What would you do with an extra 30% disposable income each month? Do you dream about ways to pay off your mortgage early?

On average, that is the amount of monthly income each homeowner spends on their mortgage and housing costs. There are other ways to save money on housing, but paying off your mortgage early is one of the smartest financial moves a homeowner can make.

Not only does it make financial sense to be mortgage free, but it can also drastically alter your everyday life and the choices you make.

These personal finance experts all found financial freedom and transformed their lives by eliminating their mortgage.

Below are simple ways to pay off your mortgage early and retire your housing debt for good.

7 Ways to Pay Off Your Mortgage Early

Financial experts agree that eliminating debt is one of the best ways to building wealth in your life.

If you have reduced all of your credit card expenses, personal loans, and you have an emergency rainy day fund set aside, then yes it does make sense to pay off your mortgage early.

1. Refinance to a Shorter Term Mortgage

One of the best and most popular ways to pay off your mortgage earlier and live mortgage free is to refinance to a shorter term.

Depending where you are at with your household budget and financial situation, refinancing to a shorter term may or may not be possible.

You will have to complete your own analysis to see if you have the extra money available each month to put towards your mortgage payoff process.

For example if you have been paying on a 30 year mortgage for five years and you would really like to re-finance down to a 15 year mortgage, your payment may actually increase per month.

Speaking to a loan officer or a mortgage broker about your mortgage loan is a great way to get financial advice to see if refinancing is right for you. They would be able to advise you whether or not this would be a good financial move to make.

They will prepare a federal truth in lending document that will detail all of the charges and what your new payment would be including taxes and insurance.

If your payment does happen to increase by a few hundred dollars per month, the benefits may outweigh the extra cost.

Remember the payment you are making has more of your money going towards the principal balance of your mortgage and not the interest portion. Therefore this is a much faster way to build equity in your house and pay off your mortgage faster.

2. Round Up or Pay Extra on Your Monthly Mortgage Payments

When you make your mortgage payment every month consider rounding your payment up to the next $10, $20, or $50 mark. If you can do this every month, you would save substantial time off of your mortgage. There are many tools and apps such as accelerated mortgage payment calculators that you can use to see the effects.

An accelerated mortgage payment calculator will show you the results of how much interest and time is reduced off of your mortgage.

This is a great option if you have a very limited budget and limited resources to put towards your mortgage payment process.

You also want to be sure that the extra payment amount that is applied will be applied to your principal.

I used to send in extra payments each month to my lender to reduce my mortgage. Initially, my extra payment was being applied to my escrow account. I had to call my lender and tell them to apply all those payments towards the principal.

Going forward when I sent in an extra payment, I would be sure to write “apply to principal” on the memo line of the check.

Initially, if you have a larger amount to use for mortgage payoff such as 50k, you can make a lump sum payment to your lender. Mortgage payoff is a great way how to invest 50k in real estate because it will automatically generate monthly income. You won’t have the expense of your monthly mortgage amount.

3. Make Lump Sum Payments

Another good option on how to pay off your mortgage early is to provide a lump sum payment.

A lump sum payment is a payment that is made above and beyond your monthly mortgage payment that is applied to your mortgage balance. Be sure to check your household budget strategy to see if you have money available to contribute for a lump sum payment. Many households do this when they receive their income tax refund money. They will designate a portion to go towards principal reduction of their mortgage.

Another option would be to make lump sum payments every quarter. This will also reduce the balance and interest paid on your mortgage.

You are probably wondering how this affects your mortgage payoff process.

What happens if I make a lump sum payment on my mortgage?

Making a lump sum mortgage payment has significant effects on your mortgage payment process. When you make a lump sum mortgage payment, the amount you are paying reduces your principal balance on the mortgage. The overall amount you owe for the mortgage is reduced. Your lump sum payment is also saving you interest charges as well.

Mortgage on 1.0 Million Dollar Home

To show the effects of making lump sum payments on a mortgage, we are going to look at a case study.

