Are you someone who likes to keep your finances organized and separate? Have you ever considered having multiple Cash App accounts for different purposes? Perhaps one for personal use and another for business-related transactions.

While it’s easy to send money on Cash App without a debit card, it’s not as easy for multiple accounts. But wait, is it even possible to have more than one Cash App account?

In this blog post, we will explore the possibility of having multiple Cash App accounts and, if so, how to do it. So if you’re curious about the topic, keep reading to find out more.

Can You Have Multiple Cash App Accounts?

Can You Have Multiple Cash App Accounts for money transfers? Many people wonder if it is possible to create multiple Cash App accounts. The answer is yes. You can have more than one account on the platform.

In fact, Cash App allows users to have up to two accounts: one personal and one business account. Our cash app guide references multiple accounts.

However, creating multiple accounts requires different phone numbers and email addresses for each account. It’s important to note that having multiple accounts can come with some drawbacks, such as the potential for confusion and difficulty in managing multiple wallets.

In the following sections, we will explore why someone might want to create multiple Cash App accounts, the pros and cons of doing so, and how to set up additional accounts.

Why Would Someone Want to Create Multiple Cash App Accounts?

Cash App is a popular digital wallet that has become an essential part of many people’s lives. However, sometimes one account may not be enough for a person. There are several reasons why someone might want to create multiple Cash App accounts:

- People who have multiple businesses or side hustles would prefer separating their finances by having different accounts dedicated solely to each venture.

- Some users with family members who need assistance with money transfers might feel the need for more than one account.

- Others prefer having separate accounts designated for specific purposes, such as bill payments and personal savings.

However, creating multiple Cash App accounts can come with its own set of challenges. Therefore it’s important to understand both the pros and cons before proceeding further.

Pros and Cons of Creating Multiple Cash App Accounts

Creating multiple Cash App accounts can have advantages and disadvantages. The main advantage is that it allows you to keep your finances separate, which can be useful if you use the app for both personal and business purposes.

Additionally, having more than one account provides a backup in case one gets hacked or locked.

On the other hand, managing several accounts can be time-consuming as each requires a unique login and password combination. Furthermore, using different bank cards or payment methods with multiple profiles may result in higher transaction fees.

Overall, whether creating several Cash App accounts is beneficial depends on an individual’s specific needs and preferences. It might suit some users while being too complicated for others. Therefore it’s important to weigh up all the pros and cons before making this decision.

Is It Legal to Create More Than One Cash App Account?

Cash App is a legitimate and fully licensed payment service provider that allows users to send and receive money, pay bills, buy Bitcoin, and invest in stocks with ease. However, it’s against the company’s policies to have more than one personal account. Any user caught violating this rule risks getting their accounts suspended or terminated without prior notice.

Having multiple Cash App accounts can be seen as an attempt to cheat the system by taking advantage of promotional offers several times over. Moreover, having too many accounts may raise red flags for potentially fraudulent activities – which could tarnish your reputation on the platform permanently.

It’s important to note that businesses are allowed to have multiple Cash App merchant accounts under certain conditions, such as being registered separately or having different tax IDs. If you’re considering opening another account for business purposes, make sure you adhere strictly to all applicable rules and regulations.

