lived in suburbia are included in the chart below.

You can see that my annual costs related to housing were over $25,000 a year!

You read that correctly it’s for just ONE year.

Approximately 65% of my housing costs consisted of the mortgage, property taxes, and subdivision dues.

The rest of the costs included things such as landscaping, insurance for my house, and also what is known as ongoing maintenance. That term includes major capital improvements such as roofs, water heaters, and installing furnaces to name some of the big ticket items.

As a Realtor, we usually tell potential clients to budget 1% per year based on the value of your home to cover these costs that will come up over the course of homeownership.

How I Save Money in a Housing Cooperative

When I discovered housing cooperatives while looking for a place to live, I realized how much money I could save if I moved into one.

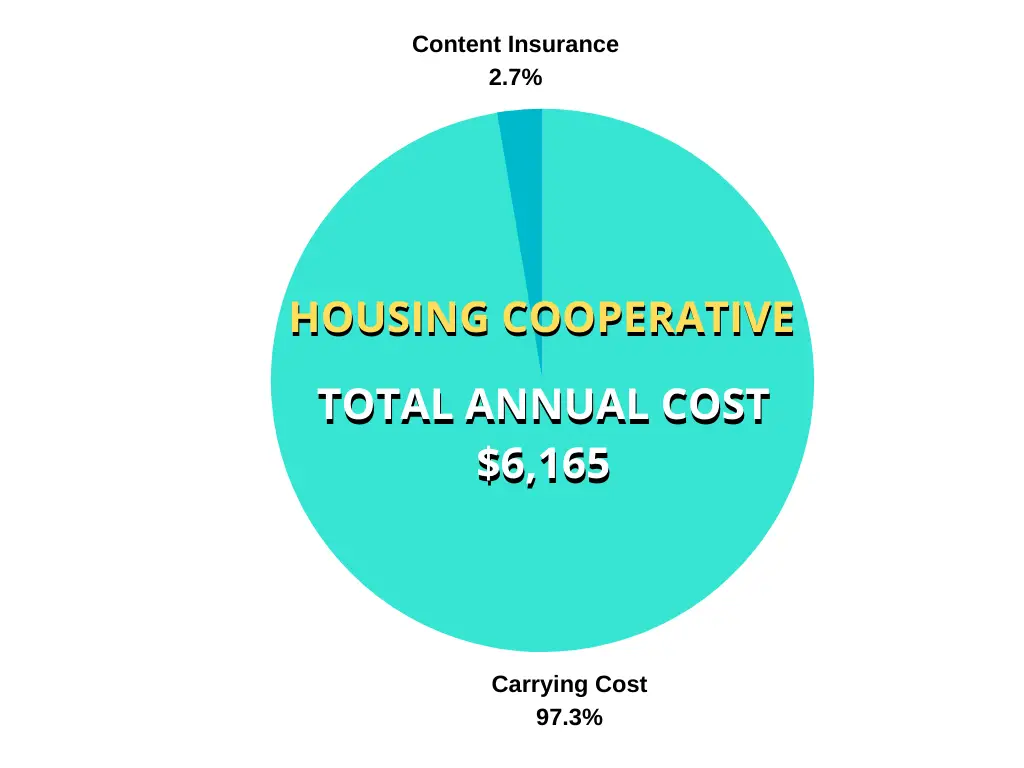

Below are the costs associated with what I have paid each year (on average) to live in my housing cooperative.

You can see from the chart above that my annual costs for housing in the cooperative are $6,165.

That number includes my monthly maintenance fee (or carrying cost) and insurance I have for my contents.

Everything else is covered by the housing cooperative. Things such as my appliances, the structure of the building, and anything that is original to my unit, say a kitchen for example, is all the responsibility of the housing cooperative.

My housing cooperative has a full-time staff of four maintenance guys to service 403 units. I don’t pay a repairman anymore or hire companies for ongoing maintenance issues like I had to do before.

My Net Annual Profit

When you look at the numbers above, you can calculate what my net profit per year is above.

Another way to think about this is that this money is guaranteed money I am now saving that I was previously using to pay my housing costs when I lived in suburbia.

