If you are struggling whether to invest in real estate crowdfunding or becoming a landlord, I can relate. As a licensed Realtor, and also a landlord myself, I have often struggled with that same dilemma too.

My time is valuable since I am a single parent with two kids juggling heavy family obligations. There is no question that my time is already stretched thin.

Toss in some variables such as working a 9-to-5 job, taking care of my kids when they get sick, running my household, and managing my rental property and tenants, there isn’t much time left for a cup of coffee even!

However, I still try to find some amount of time to focus on my real estate endeavors and investments. I firmly believe real estate offers a pathway to building wealth for the average joe.

However, there are a lot of advantages to investing in real estate through crowdfunding such as gaining financial freedom and wealth through real estate, passively.

Nowadays, there are more options than ever to invest in real estate. The equation is no longer about becoming a self-invested landlord and purchasing traditional single-family properties or multi-units.

Rather, a real estate investor can invest in real estate crowdfunding passively. Investing in real estate crowdfunding is also known as group real estate investing.

I’m going to cover some of the best low-risk options that are available for today’s real estate investor when it comes to real estate crowdfunding and group real estate investing.

What is Real Estate Crowdfunding

Before we can look at the best options for group real estate investing, a lot of people may not know what real estate crowdfunding is.

Real estate crowdfunding in principle is no different than any other type of crowdfunding that occurs out there. Think of GoFundMe which is also another example of a platform for generalized crowdfunding.

Investing in real estate crowdfunding is no different. It can be easily defined as when a group of people or investors contribute an amount of money towards a specific real estate project. A simple way to think about it would be to think of it as property crowdfunding. Investors are sharing the financial costs of investing in a real estate property at different ownership percentages.

- They can contribute and invest money to traditional companies that manage these projects or contribute money to an online platform.

- These online platforms are also considered traditional real estate management companies for these projects.

- The investors become owners of the project based on the amount of investment they contribute and therefore they can share the returns in the form of profit (or losses) of the projects.

The real estate crowdfunding platforms are companies themselves are considered private companies. Some of these companies are not traded on the public stock exchanges.

Additionally some of the real estate crowdfunding platforms have specific time limitations when it comes to selling your portion of your investment. This differs significantly from traditional stock where you can sell your share with a phone call to your stockbroker immediately.

Is Real Estate Crowdfunding a Good Investment?

Generally speaking I believe now is a good time to be an investor with real estate crowdfunding for several reasons.

- It’s always good to diversify your investment portfolio away from blue-chip stocks. Investing with a real estate crowdfunding platform is a very easy and transparent way to invest in real estate.

While it might become necessary to commit your investment for a minimum of 2 to 5 years, you can also have the dividends and profits reinvested so you can receive a greater share of ownership in the project.

By having a minimum investment period in place, you also receive some protection. This prevents the investors of a project from pulling out their money all at once. If all of the investors pulled their money out, the project might have a hard time reaching completion and turning a profiting.

Crowdfunding is considered a low-risk way how to invest 50k in real estate today. With some of the real estate crowdfunding platforms available today, you can specifically pick which projects you would like to invest in. As a potential real estate investor, you are given the power and freedom to choose where you would like to place your money and investment in.

This differs from just investing in an institutional REIT where you just pay into the REIT and have no say on the specific projects that are selected.

Related Article: Best 1031 Exchange Companies Near Me [Guidelines]

Can You Make Money Crowdfunding in Real Estate?

I believe you can make money with real estate crowdfunding platforms for a couple of reasons.

- First some of these real estate crowdfunding companies offer different levels of risk for your investment. This gives you the freedom to choose how you would like your money invested and in which projects.

- Second real estate is always a great investment vehicle for long-term growth and wealth building. Over time, real estate does appreciate.

Additionally a lot of the American housing stock has become extremely outdated. Some of these real estate investment crowdfunding platforms have projects that focus specifically on flipping properties.

In other words, your investment could contribute to a project which involves rehabbing several houses or an apartment building and then selling it for a profit.

Since you are investing in a real estate crowdfunding platform you are entitled to a portion of those profits as an investor. Additionally, many wonder can passive income be used to qualify for a mortgage when applying for a mortgage.

Another point to keep in mind when it comes to making money crowdfunding in real estate is that these crowdfunding platforms are all about maximizing their profit.

If they receive enough capital from property crowdfunding, then they can forgo a lot of things such as traditional mortgage financing for a project and all those fees associated that would normally take away from profits of a project.

What is the difference between real estate crowdfunding vs rental property?

