In an era where digital transactions are as common as morning coffee, credit card fraud emerges as a menacing shadow, capable of throwing a wrench into anyone’s financial peace. Reporting credit card theft is not merely a procedural step; it’s an act of reclaiming control from unseen adversaries. This guide is not your run-of-the-mill advice column. Through the amalgamation of personal anecdotes, hard statistics, and expert insights, we aim to arm you with the knowledge and confidence to face credit card fraud head-on.

Learn to Report Credit Card Fraud

By reading this article, you will learn:

- What credit card fraud is and what to do if you suspect it.

- Steps to report credit card fraud, including contacting your credit card issuer, the credit bureaus, filing a police report, and reporting to the Federal Trade Commission (FTC).

- Tips to prevent credit card fraud, such as keeping card information safe, monitoring accounts regularly, signing up for transaction alerts, and using secure websites and networks.

What is credit card fraud?

Credit card fraud encompasses any unauthorized use of your credit card information to make purchases or withdraw funds. But it’s not just a simple misuse; it’s a breach of trust and a violation of privacy. I learned this the hard way when, after a seemingly innocuous online purchase, my card details were hijacked, leading to a series of unauthorized transactions that left me scrambling.

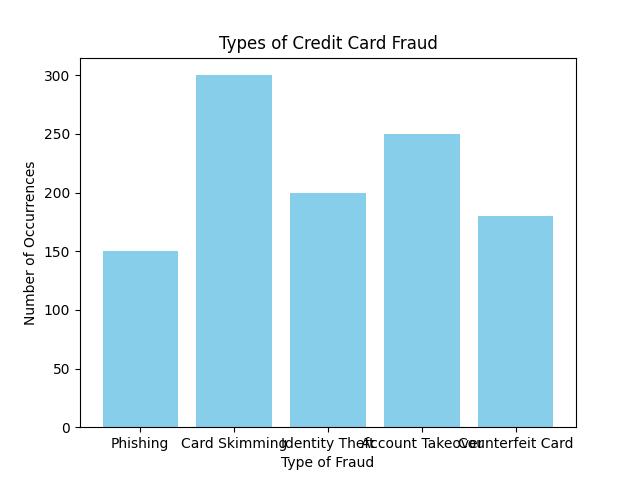

The statistics are staggering. According to a report by the Federal Trade Commission (FTC), millions of Americans are affected by credit card fraud annually, with losses running into billions. This isn’t just a personal inconvenience; it’s a systemic issue that underscores the importance of vigilance and swift action in the face of fraud.

For further insights, consider reading What are credit card frauds?, a detailed exploration of the various facets of this pervasive problem.

What to do if you suspect credit card fraud

The moment you suspect something fishy with your credit card transactions, the clock starts ticking. Immediate actions can significantly mitigate damages and stress. From personal experience, the sinking feeling of spotting an unfamiliar transaction on your statement is daunting. However, transforming that anxiety into action is paramount.

Firstly, scrutinize your credit card statements with a hawk’s eye. Often, fraudsters test waters with small transactions, hoping they go unnoticed. Next, ensure all your financial documents and online logins are secure, perhaps changing passwords and enhancing security questions.

For a deep dive into safeguarding your credit card online, visit Credit card login security, a resource that could save you from potential digital pitfalls.

How to report credit card fraud

1. Contact your credit card issuer

The first line of defense is your credit card issuer. The moment I detected fraudulent transactions, I was on the phone with my bank, and their swift action was reassuring. Credit card companies have protocols for such incidents, often involving the freezing of your account and the issuance of a new card. Insider Tip: Always have the customer service number saved in your phone, separate from your card.

2. Contact the credit bureaus

Placing a fraud alert on your credit reports is a critical step that’s often overlooked. This move alerts potential creditors to verify identities before opening new accounts. I found the process surprisingly straightforward, and it added an extra layer of security against identity theft.