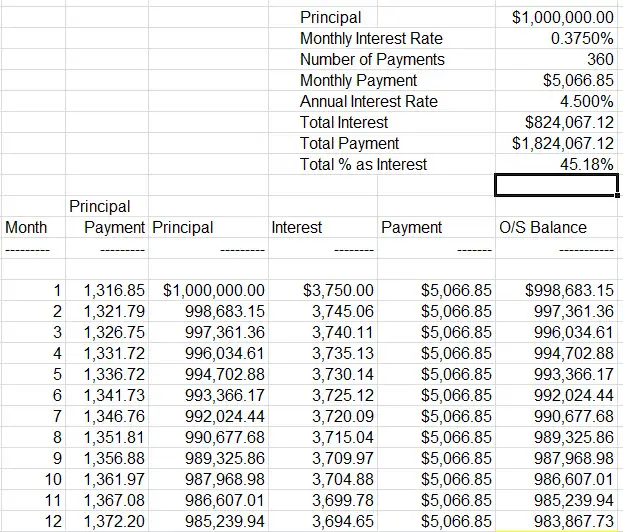

I have put together a mortgage amortization schedule for a mortgage loan in the amount of 1.0 million dollars.

Below is the first year’s worth of mortgage payments. You can see the total interest and total payment amounts which takes into account calculated daily mortgage interest as well. This number does not take into account any lump sum payments being made.

The total cost of this mortgage is $1,824,067.12!

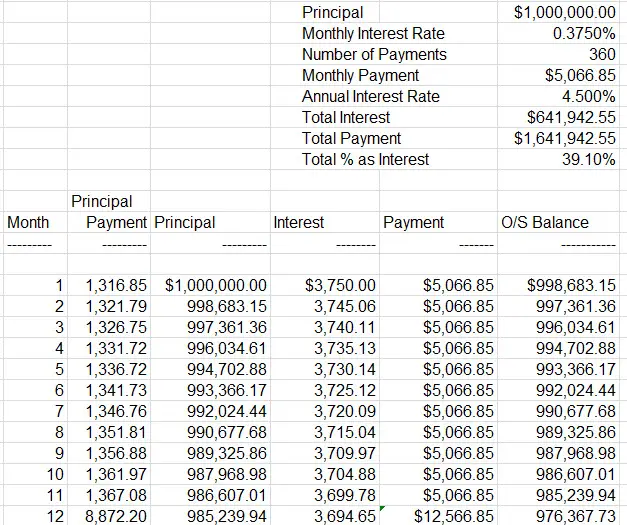

Now the example below contains a lump sum payment made every 12th month in the mortgage schedule. The amount of the lump sum payment is an additional $7,500.

If you are fortunate enough to afford a 1.0 million dollar mortgage, a $7,500 is probably a reasonable number. That amount works out to roughly a mortgage payment and a half every year that is contributed as a lump sum amount.

A few things to point out are that this total payment is $182,125 less by making a lump sum payment once a year.

Also, while you can’t see it on the schedule, this mortgage is paid off earlier because of the lump sum payments.

The mortgage balance is paid off on month 289 instead of 360. This is just a little bit over 24 years instead of 30.

Due to the fact that this mortgage amortization schedule is formula driven, the 360 on the third line is a hard key number. If I followed the schedule down to the bottom, it would end at 289 and reflect a balance of 0.

Obviously this is an extreme example, but you can see by making lump sum payments, you can save yourself a ton of interest charges.

A way to accelerate this would be to come up with money saving ideas you could implement in your every day life.

One popular area to focus on is to organize your household to save money. There are also a lot of things in your life that you may no longer need.

I recently underwent a household spending audit and I came up with a whole list of things I stopped buying to save money.

4. Increase Income

Coming up with extra income is a great way to pay off your mortgage early.

For example maybe you start taking your lunch to work and now you are saving $10 a day which is a pretty conservative number. That would work out to an extra $200 a month that could be applied to your mortgage principal.

You could also start doing some side hustles as well to come up with extra money to make a big lump sum payment on your mortgage.

I have done this in the past when I was selling houses as a side hustle. Even something as silly as taking online surveys can net you $1,500 a month will help increase your household income. This is something I have done in the past and I used some of that money to pay down one of my mortgages I had.