This is a great topic to explore and it is important to know what these differences are if you’re thinking about investing in real estate crowdfunding.

- The main differences for real estate crowdfunding and becoming a self-invested landlord have a lot to do with the tax advantages. When you invest in real estate crowdfunding, you become a shareholder. It’s very similar to owning stock. The financial consequences of that are treated as 1099-DIV or a Schedule-K1 for your income taxes depending on which investment portfolio you choose.

When you own traditional real estate rental properties, that’s not the case necessarily. There are a lot of tax advantages and deductions that your allowed to utilize when you are a landlord.

Aside from being able to eventually replace your full time income with real estate, you have other advantages as well.

When you are a landlord and own rental properties, you have things such as depreciation, and other allowable deductible costs that can affect your taxable income.

In other words, there are expenses that will offset your rental income gains.

It gets a little bit better too!

Additionally, if you have W-2 income and your real estate rentals show passive losses, those losses can also reduce your W-2 taxable income.

You can also roll over your potential capital gains and profits into a new investment property through a 1031 exchange.

Be sure to check with a CPA specifically somebody that deals with real estate investment properties and real estate rentals to see how your specific situation would play out.

Fundrise

Today, there are a lot of low-risk and great online platforms to invest in real estate with. One popular pathway for investing in real estate crowdfunding is through Fundrise.

This particular real estate crowdfunding platform has been around for eight years and focuses a lot of their operations on the use of technology.

- At the time of that this posting, Fundrise historical annual returns have average between 8.7% and 12.4%. That’s well over the rate of inflation for this time period.

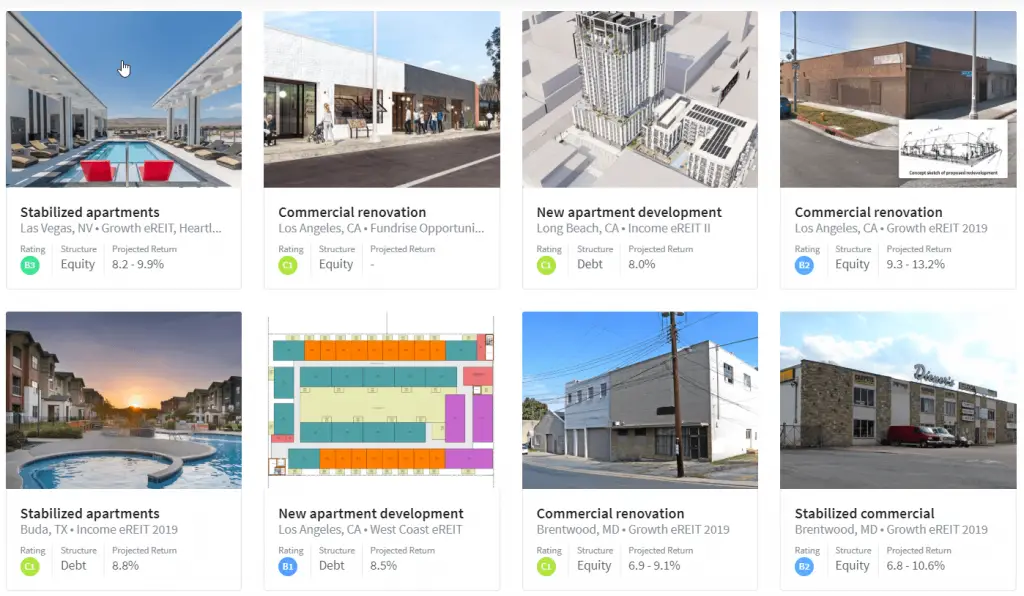

You can invest in everything and anything between single-family rental homes and multi-million dollar commercial apartment developments.

All of their portfolio plans will include a mix of projects like what is included below along with anticipates rates of return.

Fundrise has four different types of investment plans to choose from including:

- Starter Portfolio

- Supplemental Income Portfolio

- Balanced Investing Portfolio

- Long-term Growth Portfolio

They pride themselves on expert management and follow the strategy of buying investment properties for less than the replacement cost, improve the property through hands-on management and using local operators for those operations.

Their management team has over 76 years of combined experience in the real estate field.

Fundrise Fees

Fundrise annual fee consists of two parts at the time of this posting (although fees are subject to change at anytime*):

- Annual management fee .85%*

- Annual servicing fee .15%*

Fundrise $500 Minimum Investment

The best part about fundrise is that you can invest in their real estate portfolios with as little as $500!

For the average real estate investor, this is a huge advantage. A lot of commercial REITs will require a significant amount of minimum capital before you can purchase REIT shares.