My net annual profit on housing costs works out to $19,695 per year by ditching suburbia and living in a housing cooperative.

This is real money and while there are no guarantees in life, this might be the closest way to guarantee an actual and substantial savings on housing costs.

The money I’m saving is not susceptible to real estate market downturns.

To get this kind of return through home equity, my former house would have had to appreciate over 13% each year for the last 4 years. That kind of return is highly unlikely long-term.

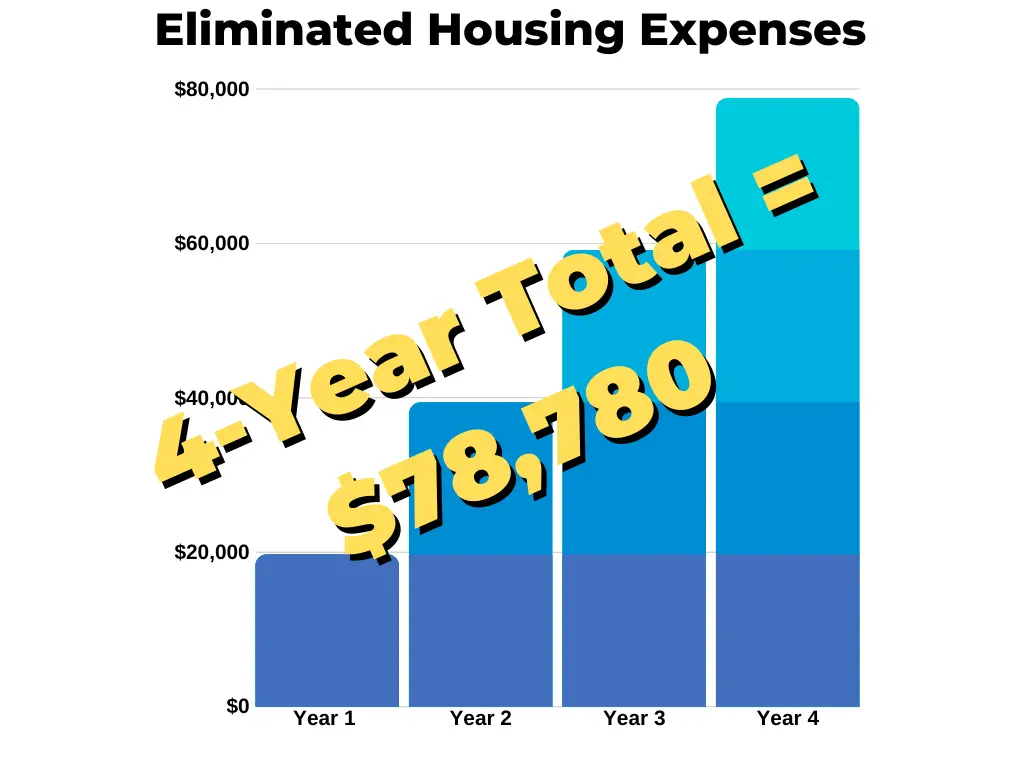

4-Year Total Eliminated Housing Expenses

I’ve been living in a housing cooperative for four years now.

- The amount of money I have saved through eliminated housing expenses based on living in the suburbs is $78,780.

If I end up living in this housing cooperative for a decade, my eliminated housing expenses would then total $196,950.

I have funneled most of this money from eliminated housing expenses into my retirement.

Additionally, I have used some of it in Fundrise and have also built a dividend portfolio through M1 Finance as well.

My goal is to create passive income streams. The rest of it is in a high-yield savings account for now.

One day I may use some of it to become a section 8 landlord to increase my net worth further.

Had I elected to stay in suburbia, the 20 year cost to me based on the numbers above would have been $393,900.

Is There a Housing Cooperative Near You?

You may be wondering if there is a housing cooperative near you. While only .8% of housing units in the country are cooperatives, rest assured, below are some areas in the country where you can find housing cooperatives near you.

