There are many different ways to measure your net worth. One way is by using what’s known as a Personal Balance Sheet, which is also called a “Cash Flow Statement.”

But, what is a personal balance sheet? What does it reveal about your finances? What is the meaning and purpose of this type of balance sheet?

We will cover those questions in detail and also the steps necessary to create a personal balance sheet.

What is a Personal Balance Sheet?

A personal balance sheet is an overview of personal finances. It’s a report card for your balance sheet, which measures all assets against liabilities.

The Purpose of a Personal Balance Sheet

A personal balance sheet shows where you stand in terms of net worth and gives an idea about how long it might take to retire or what kind of emergency fund you may need if something unexpected happens, such as loss of employment or injury. This information can be helpful if you are trying to determine how to retire on 500k, for example.

A personal balance sheet also helps find areas that can be cut back on, saving money that could go toward retirement savings plans or other investments like the stock market, for example.

Personal balance sheets show cash-in versus cash-out by category.

Examples of cash-in versus cash-out include:

- checking account balances vs. credit card debt

- savings account balances vs. mortgage loan debt

- IRA accounts with stocks that have sold off, etc.

- 401Ks with different mix investments leading up to retirement age.

An essential item on personal balance sheets is net worth.

Why Calculate My Net Worth?

The personal balance sheet calculates a person’s net worth. This is the total of all assets minus all liabilities subtracted from each other to provide an individual’s financial position, also known as their wealth.

The individual can include land, stocks, bonds plus loans, and mortgages, among many others, in the asset column on a detailed balance sheet. You can use a balance sheet as a starting point if starting out.

Why is Knowing Your Net Worth Important?

Becoming familiar with personal net worth will give you a better understanding of your personal finances. This is important because it indicates detail of how well you are doing financially and shows what might need to be cut back on, implement a budget by paycheck system, or looked at in terms of investments and retirement plans.

- Creating a personal balance sheet helps calculate your personal net worth.

- If personal assets exceed personal liabilities, then your personal balance sheet will show a positive value.

- If personal liabilities exceed personal assets, the personal balance sheet will have a negative value and indicate that you are broke or in debt to some extent.

The benefits of knowing where you stand financially include understanding how much money is coming into your household budget each month versus what’s going out, including debts and other obligations which need to be paid off monthly such as car loans, for example, or student loan bills due every semester among many others.

The goal is living within one’s means but having enough income left over after all expenses are accounted for, so there’s something saved up for retirement savings plans should an emergency arise like loss of employment or injury, etc.

Steps for Creating a Personal Balance Sheet

Below you will find simple steps to create and personal balance sheet. Steps include:

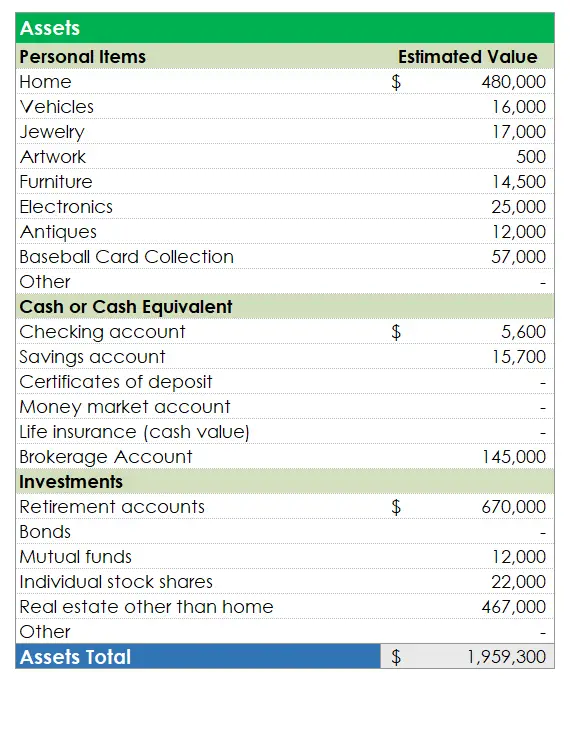

List Personal Assets

This step would include personal holdings such as personal property, brokerage accounts. Some common asset categories would consist of:

- cash, IRA assets

- stocks and bonds

- home equity with a mortgage balance

- vehicle worth on the open market

Additional assets might include loans you are owed, like debts from credit cards or lines of credit.