This is a large barrier to entry for someone who wants to start investing in real estate crowdfunding, but doesn’t have thousands of dollars sitting around.

Fundrise offers investing in real estate crowdfunding for $500. That’s it.

If your interested in learning more about Fundrise plus their special offers available today, be sure to visit the Fundrise website for the latest promotions.

Roofstock

Roofstock is a bit unique because it offers several ways that you can invest in real estate properties done through a couple of different ways.

Using Roofstock is another way to invest in real estate through crowdfunding or individually if you decide to become a landlord. This is one of the few platforms that offers an option both for real estate crowdfunding investing and also for individual rental investors.

So many people in today’s time are landlords; even Chuck Todd is a landlord!

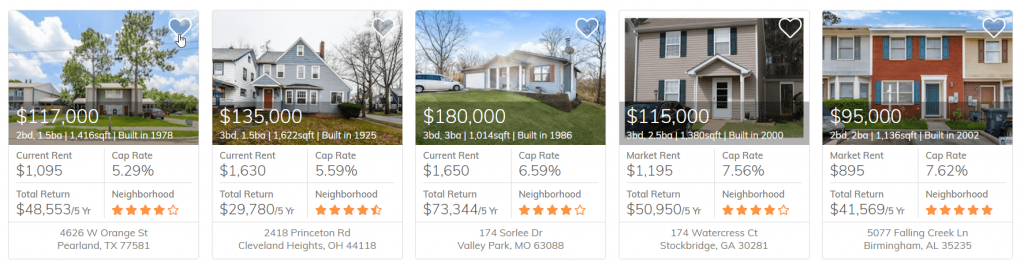

- What makes it unique is that if you want to directly buy residential real estate properties and be the owner of those properties 100%, you can do that with the Roofstock platform.

- Roofstock has an online platform where everything is set up to function as such, even listing potential CAP rates and costs along with very detailed information about a property including photos, and neighborhood information.

- Previous inspections reports are included sometimes which is wonderful from an investor standpoint to understand the history of the property.

- Another benefit is that some of these rental houses already have tenants in them. So, as a new property owner all you have to do is take over the property.

What about if your not in the same area as the rental property in question?

No problem.

Roofstock even has property management companies already partnered up to offer property management services all over the country.

So, you can literally buy an investment property with a tenant in it and already paying rent.

You don’t have to waste time either looking for a local property management company because Roofstock has property management companies available immediately as well.

You could actually become a virtual section 8 landlord nationwide by using this platform if you can find the right deals.

All you literally have to do is sign a few papers, figure out financing which includes how to buy the property, and collect the rental income from the property management company.

You will have to invest close to 20% as a downpayment initially, but you are the 100% owner of this real estate asset. That’s not the case when you invest with other real estate crowdfunding platforms.

Roofstock Crowdfunding & Roofstock Property Shares

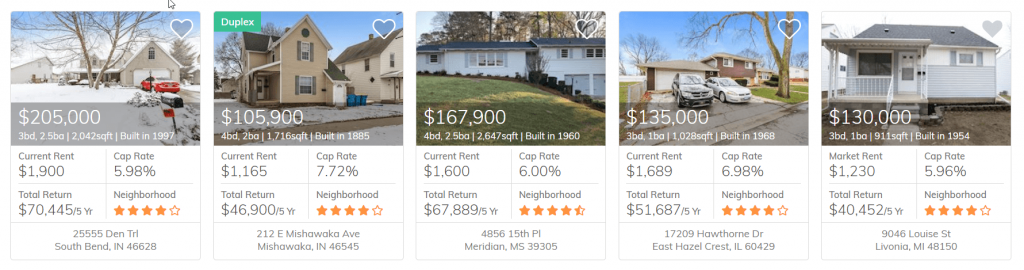

This is the other way to invest in roofstock. If being 100% invested in a property sounds like too much work (believe me I get it), you can go the route of investing in roofstock property shares.

This is basically investing in real estate crowdfunding through their division known as “Roofstock One.”

This is relatively new for Roofstock (within the last few years) and mainly grew out of demand to compete with Fundrise in this arena.

The minimum investment is ten times more than what Fundrise requires. You will have to invest a minimum of $5,000.

- Roofstock property shares basically represent 1/10th of ownership of a property. If there is a property that is listed at $70,000, the minimum amount needed would be $7,000 as an example.

- The advantage of fractional ownership is that instead of investing $40,000 into one property that you own, you can invest that same $40,000 into multiple properties, thus spreading out your risk over a number of different properties that now make up your rental portfolio.

