October is a time of year that is known for many things. It is a time for cider mills, Halloween, and crisp autumn air in some places. Those honeycrisp apples taste the best this time of year to me.

I often think of October as the preamble to the holiday season. In a few short weeks, chaos or joyful bliss (use which ever applies to your situation), will commence for the holidays. Major events such as Thanksgiving, Christmas, and New Year’s will transform my day-to-day lifestyle.

I will battle with other parents and grandparents in aisles of stores for the hottest China-made plastic toys and electronics around. There will be a lot of traveling involved, schedule coordination, and many days where kids will not be in school.

That, in and of itself, will force me to implement stricter screen time sanctions on my minions. This will force them to make a temporary alliance and team up to try and revolt against my sanctions.

Yes, it’s going to be the most wonderful time of the year in my household. Andy Williams is already singing his lullaby in my head.

Aside from all of those wonderful things I have to look forward to, October is also known for National Retirement Security Week.

Say what?

That’s right. National Retirement Security Week has been around since 2006 although initially labeled National Save for Retirement Week.

Even I, someone who has recently supercharged my savings and retirement strategy, was unaware of this until I came across some financial graffiti at a doctor appointment recently.

However, when I thought more about this, it does make perfect sense to revisit your retirement strategy during this time of year.

So FIRE wannabe’s listen up…

Here are 4 reason why National Retirement Security Week is the best time to revisit your retirement strategy

One of the best reasons why this makes the most sense to look at your retirement strategy a full two and a half months before the New Year is that a person needs time to do their research.

Check out what happens if you don’t save for retirement if you think retirement planning isn’t for you. Most of you will agree that planning is key for retirement.

In order to figure out what your retirement strategy is going to be for next year, there are a lot of things that need to be taken into account.

1. Time to Analyze Your Obligations and Household Budget

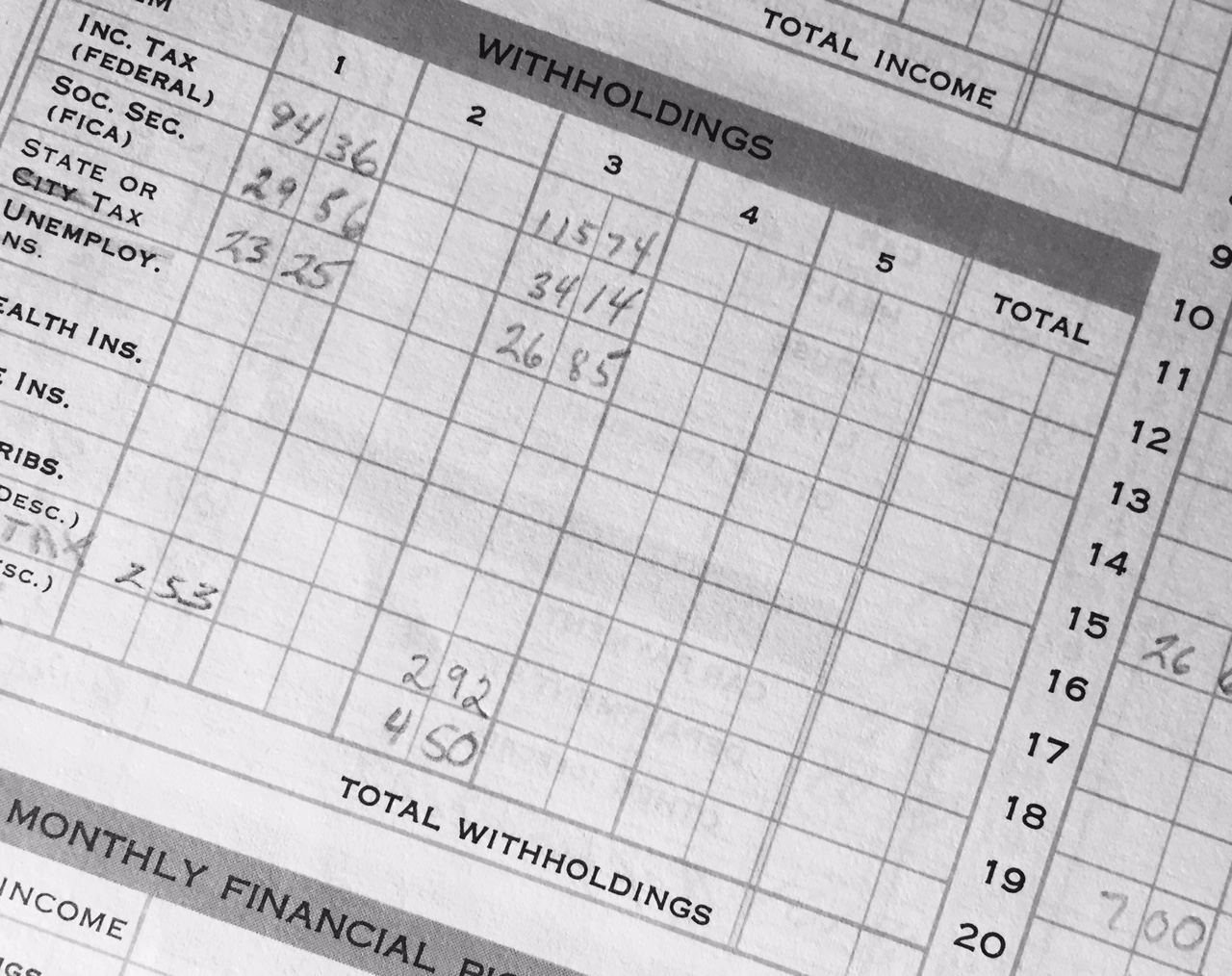

One of those items to look at is your current goals, obligations, and your household budget. In order to see if an individual will be able to contribute the same amount next year into their retirement, a review has to be done on your everyday goals and household budget.