A couple other things to eliminate are:

Trips to Starbucks

Buying second hand clothes

Eliminating your cable bill

Increasing your homeowners deductible and/or car insurance deductibles

You can also set up a separate bank account as well and save money throughout the year in this account. At the end of the year you can apply all of the money in the savings account to go towards your lump sum payment for your mortgage.

5. Make Biweekly Mortgage Payments

Making biweekly payments is also another option you have to pay off your mortgage faster. You want to check with your lender on this because some lenders do not allow this. The ones that do allow it may charge you a set up fee.

This is one of my preferred options I recommend for individuals when they ask me how to pay off their mortgage early.

Here is why…

Breaking up your mortgage payment and paying every two weeks allows a portion of that payment to remain in your bank account and earn interest.

Since you are making half of your mortgage payment every two weeks, you don’t have to shell out that large amount on the first of the month anymore. Half of that payment amount is still in your bank account for another two weeks.

If you are earning interest at 2.25% which is what today’s savings account rates are that can add up to a substantial amount of money over the course of a year.

With this option you are actually making 13 monthly mortgage payments.

By paying every other week half of your mortgage amount, you are already coming out ahead and making an extra payment.

By following this method it is very easy to reduce your mortgage by three years to six years if you were to implement this process shortly after you started your 30 year mortgage amortization schedule.

6. Refinance to an ARM Mortgage

In addition to re-financing to a shorter term fixed mortgage which was mentioned above, you can also re-finance to am arm mortgage. ARM mortgages come in different terms usually 5, 7, and sometimes 10 year terms.

The advantage of an ARM mortgage is that the interest rates are very low for a certain set number of years. Usually 5, 7 or 10 years depending on what you pick.

ARM mortgages were very popular 10 to 15 years ago. Many housing experts believe that they were one of the big causes of the housing implosion.

However if you are only planning to be in your house for a certain time, such as 5, 7, or 10 years an ARM mortgage might be right for you. The interest rate during that time frame will stay fixed. After that time period it can adjust to a new interest-rate.

There are caps as to how high the interest rates can rise per year after your fixed rate period is over. However even with the slightest increase in the interest rate percentage, your payment could be affected by an additional hundreds of dollars per month.

An ARM mortgage is a great way to have a low payment, build wealth, and pay off your mortgage early if you follow this strategy below:

If you have an ARM mortgage and you are fortunate enough to be in a sellers market you can ride the home appreciation wave. You could then sell your house at the end of your fixed rate period right before your ARM mortgage is getting ready to reset and increase.

You would gain a lot of home equity due to rising house appreciation prices and you would also have a low monthly payment.

Additionally by selling you will also have paid off your mortgage.

7. Downsizing

Another option to paying off your mortgage early involves downsizing. This may be one of the easiest ways to pay off a mortgage early. In a sellers market, it is always a good idea to reassess your current housing situation and the terms of your mortgage.

If you’re goal is to get out of debt and eliminate your mortgage, you should think about selling your house. Compared to some of the other options above, this may be the fastest way to pay off your mortgage early which is simply by moving.

If you are selling a large house it is very possible that the proceeds from your house would be enough that you could pay cash for a new place.

This is the situation that I was faced with. I had a 15 year mortgage at 2 1/2% so my payment was relatively low. What was not low was all of the taxes, maintenance, and upkeep I had for the house. Large homes are very expensive to maintain, insure, and take care of.

There were substantial savings I discovered by not having a large house to take care of anymore. I was saving roughly $25,000 a year because I did not have a large house to maintain.

That money I am saving has now become part of my retirement savings strategy and invested my extra income in passive income streams such as Fundrise, Roofstock, and Crowdstreet.

But the best part…I ended up paying cash for a new place effectively living mortgage free!

Summary

By following some of the steps above, using a mortgage payoff calculator, and applying extra principal payments, you will be able to join the ranks of millions of Americans and pay off your mortgage early.

You have a choice to make

Spend the majority of your life and take the 30 years to pay off your house or you can implement some of the steps above.

If you choose to use a combination of the steps above, not only will you enjoy personal and financial freedom in your life, but you also will live a stress-free and healthier life.

The choice is yours…