- Another great advantage is that you can also buy property shares of several houses all in several different locations, not just in your immediate area.

If you decide to go the fractional ownership route with roofstock, know that it is also completely passive. You will receive economic rights. After a six month holding period, you can liquidate your share subject to the terms of Roofstock One.

Roofstock Property Shares Advantages

A great way to explain the Roofstock property shares advantage would be that it’s a hybrid option between becoming a 100% self-invested landlord and becoming an investor for an institutional and commercial REIT.

In addition to holding fractional ownership of Roofstock property shares, you also are entitled to some of the tax benefits such as depreciation.

Just like self-invested owners of rental properties, being an investor with fractional ownership through property shares with Roofstock, investors can take advantage of the same depreciation. A lot of housing cooperatives in the country operate this way.

Roofstock provides investors with year-end summary and financial information for their tax returns.

If you want more information or want to start investing with Roofstock, be sure to visit the Roofstock website for additional details.

Groundfloor

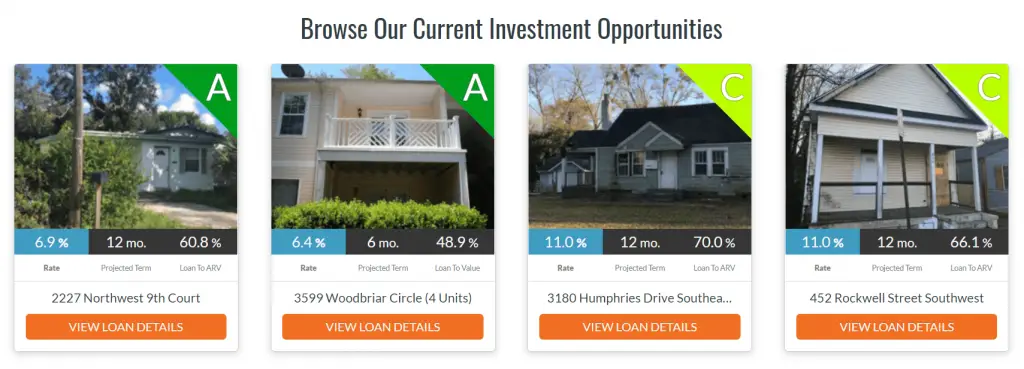

One of the easiest ways to invest in real estate crowdfunding would be using Groundfloor. In existence since 2013, Groundfloor is in online real estate crowdfunding platform that focuses on providing loans for house flippers, real estate developers, and real estate investors.

As an investor you can pick and choose which projects you would like to provide money to.

- An investor can invest as little as $10 on some projects and expect to earn between a 5% and 16% return within 6 to 12 months.

This is probably the easiest way for the part-time real estate investor to cash in with real estate investing.

- It’s also a great way to receive capital for real estate developers and house flippers.

Normally, a lot of real estate developers would have to obtain loans from the bank. Not only does this drive the cost of the overall project higher, but there are also a lot of bureaucratic requirements a real estate developer must comply with in order to receive loan funding through a bank.

By using Groundfloor, a lot of those requirements are eliminated. Not to mention, real estate crowdfunding money can be raised a lot quicker than going through a bank for some of these projects.

Is Groundfloor a Good Investment?

Groundfloor is a good alternative to high-yield savings account if you’re willing to take on a little bit of risk. Considering the lowest interest paid to an investor is around 5% that rate is higher than today’s high-yield savings accounts by at least 2% to 3%.

Keep in mind though once your investment is funded for a project, your money is not FDIC insured.

Groundfloor Crowdfunding Platform

The Groundfloor platform is easy to navigate. Once you sign up for an investor account, you are able to browse each project along with the terms of the loan and interest rate on the loans.

You can use my link down below to sign up for a free $10 to fund your account with free money!

From there, you can select which project you want to invest in. Once you invest in the project, your money is committed to the project.

After the project completes, your paid back your original investment plus the interest that has been earned from your money being invested.

Sign up here for Groundfloor to receive a free $10 for your account.

Is Real Estate Crowdfunding a Good Investment?

Deciding whether or not to invest in real estate crowdfunding is a complex answer that has a lot of variables attached to it. However, these three options above are some of the best and easiest online real estate crowdfunding platforms available to invest with.

Figuring out which one to use will depend on your particular situation and investment goals. How much risk you want to hold and how involved you want to be might also play a role in your decision.

Check out other options such as if you should get a mortgage loan from a foreign bank instead and go it alone without crowdfunding platforms.

These three options however, are great options to consider when investing in real estate crowdfunding for beginners.

Leave a Reply