There will be different times in your life when you will have to void a check. Until the future of money evolves, becoming familiar with how to void a check and why you should is a bridge you will have to cross at some point.

There are many reasons why you should void a check such as for direct deposits, for automatic payments to companies, and voiding a check for security reasons. Additionally, you may have to void a check in order to receive automatic payment for a new job and also for withdraws from a checking account into a savings account or a retirement account.

Whatever the reason, learning how to void a check correctly is also important. Below I am going to cover the steps necessary for check voiding. If you are interested in learning the details of how and why you should void checks, you will find all of those details below in this article.

What is a Void Check?

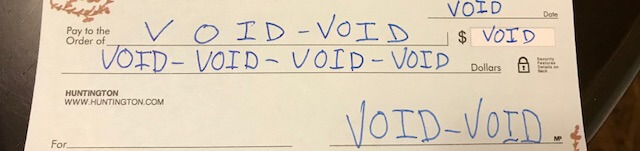

A void check is a physical check that has been cancelled out and cannot be used for any type of payment. It also contains the word “VOID” printed on it in several locations to portray that this is a cancelled check. The word “VOID” itself can either be printed by electronic means on the check, or also handwritten with a permanent marker.

Why To Void a Check

If you are wondering what someone can do with a voided check there are actually quite a few things. There are a lot of reasons why someone would want to void a check however the biggest reason is that it’s an excellent way to share your banking information quickly. With all of the advantages and disadvantages of online banking, here are a lot of reasons to void checks.

Organizations can use the banking information and your bank account number found on a void check to conduct financial transactions. The banking information such as the routing number for your financial institution and also your account number allow institutions, companies, and employers to exchange finances quickly.

By sharing your banking information, you can set up new withdraws or be paid from an employer through electronic payments such as direct deposit into your account.

Below are some of the best reasons why to void a check.

Voided Check for Direct Deposit

One of the most common reasons why to void a check is to receive payment for employment in the form of direct deposit. Hardly any employers anymore issue physical checks for payroll to employees. The reason employers no longer pay employees with physical checks is because it is too expensive.

There are costs associated with providing physical checks for payroll to employees. Some of the costs that employers have with providing physical checks is that they have to print checks and then also mail them out. Additionally, thy also have to pay for labor as well to produce and mail checks.

By using a voided check, employers can pay employees by direct deposit. Not only is it cheap for employers, but the employees also have additional security as their pay is automatically deposited into their accounts based on direct deposit times of their bank.

Void a Check for Automatic Payments

Voiding a check for automatic payments is another reason why someone should void a check. The Automated Clearing House Network (ACH) is how automatic payments are conducted from payer and payee accounts and vice versa. According to NACHA, in 2019 the ACH processed more than 24.7 billion payments. Automatic payments continue to grow year after year in volume. Voiding a check is the easiest way to set up an automatic payment.

Some of the most common ACH payments for consumers would include payments to mortgage companies, auto loans, student loans, and also tuition. Additional reasons to void a check for automatic payments would include some of the following below:

- Charitable Giving

- Utility Payments

- Subscription Services

- Person to Person Payments

- Business to Business Payments

- Home Insurance Payments

- Credit Card Payments

- Auto Insurance

- Renter’s Insurance Premiums

With a voided check, it’s simple to set up ACH payments.

Voided Check for New Jobs

With the gig economy, many people have multiple sources of income and also multiple jobs as well. Voiding a check is one of the fastest ways to get your banking set up to receive payments for your new jobs. All you have to do is provide a voided check to the employer and they will take care of the rest of the process.

Using voided checks to receive payment is a huge timesaver especially if you are working multiple jobs since you won’t have to spend more than 5 minutes voiding and submitting a check in order to receive payment.

Void a Check for a Savings Account

A lot of people have a savings account in addition to a checking account. Savings accounts usually pay higher interest rates than checking accounts do. This is especially true for high yield savings accounts. A lot of people will set up automatic transfers to savings accounts by using a voided check. Once they supply the voided check, money will be pulled automatically from their checking account over to their savings account.

Most of these savings accounts that pay higher interest rates are at different banks from where your checking account is located. That is the reason why a voided check is needed. If a savings account is at the same bank, you won’t need a voided check rather just an online transfer. However, for most high yield savings accounts, you will have to have the money sent to a different bank.

Voided Check to Fund Retirement Account

Another reason to void a check is for automatic funding of a retirement account. There are a lot of small businesses or entrepreneurs that operate their own businesses. As a result, they don’t have actual payroll withdraws into retirement accounts. Rather they make payments on their own into their retirement accounts.

While some of these business owners and entrepreneurs choose to do a lump sum payment at tax season, there are other options with using a voided check. You can use a voided check to fund your retirement account monthly, bimonthly, or biweekly. By using a voided check to automate the funding of retirement accounts, you can utilize dollar cost averaging on the purchase.

Void a Check for Errors

You can also void out a check in case you make errors during the endorsement process. Often times, a check may have an error on the front of the check that it does not affect anything on the back side as well before voiding it. Many times, people try to void checks that have problems only realizing later what was written on the reverse side that they didn’t notice before.

For example, I have sent in checks to the utility company and had a missing last name or number on the check resulting in me getting no credit for payment. Likewise, I have seen individuals bring in checks that were written with one name but then someone else’s signature was on it and their name was not anywhere else displayed.