How to Fund Multiple Cash App Accounts

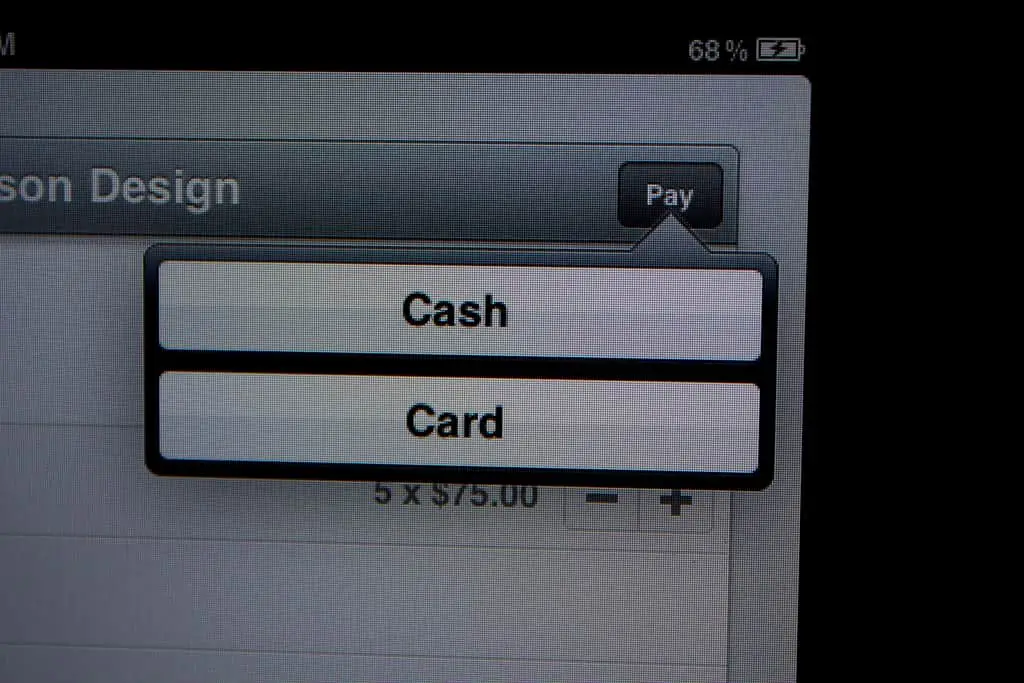

To fund your Cash App accounts, you have several options. You can use your debit card or bank account as the primary source of funds for all accounts, but keep in mind that each transaction will incur a fee. You can transfer money from PayPal to Cash App and link accounts. Alternatively, if you want to avoid fees and have multiple cards available, you can connect one card per profile when adding funds to each Cash App account.

Finally, if you’re an active user of Cash App, you can also use cash boosts or referrals to get free money. Just keep in mind that each account will still require its own referral code if you want to receive the bonus.

How to Create Additional Cash App Accounts

How to Add Another Cash App Account to Your Phone

- To add another Cash App account to your phone, first, make sure you’ve logged out of any existing accounts.

- Next, download the Cash App from the app store and create a new account by entering your email or phone number. Verify your details with the verification code sent to you via text or email.

- Once verified, link a debit or credit card and add funds to this new account.

- To switch between accounts on your device, simply log out and log back in using different login credentials.

Remember that each Cash App account has its unique login credentials. Don’t share your password with anyone else, as it can lead to unauthorized access to your private transactions and financial information across multiple profiles.

Setting Up Multiple Cash App Accounts on One Device: Tips and Tricks

- To set up multiple Cash App accounts on one device, you will need to use different phone numbers and email addresses for each account.

- Start by logging out of your current account and then downloading the app again.

- Once you have downloaded the app, create a new account using a different phone number and email address. Make sure to verify each account with a unique phone number to avoid any issues with verification.

- You can switch between accounts by logging out of one and logging into the other. Remember to keep track of which account you are currently using to avoid confusion.

The Dos and Don’ts of Managing Multiple Cash App Accounts

When setting up additional Cash App accounts, there are a few dos and don’ts to keep in mind. The policies are similar to having two Venmo accounts. Make sure to use different email addresses or phone numbers for each account so that they can be easily distinguished from one another.

Also, remember to log out of one account before accessing another to prevent confusion and avoid mixing up transactions. However, it is important not to create too many accounts as this may lead to suspicion of fraudulent activity by Cash App’s security team.

Stick to creating only the number of accounts that you need and make sure all information provided is accurate.

Managing Multiple Cash App Accounts: Tips and Tricks

Tips for Organizing and Securing Your Accounts

Just like the disadvantages of having multiple credit cards, there are difficulties managing multiple Cash App accounts.

Some tips for organizing and securing your multiple Cash App accounts include:

- Creating unique usernames and passwords for each account.

- Using a password manager to keep track of login information.

- Keeping track of which bank cards are linked to which account.

- Regularly checking all accounts for any suspicious activity.

It’s important to remember that each account needs to be managed separately, so it may be helpful to create a system or schedule for checking in on each one. Additionally, make sure you only share sensitive information with trusted individuals and avoid logging into your accounts on public Wi-Fi networks.

Linking Bank Cards and Payment Methods with Different Cash App Accounts

Linking bank cards and payment methods to multiple Cash App accounts is possible, but it requires a bit of effort. First, you need to make sure that each account has a unique phone number and email address.