Western United States

- Seattle

- San Francisco

- Northern California

- Sacramento

- Tucson, Arizona

- Phoenix, Arizona

Central United States

- Minneapolis

- Kansas City

Southern United States

- Florida – By far Florida is one of the more popular destinations. This is especially true for northern snowbirds in who come down to reside in the winter from states such as Michigan, Ohio, and New York.

- Atlanta

Midwest

The Midwest has a large concentration of housing cooperatives due to the fact that a lot of servicemen and families needed housing after the war.

- Southeast Michigan – Tens of thousands of units.

- Indianapolis – Also a very large concentration of limited equity cooperatives.

- Chicago

- Pittsburgh

- Philadelphia – Mainly market-rate cooperatives.

Eastern United States

- Boston

- New York City

- New Jersey

- Washington, DC

Housing Cooperatives vs Suburban Living

Housing affects all of us. Shelter is one of the basic necessities needed for survival.

The differences between living in a co-op versus living in a subdivision are like night and day.

With suburban living as a homeowner, you are a master of your domain and king of your castle.

You have the freedom to do any type of home renovation or modification that you deem necessary.

When it comes to occupancy, you have the freedom to have as many people stay in your house with suburban living.

In a cooperative you don’t have the luxury of these free choices.

You must get permission to make any type of modification and you must abide by the cooperative rules.

You can only have a certain number of family members living with you. In a cooperative you give up some freedom of your lifestyle but gain financial freedom in your life.

My Experience Living in a Housing Cooperative

Today, when I think about the unconventional decision I made to drastically downsize my lifestyle and move into a housing cooperative, I struggle if it was the right decision.

What it has cost my family has been lifestyle freedom. I’ve bought a share of membership in a corporation, not a real estate asset.

As a result, my kids don’t have a place to ride their bikes, play in a backyard, or play with other kids in the cooperative. Out of 403 units in my cooperative, only a handful have children.

These issues bother me from time to time.

As a single parent, I think we scrutinize and question the decisions we make for our kids more since we have to go at parenting alone. We want to make sure we’re making the right decisions.

Clearly there are some opportunities that are omitted from the lives of my children that other children living in a neighborhood may have.

On the other hand, I think about the benefits of living where I live.

Aside from the financial benefits, I’ve taught them more about community living. They realize why it’s important that we try to get along with our neighbors since we live so close to them; sometimes hearing their conversations through the wall.

Housing Cooperatives Provide an Unconventional Pathway to Financial Independence

I’ve been a resident of a cooperative community for four years now.

I moved into my housing cooperative before I knew what the FIRE (FI/RE) movement was or FinCon, and was blogless back then.

The one thing I can tell you about living in a housing cooperative is that it is one of the best unknown and unconventional ways to reduce your housing expense costs quickly.

It provides a pathway to financial independence and opportunity.

Once I sold my suburban house, all of my housing costs disappeared.

They were gone and didn’t exist anymore. Those financial responsibilities I had were no more.

At that time, I didn’t realize the full extent of how those costs affected my financial life on a daily basis.

Then I watched a documentary.

I recently viewed the Playing With FIRE Documentary at FinCon and became overwhelmed with emotion; something I was not expecting.

The reason for this was because the movie took me back to a time in my life when my family and I had those same financial issues and struggles; which are so common for a lot of young families just starting out in their starter homes.

I had gone through the process portrayed in the movie of picking up and relocating; drastically changing the lifestyle of my family.

It’s a hard thing to go through on so many levels.

I did this change unpartnered, with two kids, and also with two Jack Russell’s (which is really like a newborn third kid…that always stays a newborn!).