Will there be big ticket expenses next year?

Will I have enough to cover these expenses?

Should there be more money set aside in my emergency fund?

Should I reduce my savings and retirement strategy for next year?

All of these questions and your current financial situation have to be looked at and taken into account because expenses today do affect your retirement strategy and the lifestyle you want to live.

2. Time to Analyze Your Retirement Lifestyle

Another thing that you should do is to try and look at and picture your lifestyle in Retirement. There is no question that retirement in general is going to cost a boatload of money. All of the financial experts claim that. Maybe your magic number is going to be $1.0M. However, you also need to define what your retirement lifestyle will look like.

Will that include insurance?

What are you going to do if you are too young to qualify for Medicare?

Where do you think you want to live?

What kind of household will you have?

Are you going to want to travel?

If you want to splurge a little bit in retirement you may need more than that amount. The more questions you can answer early on the better off your strategy will be. Obviously nobody has a crystal ball and no one can predict with certainty what the future holds for them. However, you might be able to take note of some things that have a high probability of happening for example knowing a certain region you may want to retire in.

3. Time to Analyze your Retirement Plan and Allocation

Taking the time to look into your current allocation of how your money is invested in your retirement accounts is a great thing to do annually. I would actually recommend either calling your retirement administrator, if you have an employer who is sponsoring the plan, or attending one of their open houses in person.

A lot of employer retirement plan administrators hold sessions and open houses during National Retirement Security Week for employees. One reason for this is to educate the employee on new tax laws and rules that may change or affect the employee’s retirement strategy.

Often times, there are new rules that take effect that you may not even be aware of. For example my employer offers all kinds of crazy catch ups. One of those include being able to go back up to three years and “catch up” on contributions in my 457 if I was not able to max out to the $18,500.

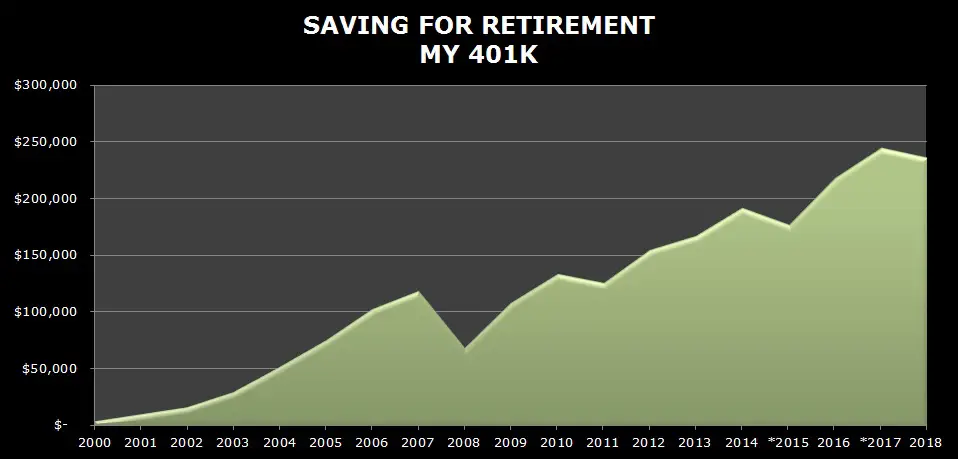

That would work out to contributing an extra $55,000 into my retirement accounts. That would work out to an additional $165,000 in my retirement accounts. That amount would be able to generate earnings and grow for at least another 20 years.

It also takes time to look at your allocation of retirement funds. If you do not feel comfortable analyzing the funds yourself then you should go see a professional who can guide you based on your goals, age, and target retirement date. Maybe your mix of retirement funds are not aggressive enough or maybe they are too aggressive based on your age.

There are also retirement date funds some employers offer that automatically do the fund allocation so you do not have to rebalance the portfolio throughout. All of these things should be looked at.

4. Time to Formulate Annual Retirement Strategy

It does take time to get your plan together of how you are going to tackle your retirement strategy for next year. Maybe you want to increase your contribution but don’t have the money and are short a bit on how to get there.

Thinking outside the box and maybe refinancing might lower your monthly payment. My mortgage lender will reach out to me occasionally with programs to lower my monthly payment with their great offers.

By lowering your household obligation expenses and payments, you can use the savings as a way to increase your retirement contributions. Win.

And remember you are funding retirement accounts with pre-tax dollars. So you are actually investing 25%, 28%, or 30% (whatever tax rate you are in) MORE than the money you came up with from reducing after-tax expenses.

Wrap Up

There really is no better time during the year than National Retirement Security Week to take a look at your retirement strategy.

You should review your retirement strategy annually and make sure you are on track. By reviewing your retirement strategy annually, you may be able to take some of the guess work out of some of your unknowns.

You might be able to address some areas such as where you may retire to and what your health insurance needs might be. By knowing that information, will help you figure out how much you need to save. Adjusting your strategy early on will help meet those needs in the future.

By making these adjustments in your retirement strategy today, you can create a great retirement life for tomorrow.

Leave a Reply