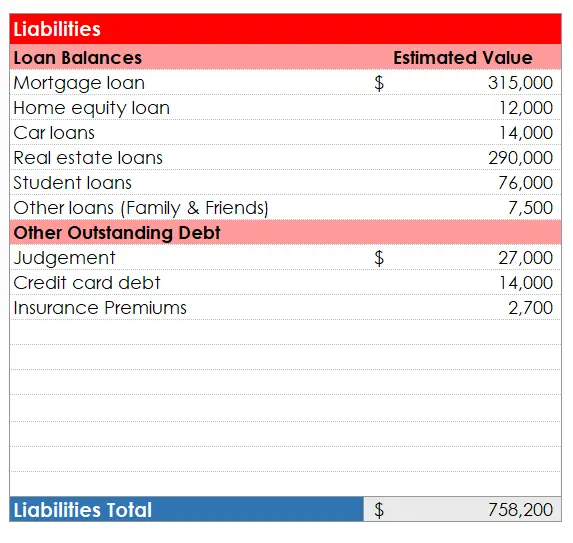

List Personal Liabilities

List personal liabilities or debts incurred by an individual in a particular year. Be sure to know the differences of outstanding balances vs. principal balances when considering liabilities. Common types of debt include:

- credit card balances

- loans from friends and family members

- Student loan bills due every semester, among others, need to be paid off monthly; for example, car loans are typically financed over time with payments each month until all amounts owed have been repaid, etc.

- Debt can also take the form of short-term obligations such as utilities or insurance premiums that must be paid at specific intervals throughout the year, for example, versus long-term commitments like buying a house where there is a fixed commitment (monthly payment). Still, it lasts much longer than savings accounts along with checking, savings bonds, gold and precious metals, personal belongings plus retirement accounts, or any other personal saving account.