In these cases, you may wish to void but also insist that an immediate stop payment be placed so that other people will not cash the check thinking it is theirs.

Void a Check for Security

There are a few reasons when you should void a check for security. If you have ever lost a check or noticed that a check is missing, you will want to void those checks. It’s important to always account for missing checks and void them. This prevents someone from finding them and committing fraud by writing fake checks.

The other reason to void a check for security is if you wrote a check and it was never cashed after a considerable amount of time. It’s not a good idea to leave uncashed check still out there especially if it is a third party check. Voiding uncashed checks is another way to protect your financial security so no one else can manipulate or alter the check if found.

How to Set up Direct Deposit Without a Voided Check

It’s very common these days for people to not use personal checks anymore. With advancements in banking technology such as bill payment, a lot of people don’t even need checks anymore. You can obtain a voided check even if you don’t use checks. If you are trying to set up direct deposit with a new employer and you don’t have any voided checks available, there are other options.

Below are some of the best ways to set up direct deposit without a voided check.

Use a Starter Check

If you need to set up direct deposit but don’t have any checks, starter checks, are an option. Simply contact your bank and ask for a few starter checks. Most banks won’t charge you for these but that is not always the case. Be sure to ask if there are any fees involved.

Once you have a starter check, simply void it just like it was a normal check. Starter checks don’t contain personal information most of the time, but all you are concerned with is the routing number and account number located on the starter check. That will be sufficient to set up direct deposit.

Have Your Bank Print a Blank Check

You can also have your bank print a single blank check as well. You can void that check and use that for setting up direct deposit. The difference between printing a blank check and a starter check, is that a printed check would have your name and address on it, whereas a starter check would not.

Get a Bank Letter

Another way to set up direct deposit without using a voided check is to get a letter from your bank detailing your financial routing and account numbers. Most banks should be able to provide this to you and most of the time this will be free.

Set Direct Deposit Up Online

Most of the time, you can set up direct deposit online without a voided check. A lot of employers now offer direct deposit authorization forms available online for you to complete. All you have to do is simply type in your financial institution along with your routing number and account number. Often times, this is all that will be needed to set up direct deposit.

How to Void a Blank Check Correctly

There is a specific way to void a blank check correctly. The best way how to void a blank check correctly is to write “VOID” in several areas of the check. While you can write “VOID” in one area on the check it’s not the best way to void it. Rather you want to write “VOID” on the lines of pay to the order of (also known as the payee line) and the date line.

You should also write void in the dollar payment amount box and also on the line where you spell out the dollar amount of the check. Additionally, you should also write in void on the signature line (also known as the signature box) as well. You should use caution, so you do not cover up the routing number or account number accidentally. Financial institutions need to be able to read those numbers so they can set up payments to your account if that is why you are voiding a check.

How to Void a Written Check Correctly

How to Void a Check Lost in the Mail

If you need to void a written check that has been lost in the mail, you will need to contact your bank and cancel the check.

Calling your bank and voiding the check is the only way to void a check that has already been sent and mailed. Whether your check was never received, or you no longer need to pay someone with the check, calling your bank and canceling out the check will take care of both of those situations.

Voiding a Cashier’s Check

Voiding a cashier’s check is different than voiding a personal check and more involved than simply calling the bank. A cashier’s check is also known as a bank check. When you request a cashier’s check the money is immediately withdrawn from your account and into the bank’s. Then the bank makes out a cashier’s check for you.

Related Questions about Voided Checks

Do banks charge to void a check?

Most banks do charge a fee to void checks. The fees vary from bank to bank to cancel checks already out in the mail that you cannot retrieve. Check your banks website as most of the fees are listed online for their services.

Is it safe to email a voided check?

While you can email a voided check if you have to, it is not a recommended practice. If your computer falls prey to malware or worse yet, someone was able to retrieve or intercept the email that you sent with your voided check, you could face unauthorized withdraws. However, if emailing a voided check is absolutely necessary, be sure to encrypt the file with password protection techniques.

Can you cash a voided check?

If you are trying to cash a check that has the word “VOID” written all over it, you are not allowed to cash it. While there are plenty of places to cash a personal check near me, none will take a voided check. A voided check has been cancelled and no bank knowingly will allow you to cash it. Additionally, this could also constitute fraud if you knew that you had a voided check. You should always void your check after making a mobile deposit.

What will happen if I deposit a voided check?

There are situations where you may come across an old check, and you might deposit it at your bank. You might not know that this check was voided out previously. Sometimes voided checks do go through initially as deposits. However, the bank will usually correct their error and either retrieve the money deposited into your account or simply not allow the deposit to go through.

How to dispose of a voided check?

The best way to dispose of a voided check is to shred it or destroy it. Additionally, you can also split up the left over pieces into multiple trash containers. This prevents someone from retrieving the pieces of your check.

How to void a check from a previous year?

The best way to void a check from a previous year is to contact your bank and have them cancel the check. You don’t want a check out there floating around that has not been cashed because it could fall subject to abuse and fraud.

Wrap Up

Knowing how to void a check correctly is important for everyone to know. As you can see there are many reasons why voiding checks are important such as for setting up direct deposits, ACH payments, and also giving to charities. Voiding lost checks prevents check fraud and also can protect your bank account from suspicious activity.

The way to void a check varies depending on if the check is blank, written, or in the mail. However, by following the best practices above how to void a check correctly, you can rest assured that your finances will not fall subject to financial peril.