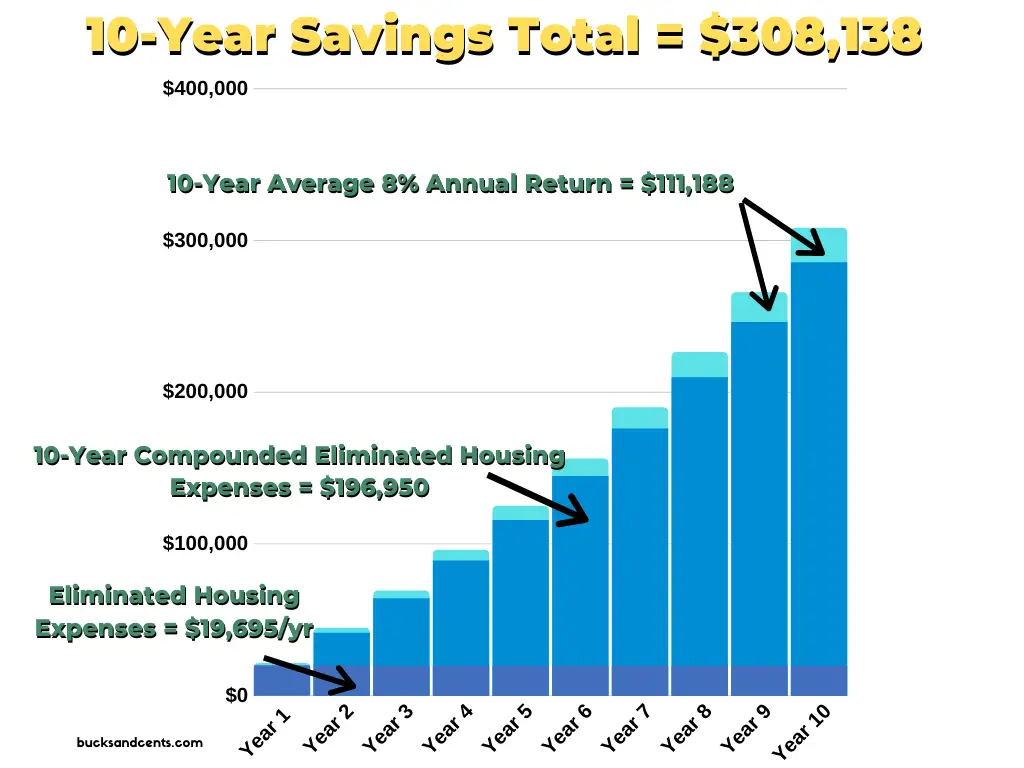

To date, I’ve profited close to $80,000.

- If I continue on this pathway for the next 10 years with an 8% return, I would profit $308,138.

- The 8% return a year cumulatively would total $111,188.

- The ten year net total of eliminated housing costs from living in suburbia, would total $196,950.

I still get emotional about my journey and all of the decisions, hard decisions, I had to make along the way to get here.

Then I think about all those families, probably hundreds of millions or more, in the country who are paycheck to paycheck struggling.

Most of those people may never be able to make changes to their lives. That will be the life that they live.

Why?

Change (and especially unconventional change) is hard to adapt to.

Remember the example I gave above that had to do with starter homes and empty-nesters? That’s the predefined housing progression for a lot of families in our country.

Making a decision such as moving into a housing nonprofit corporation that is mainly filled with senior citizens when your midlife with kids and pets doesn’t coincide with that housing progression timeline.

It’s completely unorthodox.

It’s not normal and a lot of people are scared of not normal.

Somedays, I can’t even believe I did it.

However making unconventional decisions sometimes can reap the greatest of rewards.

Looking Forward:

I’m now part of the .8% of families in the country that live in a housing cooperative and as a result, I am saving $20,000 a year to benefit my family for the days of tomorrow.

While I don’t know how long I will live in my co-op, I’ve learned and gained so much personally and financially from the experience so far.

Personally, it’s given me new viewpoints on community living. I consider different perspectives on things now more so than before because of the community I live in and I have done a lot more self-reflection.

I’ve realized that unconventional change forced me to grow as a person.

I’ve also focused more on my kids as a result of not being financially “over-committed.”

Financially, it’s put me very far ahead. When I started on this path, I didn’t quantify the savings costs initially as the reason to move into a cooperative. I knew I would be saving a little bit of money, but I mainly needed a place to live.

However, financially, its been a great way to save money. I used to save $1,000 maybe $2,000 a year.

Now, I save $20,000 a year.

If I were to sum up my experience to others, it would be this…

Don’t be afraid of transformational change because you will come out on the other side with unintended results.

Those personal and financial results might better the life of your family in ways you didn’t even know were possible.

Leave a Reply