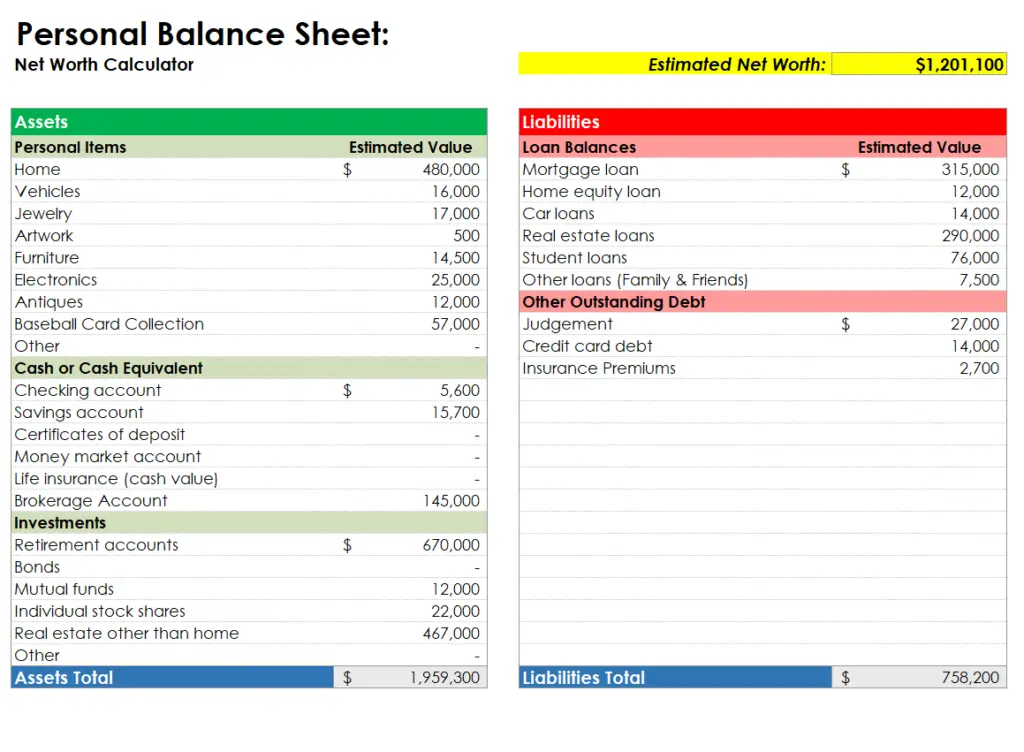

Steps How to Calculate Net Worth from a Balance Sheet

Calculating personal net worth is simply the personal assets minus personal liabilities. It can be described in the formula below:

personal net worth = personal assets – short-term obligations

Add up all personal assets and personal liabilities. If personal assets exceed personal liabilities, then the net worth will be a positive value.

See how to use QuickBooks for personal finances and budgeting. If an individual’s balance sheet has a positive value, they have more assets than liabilities. If the balance sheet shows negative values or is in debt (liabilities exceed assets), at least some of their income should be directed to paying off debts and reducing them.

Net Worth for Personal Balance Sheet Example

An example of net worth for personal balance sheet is personal assets of $20,000, and personal liabilities are $15,000 for a total net worth of $5000.

How to Deal with Negative Net Worth

If you have created a personal balance sheet and have calculated a negative net worth, it’s time to make changes. The personal balance sheet will provide a good starting point for making necessary individual finance adjustments so you can start building wealth from nothing.

There is no doubt that you will have to make some decisions that will impact your financial life to improve your net worth. Achieving positive net worth personal balance sheets will take time and personal dedication to achieving your personal financial goals. You can use a simple tool such as a personal finance flowchart to help priority rank your personal finance goals.

Personal Balance Sheet and Income Statement Adjustments

There might be times when you adjust your balance sheet for items such as getting a loan, saving up money, investing in stocks and bonds, etc.

How do you make these adjustments on your personal balance sheet?

This is done by personal assets written in the left-hand column and personal liabilities on the right-hand side. The two columns will be added to get your net worth and any adjustments made for personal balance sheet items such as personal savings accounts, stocks, bonds, etc.

After adjusting your personal balance sheet for personal assets or liabilities, you’ll need to determine if it’s a positive value (you’re doing better) or negative value (you are not well off).

Some examples of when adjustments might be needed could include:

- Trying to get a loan: personal assets would go up to $10,000, and personal liability goes down $5,000; net worth is now +$5,000

- Saving money: personal asset column will show the amount being saved every month, such as $1,000 dollars, while the other side in the two columns will decrease by that same amount each month, so they match monthly; net worth will stay around zero but increase over time with interest on a personal savings account.

- Investing in stocks or bonds: personal assets would go up, and personal liabilities will decrease; net worth is now +$5,000.

The personal balance sheet is an excellent place to start when trying to determine your personal financial health and where you stand financially so you can make adjustments for specific personal goals like retirement plans, for example, among many others.

Other Reasons for Using a Personal Balance Sheet

Personal balance sheets can be helpful in many ways. Below is a list of other popular reasons to use one:

If You’re Trying to Get a Loan

The lender will want to know your net worth, so the personal balance sheet must be up-to-date and accurate.

You’re Going Through Bankruptcy Proceedings

Your lawyer needs an updated copy of your financial record in order to file for bankruptcy protection on behalf of their client.

Relationship Problems with a Spouse or Partner

A personal balance sheet can help prove the other side in an argument wrong when claiming that you’re not financially responsible and should therefore be paying more throughout your relationship.

