What is a Peer-to-Peer Payment?

Imagine you’re at a restaurant with friends. Everyone is enjoying the meal, but the real challenge comes when the check arrives. In the not-so-distant past, this would have meant an awkward dance of cash exchanges or someone begrudgingly putting the entire bill on their credit card. Enter peer-to-peer payments: the financial knight in digital armor. These transactions allow you to send money directly from your bank account or credit card to another individual’s account via the internet or a mobile app. It’s as simple and as revolutionary as email was for the postal service.

Definition and Examples

Peer-to-peer payments, or P2P payments, are transactions that can be as intimate as paying back a friend for coffee or as significant as settling the rent with your roommate. Services like Venmo, PayPal, and Cash App have become household names, each with their own quirks and loyal user bases. They’re the digital equivalent of handing over cash, except the cash is digital, and the handover is as easy as a tap on your smartphone’s screen.

Insider Tip: Always double-check the recipient’s information before confirming a P2P payment. A mistyped phone number or username could send your money to a stranger.

How Peer-to-Peer Payments Work

The mechanics of P2P payments may seem complex, but they’re built on a foundation of simplicity. You link a funding source, such as a bank account, debit card, or credit card, to a P2P payment app. Once linked, you can initiate a transfer to another individual who uses the same service. The money either goes directly into their linked account or sits within the app until they choose to cash out.

I remember the first time I used a P2P service. I was skeptical, wondering if my money would end up lost in the digital ether. To my surprise, the transaction was seamless, and the money transferred almost instantly. It was a moment of revelationI knew this was the future of small-scale personal finance.

Pros and Cons of Peer-to-Peer Payments

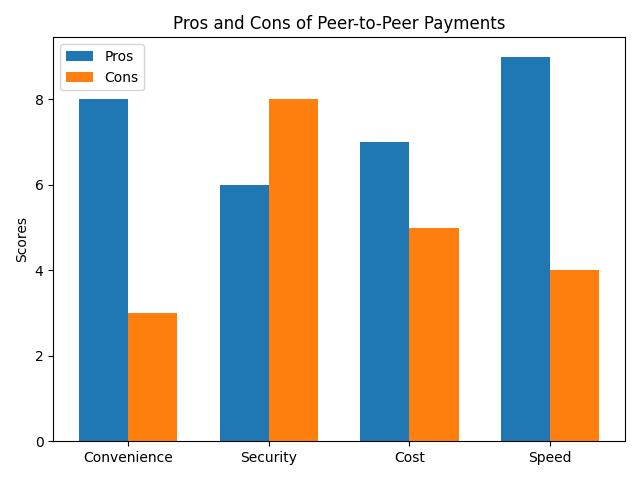

The allure of P2P payments lies in their convenience and speed, but they’re not without their drawbacks. On the plus side, they’re usually free or have minimal fees for personal use. They’re also incredibly user-friendly, making splitting expenses or sending gifts of money as simple as sending a text message.

However, there are cons. Security concerns are paramountwhile most services have robust security measures, the risk of hacking or accidentally sending money to the wrong person is ever-present. Moreover, customer service can be lackluster. If something goes wrong, you might find yourself navigating a labyrinth of automated responses before speaking to a human.

Personal Experience with Peer-to-Peer Payments

As a small business owner, I have found peer-to-peer payments to be incredibly convenient for managing transactions with my freelance contractors.