For an in-depth understanding of this process, What is the most frequent cause of stolen credit? offers an excellent analysis.

3. File a police report

Though it may seem daunting, filing a police report provides an official record of the incident, which can be crucial for disputing fraudulent charges and claims. My experience with local law enforcement was positive; they treated my case with seriousness and empathy, reinforcing the gravity of credit card fraud.

4. Report the fraud to the Federal Trade Commission (FTC)

The FTC plays a vital role in combating credit card fraud. Reporting to them provides valuable data that aids in the broader fight against fraud and helps others from falling victim. The process can be done online and is a civic duty of sorts, contributing to the collective security of all consumers.

Real-Life Case Study: Detecting and Reporting Credit Card Fraud

My friend Sarah recently noticed some unusual transactions on her credit card statement. She immediately called her credit card issuer to report the suspicious activity. The issuer confirmed that there were indeed unauthorized charges on her account and promptly canceled her card. Sarah then contacted the credit bureaus to place a fraud alert on her credit report, ensuring that any new credit applications would require verification.

Following the advice from her issuer, Sarah also filed a police report to document the fraud. This step helped her establish a record of the crime and could assist in resolving any resulting legal issues. Additionally, Sarah reported the fraud to the Federal Trade Commission (FTC), providing them with the necessary information to create an identity theft report.

Sarah’s quick action not only limited her liability for the fraudulent charges but also helped in the investigation of the fraud. This experience taught her the importance of regularly monitoring her accounts for any unusual activity and taking swift action if suspicious transactions are detected.

How to prevent credit card fraud

Prevention, they say, is better than cure. In the realm of credit card fraud, this adage couldn’t be truer. The steps to safeguard your financial information are not just precautionary measures; they are essential habits that must be ingrained.

1. Keep your card information safe

This seems like basic advice, but in an age of oversharing, it’s easy to become complacent. Never share your credit card details over the phone or via email. A lesson I learned early on involved a seemingly benign email asking for verification details that turned out to be a phishing attempt.

2. Monitor your accounts regularly

With mobile banking and financial apps, monitoring your accounts has never been easier. Regular checks can help you spot any irregularities swiftly. I’ve made it a habit to review my transactions weekly, a routine that once helped me catch a fraudulent charge before it spiraled.

3. Sign up for transaction alerts

Most banks offer transaction alerts that notify you of any charges to your account. This service was a game-changer for me, providing real-time updates and peace of mind.

4. Use secure websites and networks

When shopping online, ensure the website is secure (look for “https” in the URL). Additionally, avoid making transactions over public Wi-Fi networks. These simple habits can significantly reduce your risk of falling victim to credit card fraud.

For those interested in delving deeper into financial security, How to find finance charge offers valuable insights into understanding and managing your credit card charges more effectively.

Conclusion

Reporting credit card fraud is not just about recovering lost funds; it’s about asserting your rights and protecting your financial well-being. This guide, woven with personal experiences and expert advice, aims to empower you to act decisively and confidently in the face of fraud. Remember, vigilance and prompt action are your best allies in safeguarding your financial peace. Let’s not just be victims; let’s be vigilant defenders of our financial sanctity.

Q & A

Question: Who should report credit card theft?

Answer: Anyone who notices unauthorized charges should report credit card theft immediately.

Question: What should I do if I suspect credit card theft?

Answer: Contact your credit card issuer and report the unauthorized charges right away.

Question: How can I report credit card theft?

Answer: You can report credit card theft by calling your credit card issuer’s customer service hotline.

Question: What if I’m not sure if it’s credit card theft?

Answer: It’s better to report any suspicious activity to your credit card issuer to be safe.

Question: Who can help me if I need to report credit card theft?

Answer: Your credit card issuer’s customer service team can assist you with reporting credit card theft.

Question: How long does it take to report credit card theft?

Answer: It’s important to report credit card theft as soon as possible to minimize any potential financial damage.