You Need to Make a Large Purchase

You want to purchase something expensive such as furniture, for example, but don’t have enough money saved up yet. A personal balance sheet will show where there is room in your budget for these kinds of purchases. You may need to make adjustments so that you’ll have this extra money available or find ways to cut costs elsewhere. This will help keep future net worth positive while allowing you to enjoy things now without worries about financial issues down the line.

Need Help Tracking Fees

If you are trying to track fees on your accounts, a balance sheet can help. Once you know how to find your finance charge, you can use your personal balance sheet to track this interest. Being able to eliminate this monthly charge will put money in your pocket. It can also help reduce loan amounts if your proportion of loan balance to loan amounts is too high.

How Do You Improve Your Personal Balance Sheet?

The best way to improve your personal balance sheets is by setting long-term goals and following the ways to improve your budgeting skills.

You can use the personal balance sheet to help you figure out how much money you need to reach these goals.

Make adjustments where necessary so that your personal assets match your liabilities, and your net worth will improve. You’ll be able to enjoy life more knowing that everything is on track when it comes to finances, without any worries at all about what may happen down the line.

- Personal Balance Sheet: Total Assets – $0 | Total Liabilities = $-3000

- Net Worth: ($3000) (-$5000) (+$2500) || Positive Value (you’re doing better): +25000; Negative Value (not well off): -3500 || Clear Net Worth: positive value of 25000 dollars or better.

Borrowing Money: Checking Account Balances

Using programs such as Quicken vs QuickBooks for personal finance can help with daily account balances. Personal balance sheets are beneficial when it comes to borrowing money. When you borrow a certain amount of money, your personal assets column will decrease by the same amount. The liability side will increase in value; this is known as an asset exchange transaction.

The net worth changes from negative (-) to positive (+). For example, if I need $5000 for purchasing furniture but only have $2000 saved up already, my net worth would be $4000. There’s not enough cash available in my check account balances (personal assets), so I’m going into debt with a loan instead ($0 on one side and +$5000 on the other).

If I had $3000 in my bank account (personal assets), then taking out a loan for $5000 would not change the net worth because I have enough money to cover it.

Using this tool is also a great way how to teach teens about financial responsibility when adulting.

How to Calculate Your Personal Balance Sheet:

– Assets: The valuables that are available and can be converted into cash, such as stocks, bonds, home equity, or other investments; Includes things like retirement accounts too if they’re liquidated right away

+ Liabilities: Money owed by an individual from loans, credit cards, or lines of credit used to purchase items on installments

= Net Worth: Difference between total liabilities and total assets reflects whether someone has more debt than savings or vice-versa

Related Questions:

What is the difference between a positive and negative net worth?

The difference between positive and negative net worth is whether the person has more debt than savings.

How does debt impact my personal finances?

The more money owed, the higher the risk of an economic downturn.

How does net worth affect my credit score?

Your net worth has a minimal impact on your credit score, so it’s not something to worry about too much if it is positive or negative; however, this might change when applying for certain liability loans such as mortgages and car payments.

What are some ways to increase personal assets?

Some examples include saving up more money into investments like retirement accounts, finding better-paying jobs that allow you to save money at the same time while working fewer hours per week (or quitting out altogether), using coupons or other discounts available from businesses instead of spending full price whenever possible without sacrificing quality.

How should I find assets to generate additional wealth?

You can find assets by doing things like taking on an extra job, investing in stocks or other financial instruments to generate income from your money.

What is an asset exchange transaction?

An asset exchange transaction is when a person borrows money. The personal assets column will decrease by the same amount (the total of all your non-cash assets), and the liability side increases in value; this is known as an asset exchange transaction.

Conclusion

When you create a personal balance sheet, you are creating a financial tool. They are excellent tools for people who want to borrow money. You can use personal balance sheet templates to map out and calculate your net worth. Making adjustments and following budgetary guidelines is also key to maintain a positive net worth.

They have other uses, which include assisting with daily financial management or understanding the financial situation of someone you are planning to do business.