Then, you can add a bank card or payment method to each account by going to the “Banking” tab and following the prompts. Once you have it linked, you can use your Cash App account at the online stores that accept Cash App for payment.

It’s important to note that you cannot link the same bank card or payment method to multiple Cash App accounts. If you try to do so, you will receive an error message. Additionally, be aware that each account may have different transaction limits and fees associated with it.

To switch between accounts, simply log out of one account and log in to another using the appropriate login credentials. It’s also a good idea to keep track of which bank card or payment method is linked to which account for easy reference.

Transferring Funds Between Your Own Various Cash App Wallets

Once you have set up multiple cash app accounts, it’s important to know how to transfer funds between them. This process is quick and easy and can be done in a matter of minutes.

- To transfer funds from one account to another, open the Cash App on your mobile device and locate the “Balance” tab.

- From there, select the account that has the desired balance you wish to transfer. Next, click on “Cash Out” and choose which bank account or debit card you want to deposit the money into.

- After completing this step for your first account/cash app wallet, simply switch over to your other profile by logging out and back in under a different email address/phone number combination.

- From there, navigate again to Balance > Add Money > (Type Amount) > Confirm. The last step will ask for either Touch ID or PIN input verification, depending on what security measures each profile requires.

- Then click “Transfer,” and confirm any prompts asking if you are sure about going forward with this transaction.

Be sure to wait patiently as it may take anywhere from one to two business days depending upon how much currency is being exchanged between these profiles, but generally speaking, most transactions happen instantly once authorized properly!

Avoiding Scams While Using Several Cash App Profiles

While having multiple Cash App accounts can be useful, it’s important to be aware of potential scams. Scammers may try to take advantage of people with multiple accounts by sending fraudulent requests or attempting to steal personal information.

To avoid falling victim to these Cash App scams, it’s important to always verify the identity of the person you’re sending money to and never give out personal information like your login credentials or Social Security number.

Additionally, make sure to keep your devices and accounts secure by using strong passwords and enabling two-factor authentication. If you receive any suspicious requests or messages, report them immediately to Cash App support. By staying vigilant and taking necessary precautions, you can safely use multiple Cash App accounts without falling prey to scams.

FAQs

Can I Have Two Cash App Accounts With The Same Phone Number?

No, you cannot have two Cash App accounts with the same phone number. Cash App requires each account to have a unique phone number or email address associated with it. Additionally, you can’t be simultaneously signed in to multiple accounts at once.

Can I Use the Same Phone When Signing in to Multiple Cash App Accounts?

Yes, you can use the same phone when signing in to multiple Cash App accounts, but only one at a time. You will need to log out of one account before logging into another.

How Do I Update My Account Information on Cash App?

To update your account information on Cash App, go to your profile and select Personal. From there, you can edit your contact information, such as your email address and phone number. If the phone number or email is already associated with another account, you will not be able to use it for your current account.

Is It Possible to Merge Two Cash App Accounts?

Yes, it is possible to merge two Cash App accounts by transferring all funds from one account into the other. However, this process is irreversible, so make sure that all funds are transferred correctly before merging them together.

How Do I Transfer Money Between Two Different Cash App Accounts?

To transfer money between two different Cash App accounts, open up both apps and enter the username of the person who will receive the money into their respective app’s search bar. Then enter the amount of money that needs to be transferred and confirm the transaction on both ends.

Is There an App for Managing Multiple Cash App Accounts?

Yes, there are several apps available for managing multiple cash app accounts, such as Money Manager and MoneyWise, that allow users to track their spending across multiple cash app accounts in one place. Additionally, some banks also offer mobile banking apps that allow users to manage their finances from one central location.

Conclusion: Should You Consider Creating More Than One Account?

Multiple Cash App Accounts can be an appealing prospect for several reasons. However, creating and managing multiple accounts can also come with its own set of challenges and potential risks.

Before deciding to create additional profiles, it is essential to consider the pros and cons outlined earlier in this article. It is crucial to remember that maintaining multiple Cash App accounts requires extra effort concerning account management, fund transfer between wallets, and maintaining cybersecurity practices actively.

That being said, businesses handling vast transactions or individuals who wish to compartmentalize their spending may find having separate Cash App accounts more manageable.

With proper organization skills and knowledge about how to use several accounts safely, some people might benefit from having more than one cash app account. Ultimately, it comes down to individual needs; therefore, weigh the benefits versus limitations before making a decision.