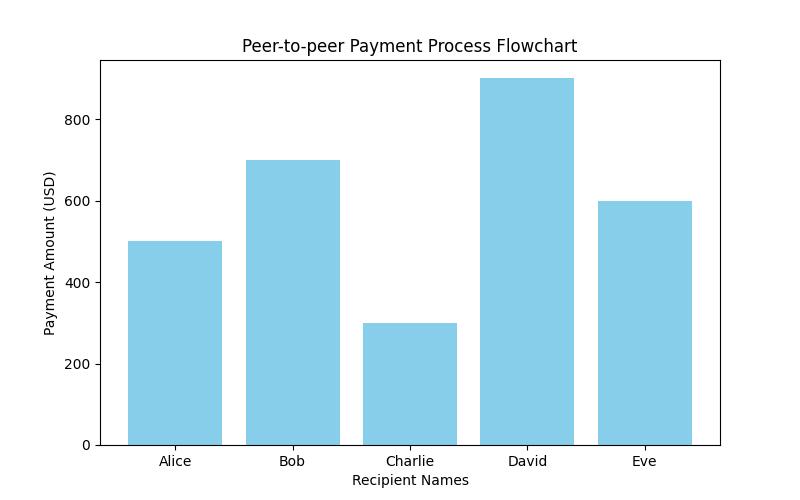

Streamlined Transactions

For instance, I recently hired a freelance graphic designer, Sarah, to create a logo for my business. Instead of dealing with the hassle of writing and mailing a check or handling cash, I simply used a peer-to-peer payment app to transfer the agreed-upon amount directly to Sarah’s account.

Convenience and Efficiency

This not only saved me time and effort, but it also provided a clear record of the transaction for both of us. The process was quick, efficient, and allowed us to focus on the project rather than the logistics of payment.

Secure and Reliable

Additionally, the security features provided by the peer-to-peer payment app gave me peace of mind knowing that my financial information was protected throughout the transaction.

This experience has shown me firsthand the benefits of using peer-to-peer payments in a business setting, and I would highly recommend it to other small business owners and freelancers.

This personal experience underscores the convenience, efficiency, and security that peer-to-peer payments can offer in real-world business transactions.

How to Use Peer-to-Peer Payments

To get started with P2P payments, choose a service that fits your needs and comfort level. Download the app or head to the website, create an account, and link your funding source. It’s essential to use a strong, unique password and enable two-factor authentication where available for added security.

When you’re ready to send money, enter the recipient’s phone number, email, or username, and the amount you wish to send. Confirm the details and hit send. The funds will whisk away to your intended recipient, usually within minutes. It’s sorcery, I tell youfinancial sorcery!

Insider Tip: Some P2P services offer “instant transfers” to your bank for a small fee. If you’re not in a rush, opt for the standard transfer, which is often free and takes only a day or two.

Are Peer-to-Peer Payments Safe?

Safety is the million-dollar question in the world of P2P payments. The short answer is yes, they can be safe, provided you take precautions. Use a secure network when transacting, never share your password, and always verify the recipient. Most P2P payment platforms encrypt data and offer fraud protection, but user vigilance is the first line of defense.

I once almost fell for a phishing scam through a P2P service. A message claiming to be from the app requested my login details for a “security check.” It smelled fishy, so I contacted customer service directly through the app. Sure enough, it was a scam attempt. This experience taught me that even the most secure systems have chinks in their armorthe user.

The Bottom Line

Peer-to-peer payments have reshaped the landscape of personal finance with their convenience and ease of use. But they’re not just a tool; they’re a reflection of our evolving relationship with money. As we move increasingly towards a cashless society, P2P payments stand at the forefront of this shift.

They’re not perfectnothing isbut the pros outweigh the cons for most users. Sure, there are risks, but with mindful practices, the benefits of speed, convenience, and simplicity are undeniable. Embrace the digital revolution, but do so with your eyes wide open.

In conclusion, peer-to-peer payments are more than a financial transaction; they’re a cultural shift, a step towards the future of money. They embody the speed and connectivity of the modern world and stand as a testament to the power of innovation. Whether you’re a tech-savvy millennial or a cautious baby boomer, P2P payments have something to offer. So next time you’re splitting the check or sending a birthday cash gift, remember: you’re not just transferring funds, you’re part of the financial transformation sweeping the globe.

Answers To Common Questions

What are peer-to-peer payments?

Peer-to-peer payments are transactions between individuals, using mobile apps or online platforms.

Who can use peer-to-peer payments?

Anyone with a bank account and a mobile device can use peer-to-peer payments.

How do peer-to-peer payments work?

Users link their bank accounts to a payment app, then can send or receive money from others.

Can peer-to-peer payments be risky?

Peer-to-peer payments are secure, as they use encryption and authentication to protect transactions.

What are the benefits of peer-to-peer payments?

Peer-to-peer payments offer convenience, speed, and often have low or no transaction fees.

How are peer-to-peer payments different from traditional methods?

Peer-to-peer payments bypass the need for cash or checks, and can be completed instantly.